Market-Defying Growth Stocks: 2 Picks Set to Outperform Through 2030

Forget Wall Street's crystal ball—these two growth engines are rewriting the rulebook.

The Long Game Advantage

While traditional investors chase quarterly earnings, these companies operate on a different timeline. They're building foundations that won't just survive market cycles—they'll dominate them.

Innovation as Fuel

One player disrupts legacy industries with technology that makes old models obsolete. The other creates entirely new markets where none existed. Both share a common trait: they're not just growing—they're accelerating.

The 2030 Horizon

Five years might as well be fifty in tech time. These stocks aren't playing for incremental gains—they're positioned for exponential returns that make conventional market benchmarks look like amateur hour.

Because let's be honest—if your portfolio strategy still revolves around dividend aristocrats, you're basically investing in rotary phones.

Image source: Getty Images.

1. Alphabet

With a market cap of almost $3 trillion, Alphabet is one of the largest companies in the world. However, the tech leader has growth prospects that would make corporations a tenth of its size blush. First, Alphabet's core business remains an incredible opportunity. The company dominates the digital ads market thanks to Google and YouTube, which are the leading platforms in their respective niches and among the most popular websites worldwide.

Alphabet also benefits from network effects across both platforms, as its DEEP ecosystem grants it access to data that allows it to improve its search algorithms. The digital advertising market is projected to continue growing through the end of the decade (and beyond), which should provide a strong tailwind to Alphabet.

Notably, the rise of artificial intelligence (AI) chatbots did not significantly disrupt Google's search volume, as the company has adapted by adding AI overviews to its search results. While Alphabet faced the threat of an unfavorable outcome in its antitrust lawsuit, with the possibility of losing its all-important Chrome browser, the tech giant avoided that fate. All these factors (and more) make Alphabet's prospects in the digital ads market very promising.

Then there is the company's work in cloud computing and AI. Alphabet is a cloud leader, holding the third-largest market share in the industry. The company's Google Cloud sales are growing faster than the rest of the business. Alphabet's AI-related services are providing a boost here. There should be plenty more where that came from, as we're still in the early innings of the AI revolution, so Alphabet's outlook in this area over the next five years also looks attractive.

It might already be one of the largest corporations at almost $3 trillion, but in my view, there is a good chance Alphabet will deliver a 14.9% (or higher) compound annual growth rate, enabling it to double by the end of the decade.

2. Veeva Systems

Veeva Systems is a minor player in the cloud computing industry compared to Alphabet. However, Veeva is the leader in its corner of the market. It mainly serves the life science sector. Veeva Systems has built cloud solutions with the needs of pharma, biotech, and medical device companies in mind. This industry has specific demands regarding legal and regulatory compliance, data integrity, patient privacy, and much more. So, while Veeva Systems can't compete with Google Cloud in sheer size, it makes up for it in specialization.

And once its clients opt for its services, they become deeply entrenched in their day-to-day activities, making it complex and potentially costly to switch, which grants Veeva Systems' business high switching costs.

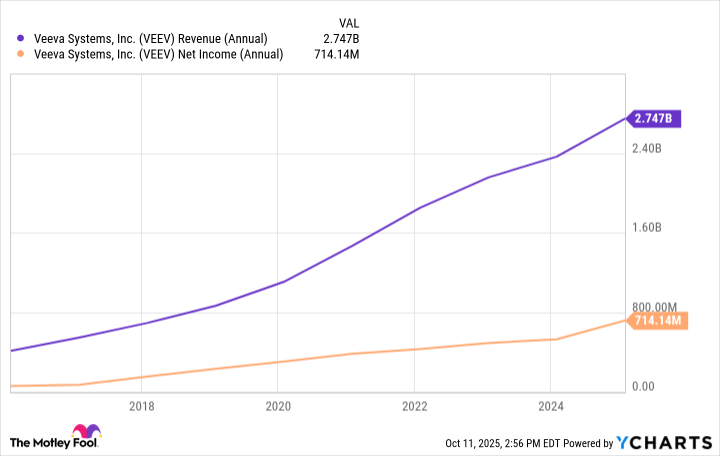

The company has become the go-to cloud provider for many of the largest life science companies in the world, which shows that its solutions are trusted and relied upon in the industry. Veeva's financial results have remained strong as well, with consistent revenue and earnings growth over the past five years.

VEEV Revenue (Annual) data by YCharts

And we should expect the same through the end of the decade. The industry it serves is consistently growing due to the constant demand for medical services and innovative breakthroughs.

Being the market leader should position Veeva Systems to cash in on this through the end of the decade. The company estimates a $20 billion addressable market, much higher than the $3 billion in sales it reported over the trailing-12-month period. The company looks set to deliver superior returns through the next five years.