This Beaten-Down AI Stock Could Stage a Monster Comeback by 2028

AI Stock Primed for Epic Turnaround

The once-high-flying artificial intelligence play shows all the signs of a classic redemption arc—if you're willing to stomach the volatility.

Market Dynamics Shift in AI's Favor

While Wall Street analysts chase quarterly earnings like dogs chasing cars, this company's long-term AI infrastructure investments position it for massive gains when the cycle turns. The 2028 timeline gives their R&D team three full product cycles to execute.

Technical Indicators Flash Green

Recent price action suggests institutional accumulation beneath retail radar. Short interest remains elevated—perfect fuel for a squeeze when catalysts emerge.

Execution Over Hype

Unlike meme stocks that rise on empty promises, this company's patent portfolio and enterprise contracts provide actual fundamentals. Their comeback hinges on commercializing research that's currently ahead of its time.

Bottom Line: Contrarian investors might find this the ultimate 'buy when there's blood in the streets' play—assuming they can ignore the usual financial pundits who'll claim they saw it coming all along.

Image source: Getty Images.

AI is set to drive stronger growth in semiconductor equipment spending

The proliferation of AI has played a central role in driving robust growth in semiconductor demand over the last three years. The picture for the next three years seems favorable as well, with CEO Lisa Su forecasting that sales of AI accelerator chips such as graphics processing units (GPUs) and custom processors are set to increase at an annual pace of 60% through 2028, generating a massive $500 billion in annual revenue.

It won't be surprising to see that happening, given how fast the demand for AI computing in the cloud is increasing. Cloud infrastructure providers such as,, Google, anddon't have enough data center capacity at their disposal to meet customer demand for training and deploying AI models, or for running inference applications in the cloud.

This has led to a massive order backlog at the leading cloud computing companies. For instance, the combined backlog of Amazon, Microsoft, and Google stood at a whopping $669 billion at the end of the previous quarter. Oracle recently reported remaining performance obligations (RPO) worth a whopping $455 billion, up by a massive 359% from the year-ago period.

So, these cloud giants are already sitting on more than $1 trillion in revenue backlog that they need to fulfill. That's the reason why the spending on chipmaking equipment can be expected to accelerate over the next three years, as these companies are likely to keep spending huge amounts of money on setting up data center infrastructure. That's going to create demand for more chips, which in turn will lead to an increase in demand for the chipmaking equipment that ASML sells.

What's worth noting is that the chips used for tackling AI workloads -- be it in data centers, personal computers (PCs), or smartphones -- are manufactured using advanced process nodes. These advanced nodes help make chips with small transistor sizes, usually below 7-nanometer (nm). Not surprisingly, leading chipmakers are looking to make their chips smaller to increase computing performance and reduce energy consumption simultaneously.

ASML is the only company that can help chipmakers print smaller chips with its high NA (numerical aperture) extreme ultraviolet (EUV) lithography machines, which can be used for making chips that are just 2nm in size. This explains why companies such as SK Hynix,, and Samsung have been lining up to purchase ASML's high NA machines to further shrink the size of their process nodes in a bid to manufacture cutting-edge chips.

ASML's monopoly-like position in the EUV lithography market explains why the demand for its equipment is expected to take off. S&P Global estimates that ASML's EUV sales could rise an impressive 49% this year, followed by further growth in unit volumes and the average selling price (ASP) through the end of the decade.

Industry association SEMI is expecting the spending on equipment capable of producing advanced chips to increase to more than $50 billion by 2028, which WOULD be a big jump from last year's outlay of $26 billion. This could pave the way for substantial upside over the next three years.

ASML could turn out to be a solid investment for the next three years

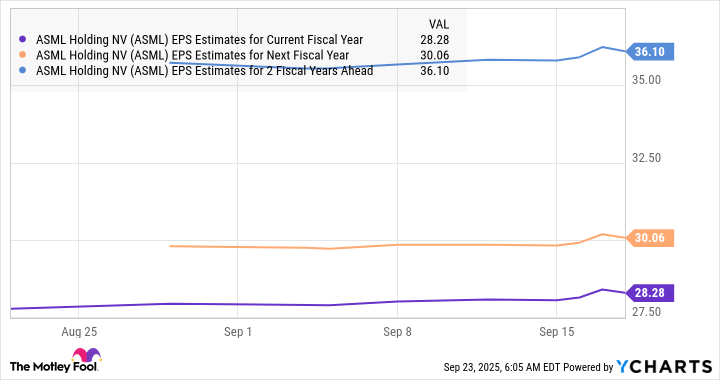

The points discussed above make it clear that ASML has the potential to deliver solid growth over the next three years. Its earnings growth is expected to accelerate remarkably in 2028 following an expected single-digit increase next year.

ASML EPS Estimates for Current Fiscal Year data by YCharts.

What's worth noting is that ASML's net income has increased by 67% in the first six months of 2025 from the same period last year. Given that the company is expected to witness a nice jump in the ASP of its EUV machines over the next three years, especially the high-NA machines, there is a solid chance that it could deliver stronger growth than what analysts are forecasting.

Assuming it can clock even $40 per share in earnings in 2028 and trades at 33 times earnings after three years (in line with the tech-ladenindex), its stock price could hit $1,320. That would be a 38% increase from current levels. But don't be surprised to see this AI stock delivering much bigger gains. The market could reward it with a premium valuation on account of the potential acceleration in growth.