Bitcoin Hyperdrive: Surging Past $24M After Massive Whale Accumulation

Bitcoin rockets toward unprecedented $24 million valuation as institutional whales go on buying spree.

The Great Accumulation

Massive wallets loading up on BTC positions signal major confidence in digital gold's next leg up. These aren't retail investors dipping toes—these are billion-dollar bets placing foundation stones for the next crypto cycle.

Liquidity Tsunami

When whales move, markets follow. The recent accumulation phase created buying pressure that could propel Bitcoin into price discovery territory unseen in traditional markets. Forget stocks—this is digital scarcity meeting institutional demand.

Regulatory Irony

While traditional finance debates paperwork, Bitcoin's network effect grows exponentially. The very institutions that once dismissed crypto now scramble for position—proving once again that money flows where it's treated best. Sometimes the best regulatory approval comes from market forces, not government forces.

1. Walmart is expanding beyond just physical stores

Whentook the e-commerce world by storm, there were concerns that Walmart's business might be in trouble as it was seemingly lagging in that space. Although those concerns were initially valid, Walmart has been intentional about expanding its business beyond its physical stores.

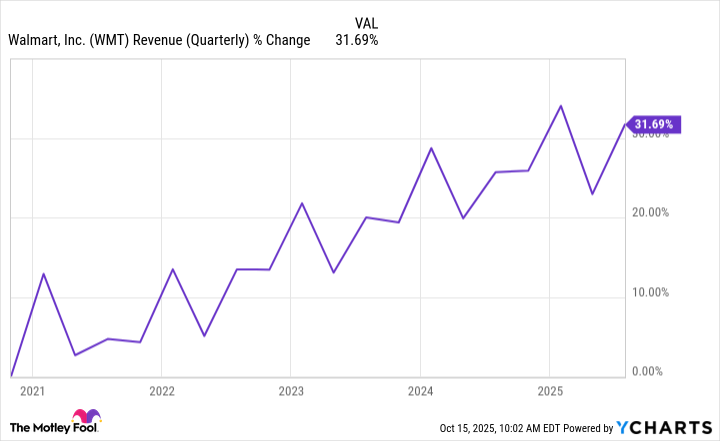

In its fiscal second-quarter (ended July 31), Walmart's e-commerce growth was one of the key highlights. Total revenue increased 4.8% year over year to $177.4 billion, but its e-commerce segments grew much faster. U.S. e-commerce sales increased 26% year over year, and international e-commerce sales increased 22% year over year.

WMT Revenue (Quarterly) data by YCharts

Walmart may never catch up to Amazon in the e-commerce space, but it has an advantage that Amazon lacks: thousands of stores across the country that can serve as fulfillment centers. Customers can place orders that can be fulfilled at the Walmart closest to them, reducing delivery time. It noted that it can reach around 93% of U.S. households with same-day delivery.

2. Memberships are beginning to pick up steam

Walmart has also introduced a new revenue stream beyond product purchases with Walmart+. Walmart+ is a membership that offers customers benefits like free and same-day delivery (with no minimum), savings on fuel purchases, streaming benefits, Scan & Go checkout, and more. It's similar to Amazon Prime's mix of loyalty perks and convenience.

In the second quarter, Walmart+ membership income grew by double digits. In addition to Walmart+ bringing in recurring revenue, it also helps with Walmart's gross margins because it's revenue coming in without needing to sell physical products. These higher-margin subscriptions can help Walmart keep its prices low by supplementing its lower-margin retail sales.

It also helps that people with a Walmart+ membership are more likely to shop at Walmart to take advantage of the membership's perks. That's a cycle that should bode well for Walmart's revenue going forward.

3. Walmart's dividend is as reliable as they come

Although Walmart has outperformed the S&P 500 this year, it's not known for consistent explosive growth. One of the biggest appeals of investing in Walmart is its dividend, which has contributed a lot to its total returns over the years.

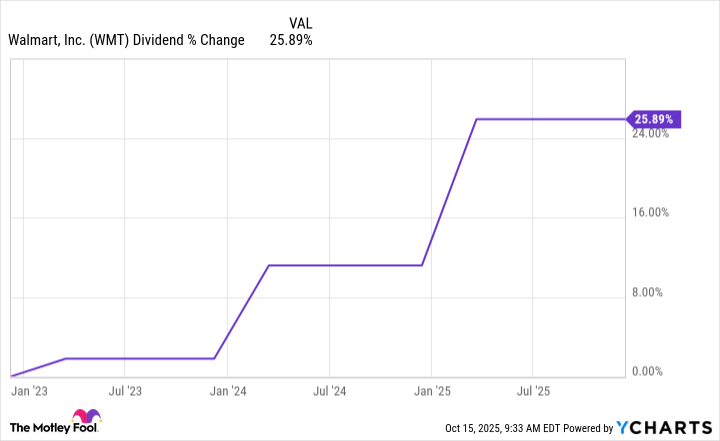

Because of Walmart's stock price growth this year, its dividend yield is currently only around 0.85%, which is less than its 1.85% average over the past decade. However, the appeal comes from its consistent dividend increases. Walmart is a Dividend King (a company with at least 50 consecutive years of dividend increases), a title that only a few dozen companies hold.

In February, Walmart announced it was increasing its annual dividend by 13% to $0.94 per share, marking its 52nd consecutive year of increases. The dividend has increased by over 25% in just the past three years alone.

WMT Dividend data by YCharts

Walmart's recent dividend increase shows the company is confident in the durability of its cash flow. Companies typically don't increase their annual dividend by as much as 13% unless they're confident their cash FLOW can sustain it without taking away resources from other areas, such as reinvesting profits for further growth.