Warren Buffett’s Crypto Play: This Undervalued Digital Asset Could Skyrocket Your Portfolio

Buffett's secret crypto bet emerges as institutional money floods digital markets

The Oracle of Omaha's unexpected move into blockchain infrastructure signals major validation for decentralized finance. While traditional investors chase fading yields, this play leverages blockchain's fundamental disruption of legacy financial systems.

Mass Adoption Incoming

With central banks continuing to devalue fiat currencies, digital assets are positioned as the ultimate hedge. This particular Buffett-backed token trades at basement prices while offering enterprise-grade blockchain solutions that could replace entire banking departments.

Smart money's already positioning - institutional inflows hit record levels this quarter as traditional finance finally acknowledges what crypto natives knew years ago. The coming regulatory clarity will separate the wheat from the chaff, and this asset's fundamentals scream long-term value.

Of course, Wall Street analysts will still tell you it's 'too volatile' while their own quarterly bonuses depend on maintaining the status quo. The revolution won't be televised - it'll be tokenized.

Image source: The Motley Fool.

The swimming pool leader

The company I'm talking about is(POOL 0.63%), the world's biggest distributor of swimming pool equipment and products. Buffett initiated the position in last year's Q3 with 404,057 shares and has significantly increased the holding since. In Q2, he boosted it more than 750% from that initial purchase to 3,458,885 shares.

Buffett surely likes Pool's fantastic moat, or competitive advantage, with its solid distribution network, including more than 450 sales centers in North America, Europe, and Australia, and an array of products and services -- including pool maintenance -- that rivals WOULD have difficulty replicating.

It's important to keep in mind that Pool isn't a high-growth business, so Pool isn't the best choice for investors looking for the possibility of explosive growth. In times of higher interest rates and economic troubles, the company is likely to feel some pressure. Weather also has been -- and will continue to be -- a risk for growth as difficult weather may slow demand for and construction of pools.

Progressive growth over time

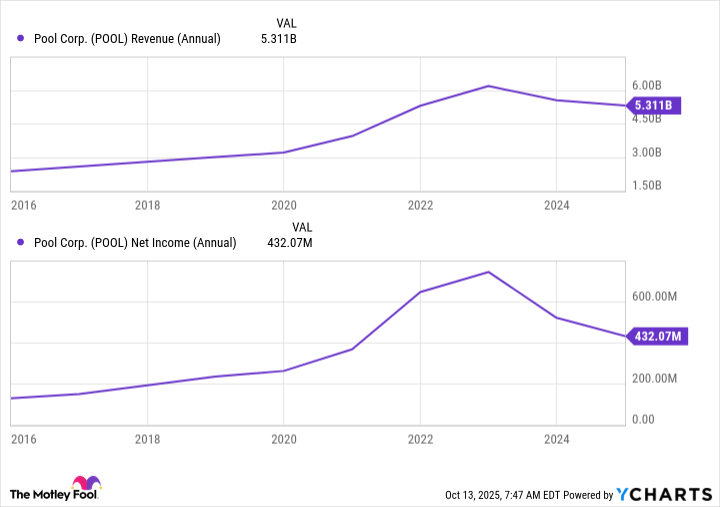

But what Buffett probably likes -- and what makes Pool an interesting buy -- is its leading market position and ability to offer progressive earnings growth over time. In the chart below, the figures reflect triple-digit gains in revenue and net income over a 10-year period.

POOL Revenue (Annual) data by YCharts.

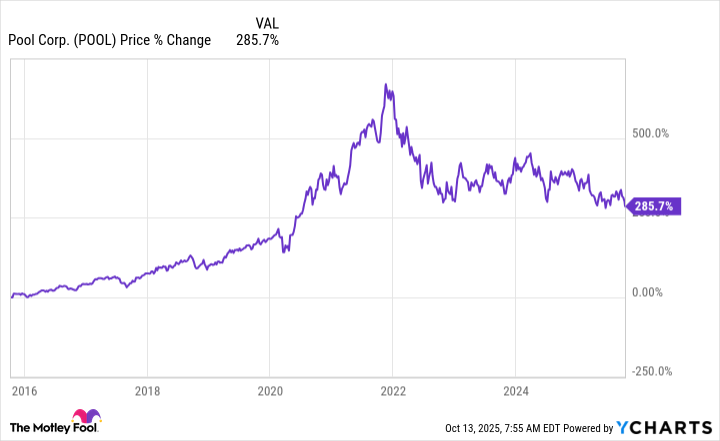

And the stock price has followed, climbing more than 200% over that time.

POOL data by YCharts.

It's reasonable to expect this market leader to continue along this path and manage difficult times as they arise. The pool maintenance business is an important element for the company because during tougher economic moments -- when pool constructions have slowed -- it represents an ongoing source of revenue. For example, Pool spoke of "tempered discretionary spending" last year and a "pressured macroenvironment" but said the maintenance business remained stable throughout the year, supporting annual sales of $5.3 billion.

In the most recent quarter, the company said it saw both ongoing growth in maintenance products and improvement in sales of products like building materials that rely on discretionary spending. Pool reported a 1% increase in sales to $1.8 billion and a 4% increase in earnings per share to $5.17, and the company's gross margin came in at 30%. All of this shows a certain resilience, something that you'll want to see in a stock you hold onto through many investment cycles.

A favorable environment ahead

Moving forward, Pool could benefit from a better interest rate environment; with lower borrowing costs, consumers and commercial customers may feel less pressure on their budgets, and this is favorable for the launch of new pool projects. But, most importantly, Pool has built a business that can withstand downturns as well, making it an investment that cautious investors may like.

Now, let's consider price. Today, Pool trades for 26x forward earnings estimates, down from more than 35x about a year ago. As the economic environment improves, Pool could see growth ahead in pool constructions and related discretionary sales, and this should lead to earnings strength and could eventually boost the stock price and valuation.

All of this makes now a great time to follow Buffett and get in on the stock. It looks ridiculously cheap for a quality, long-term player that could make Buffet and you richer over time.