Trader’s $17.6 Million XRP Short Gets Liquidated - Total Losses Surpass $3.6 Million

Another brutal liquidation rocks the crypto markets as a massive XRP short position gets hammered.

The $17.6 Million Gamble

Position gets partially liquidated—again. Total losses now exceed $3.6 million and counting. This marks the latest in a series of painful liquidations for the trader.

Short Squeeze Carnage

XRP's price action continues to punish over-leveraged positions. The perpetual contract market shows no mercy to those betting against the digital asset.

Risk Management? What Risk Management?

Another reminder that in crypto trading, sometimes the biggest risk isn't market volatility—it's overconfidence in traditional financial strategies that don't account for crypto's 24/7 momentum shifts. But hey, at least someone's making money on the other side of these liquidations—probably the same Wall Street firms that still call crypto a 'fad' while quietly running their own trading desks.

Who is Benjamin Graham, and what does he have to do with Energy Transfer?

Benjamin Graham was a famed value investor, the author of The Intelligent Investor, and he was one of the main mentors to Warren Buffett. He's widely credited as one of the founding fathers of fundamental analysis. Energy Transfer didn't exist when Graham was alive, so there's really no direct connection here. But one of Graham's favorite tools, used throughout The Intelligent Investor, is highly relevant.

Image source: Getty Images.

Simply put, if Graham were looking at Energy Transfer today, he WOULD likely compare the midstream master limited partnership (MLP) to an alternative investment choice. That's not rocket science, but it is an often-overlooked step on Wall Street. The comparison here is going to be to fellow North American midstream giant(EPD -1.23%), and it might change your mind on Energy Transfer.

The businesses are roughly similar

From a top-level view, both Energy Transfer and Enterprise operate large, fee-based midstream businesses. Each company's revenue tends to be fairly consistent over time since the main determinant is the amount of oil and natural gas moving through their networks of pipeline, storage, processing, and transportation assets.

Energy demand tends to remain strong even when energy prices are weak, given the importance of oil and natural gas to the world. Energy Transfer is a bit more complex, noting that it is the general partner for two other publicly traded MLPs, but overall, the businesses are roughly similar.

The yields are only a little different

As already noted, Energy Transfer's unit price has dropped around 15% while Enterprise's drop is about half that amount. It isn't surprising that Energy Transfer's yield is higher, at 7.5%. That's around 0.6 percentage points more than Enterprise's 6.9% yield.

Energy Transfer is, essentially, offering dividend investors a nearly 9% boost to the income they would generate from the same dollar value investment. The question that has to be asked here is whether that extra yield is an opportunity or the associated risks are too high, ultimately making the lower yield more attractive.

The yields are both well covered

A key metric to examine for midstream MLPs is distribution coverage. This is basically dividing a business's distributable cash FLOW by the cash it is actually distributing. The higher the coverage ratio, the better. In this case, both Energy Transfer and Enterprise have strong coverage. That said, Energy Transfer's coverage ratio was 1.7 in the second quarter, while Enterprise's was 1.6. That's a slight edge for Energy Transfer but not a huge one.

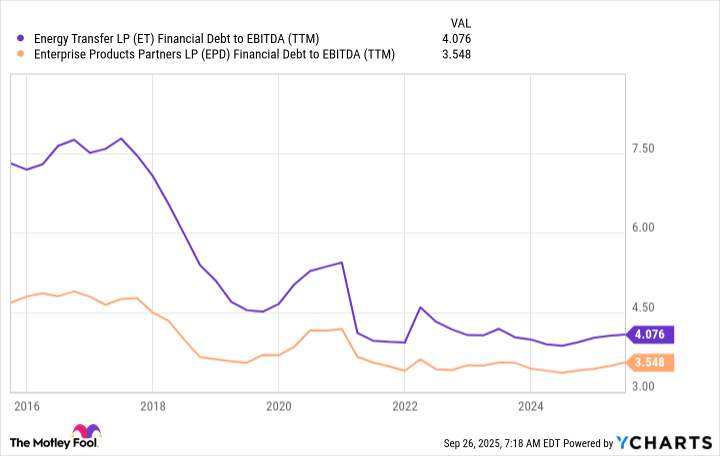

Financial strength is roughly similar

Another important metric in the midstream space is financial debt to EBITDA (earnings before interest, taxes, depreciation, and amortization), which is a measure of a business's leverage. On this measure, Enterprise comes out on top but only by a little. Energy Transfer has a history of operating with more leverage, but it made the decision to deleverage in 2020 (more on this below). At this point, its financial debt-to-EBITDA ratio is around 4 compared to 3.5 for Enterprise.

ET Financial Debt to EBITDA (TTM) data by YCharts. EBITDA = earnings before interest, taxes, depreciation, and amortization. TTM = trailing 12 months.

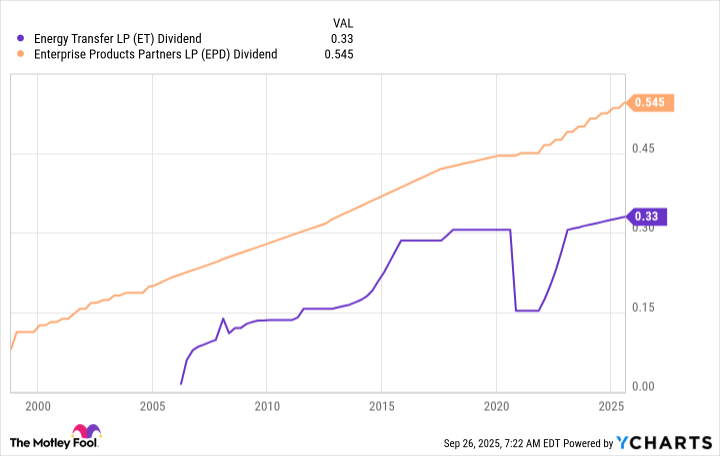

Energy Transfer's distribution history falls short

Energy Transfer's 2020 decision to reduce leverage, however, came at a material cost. The board of directors enacted a 50% distribution cut. The freed-up cash went toward reducing leverage. Interestingly, Enterprise made a roughly similar choice a few years prior, with the goal of improving its distribution coverage. Only it didn't resort to a distribution cut to improve its financial metrics. It simply slowed down distribution growth for a few years. At this point, Enterprise Products Partners has increased its distribution annually for 27 consecutive years.

ET Dividend data by YCharts.

While Energy Transfer's distribution is growing again, and above where it was prior to the cut, The Graph above highlights a big difference. Enterprise Products Partners' distribution has provided a reliable and growing income stream for unitholders. Energy Transfer's distribution has been a lot more variable. This is the big win for Enterprise and the one that will likely make it the better option for most income investors.

The added yield isn't worth the added uncertainty

Energy Transfer and Enterprise Products Partners are so similar that you could persuasively argue for either one as an investment. And neither one is likely to be some huge investment mistake. But if you need the income your portfolio generates to pay the bills, then Enterprise Product Partners' slightly lower yield backed by the more reliable distribution history is probably the best choice. And while the 8% price dip isn't huge, it could still be an excellent opportunity for conservative income investors.