XRP Price Prediction October 2025: ETF Catalysts Could Launch XRP From $2.80 to $5

XRP stands at the edge of a potential explosion as ETF approvals loom on the horizon.

The Regulatory Green Light

Institutional money floods crypto markets when traditional finance gets its paperwork stamped. SEC approvals for spot XRP ETFs would unlock billions in dormant capital—the kind that moves markets from speculative to substantial.

The $2.80 Launchpad

Current pricing sets the stage perfectly. At $2.80, XRP maintains enough stability to attract conservative investors while offering explosive upside that hedge funds crave. The number represents both technical support and psychological threshold.

The $5 Target Zone

Five dollars isn't just another price point—it's the gateway to mainstream adoption. Hitting this level would validate XRP's utility beyond payment settlements and position it as a legitimate store of value. The math works: ETF inflows could easily bridge the $2.20 gap.

Of course, Wall Street will take its usual cut while pretending they discovered digital assets yesterday. But for those who've weathered the regulatory storms, October 2025 could finally deliver the payoff that's been years in the making.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Since the start of the year until August, it has sold 6.9 million units, which is 5% higher year-over-year. For context, throughout 2024, it sold 10.1 million vehicles.

In the U.S., sales jumped by 13.6% to 225,367 vehicles in August — or by 7.2% to 1.6 million units between January and August 2025. Toyota attributed the growth to the recovery from last year’s production stoppage, which was caused by recalls of its luxury midsize sports utility vehicle (SUV), Lexus TX, and its more affordable, mainstream counterpart, Grand Highlander.

Toyota Sees ‘Strong Performance’ in U.S.

Furthermore, the boost in U.S. sales was also due to “strong performance” in sales of the hybrid versions of its popular vehicles, such as the sedan Camry and the RAV4 SUV.

This is despite reports suggesting that the automobile manufacturer was considering ending the production of its Lexus ES sedans in Kentucky, with plans to merge the plant with its facility in Indiana, where it produces the Lexus TX SUVs. Some analysts viewed the MOVE as a response to President Trump’s tariff strategy and the subsequent increase in production costs.

Sales Return Flat in China

Meanwhile, in China, Toyota’s second largest market, sales growth in August was marginal, with 153,415 units sold — up 0.9% year-over-year. However, between January and August 2025, it sold 1.1 million vehicles, representing a 5.8% increase from the same period last year.

“Despite the ongoing severe market environment, including a shift to new energy vehicles and intensifying price competition, sales were up year-on-year thanks to the success of promotional measures tied to government subsidy policies and strong sales of the new battery electric vehicle bZ3X,” Toyota noted.

Back home in Japan, sales fell 12.1% year-over-year to 96,269 vehicles in August. That’s a 7.3% decline to 999,963 units since the start of the year. Toyota said it had to stop and delay deliveries of its vehicles in Japan due to the earthquake off the Kamchatka Peninsula.

This piled on the pressure from the recall of its Prius models last year, the carmaker added.

Is TM a Strong Buy?

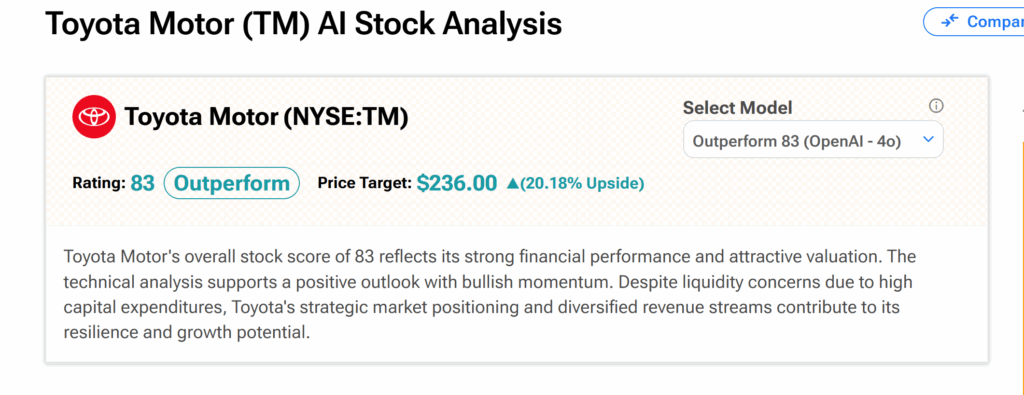

TipRanks’ AI Stock Analyst gives Toyota’s shares an Outperform rating score of 83 out of 100, citing its financial performance and valuation. The average TM price target of $236 suggests a 20.13% upside potential.