The Smartest Dividend Stocks to Buy With $1,000 Right Now

Dividend stocks deliver steady cash flow while traditional finance sleeps on digital assets.

Income-Generating Powerhouses

Smart investors deploy $1,000 strategically into dividend aristocrats—companies that consistently reward shareholders while crypto markets fluctuate wildly.

Defensive Positioning in Volatile Times

These established players generate real revenue and share profits directly with investors, unlike speculative assets that promise moon shots but often deliver crater landings.

Compounding Your Way to Wealth

Reinvesting dividends creates a wealth-building machine that quietly outperforms most active trading strategies—especially those chasing the next meme coin sensation.

While Wall Street analysts debate P/E ratios, dividend stocks keep cutting checks. Sometimes the smartest move is the most boring one in a room full of financial 'innovators' reinventing the wheel.

Coca-Cola

In general, dividend stocks are known for their stability and profits, which they return to shareholders. But at the top of the pack, there is an even more elite group of companies called "Dividend Kings," which have increased their dividends for a jaw-dropping 50 consecutive years or more. With 63 years of dividend hikes, Coca-Cola is firmly within this category.

Coca-Cola's impressive dividend track record speaks to the resilience of its business model and economic moat. Perhaps no other company has mastered the art of beverage branding so well. Coca-Cola has established itself in virtually every corner of the world through a combination of traditional advertising, sponsorships, and intense localization.

Once established, a strong brand is a profound advantage because it can change a product's elasticity of demand. Despite rising costs for inputs like aluminum and labor, Coca-Cola has been able to pass much of this on to its customers, allowing it to maintain long-term profitability.

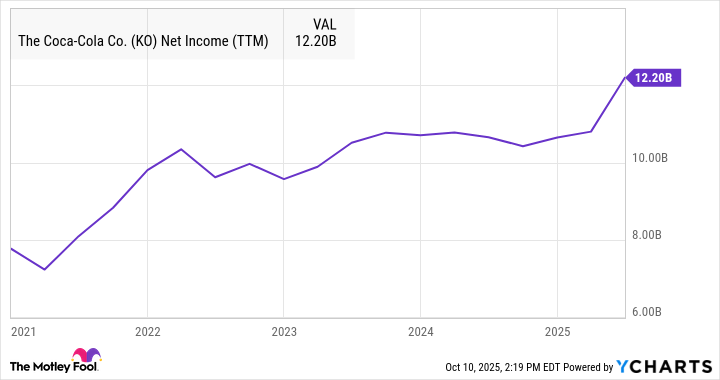

KO Net Income (TTM) data by YCharts.

With a dividend yield of 3.1%, Coca-Cola beats theaverage of just 1.2%. And with a forward price-to-earnings (P/E) multiple of 21, shares trade at a slight discount to the market average estimate of 22.

Realty Income Corporation

Real estate investment trusts (REITs) are a special type of investment vehicle that avoids paying most taxes if it returns the majority of its profits to shareholders through a dividend. But just like regular stocks, not all REITs are alike. With over 56 years of history (and 132 quarterly dividend hikes since its listing in 1993), Realty Income is clearly built to stand the test of time and reward investors while doing so.

Image source: Getty Images.

The company's edge comes from the quality of its tenants, which are typically clustered in "recession-proof" industries like dollar stores, pharmacies, and quick-service restaurants. Its assets are located all over North America, with a growing presence in continental Europe and the United Kingdom, where it has contracts with popular brands likeand.

To minimize risks, Realty Income uses a strategy called the triple net lease, where the tenant is responsible for property-level operating costs like taxes, maintenance, and insurance. This model also protects the company from real estate industry inflation and maximizes cash flow.

With a dividend yield of 5.5% (broken into monthly payouts), the stock offers an incredible opportunity for stable long-term income.

$1,000 should be just a start

When it comes to dividend stocks, bigger is better. While $1,000 is a good opening position, investors who aim to save for retirement should be slowly accumulating a much larger portfolio of diversified assets.

If a stock yields 5%, a $1,000 stake WOULD only provide $50 per year. But if your position is worth $1,000,000, you would get a whopping $50,000 a year in passive income -- more than the median income in the U.S. While that might sound unattainable, it's very doable if you start early.