Nebius Group Stock: Buy Signal or Red Flag in 2025?

Tech investors face a critical decision as Nebius Group hits inflection point.

Market Position Analysis

Nebius carves its niche in the competitive cloud infrastructure space—but faces brutal competition from established giants. The company's recent pivot toward AI-optimized solutions shows promise, yet execution remains the ultimate test.

Financial Health Check

Revenue growth accelerates while margins compress—a familiar tech sector dilemma. The balance sheet shows adequate runway, but burning cash faster than traditional investors might stomach. Another 'growth at all costs' story that Wall Street either loves or hates depending on the quarterly narrative.

Regulatory Landscape

Global tech regulations create both hurdles and opportunities. Nebius navigates this maze better than most—but regulatory risk always lurks just when companies think they've cleared the last hurdle.

Verdict: Speculative investors might find the risk-reward appealing, while value seekers should probably watch from the sidelines a bit longer. Because nothing says 'solid investment' like betting on unproven tech during macroeconomic uncertainty—what could possibly go wrong?

Image source: Getty Images.

Examining Nebius Group's success

Nebius Group was born out of Yandex, the Russian search engine and tech company. It severed all ties with Russia following the invasion of Ukraine. Now, Nebius primarily specializes in high-performance cloud computing infrastructure for AI systems.

Its portfolio also includes subsidiaries Avride, which develops autonomous vehicles and robotics, and TripleTen, an education tech business. Nebius doesn't break out financials for these segments, so there's no visibility into their overall impact on the company.

Nebius timed its strategic focus on AI perfectly to capitalize on the technology industry's insatiable demand for more computing muscle. This led to the company's second-quarter sales expanding a whopping 625% year over year to $105.1 million.

According to Nebius founder and CEO Arkady Volozh, "We expect the fundamental trends in our space to continue to drive growth for years to come." He's not the only one to believe this will happen.

Over a year ago,CEO Jensen Huang predicted the necessity of AI-specific infrastructure, such as that provided by Nebius. He dubbed them "AI factories" in a new industrial revolution where the output is inference, a term describing an AI's ability to analyze and draw conclusions from data.

Underscoring the significant need for computing capacity,contracted with Nebius in September as part of a multi-year agreement worth billions of dollars. The deal should boost Nebius revenue once it begins later this year.

Nebius Group's downsides

To meet rising AI demand, Nebius is rushing to expand capacity and construct more data centers. Supporting the build-out of AI infrastructure is not cheap, however. Nebius spent $91.5 million in Q2 capital expenditures, a 49% year-over-year increase. It also accumulated nearly $1 billion in debt on its Q2 balance sheet, up from just $6.1 million at the end of 2024.

Adding to this, the company's Q2 expenses ROSE to $216.3 million from $126.7 million in the prior year. As a result, Nebius isn't a profitable business, posting an operating loss of $111.2 million in the second quarter. However, it ended the period with net income of $584.4 million due to gains from its securities investments.

To help fund its growth plan, Nebius executed an equity offering that contributed to the company amassing $4.2 billion in gross proceeds as of Sept. 15. This allows Nebius to expand operations as it continues to ramp up revenue.

To buy or not to buy Nebius Group stock?

The revenue potential from Nebius' infrastructure operations could be substantial as the AI industry grows. Forecasts estimate the AI market will expand from $244 billion in 2025 to $1 trillion by 2031. This rapid growth will provide a tailwind to the company's business.

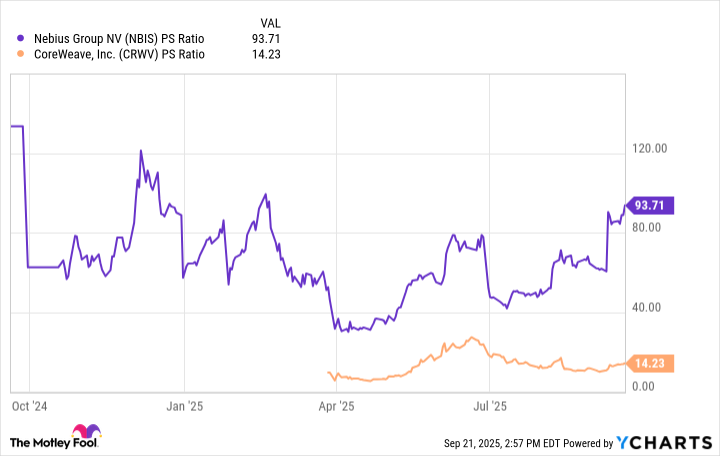

Yet while Nebius shows promise as an investment opportunity, especially after securing Microsoft as a customer, its share price valuation is also a factor in deciding whether to buy the stock now. So let's look at its stock's price-to-sales (P/S) ratio.

This metric indicates how much investors are willing to pay for each dollar of revenue generated over the past 12 months. We'll compare it to, a competitor in the AI infrastructure space that went public earlier this year, and also boasts Microsoft as a client.

Data by YCharts.

Based on its P/S multiple, the chart reveals Nebius shares are expensive compared to CoreWeave. In addition, the anticipated sales growth from Nebius' deal with Microsoft appears to be priced into the stock already.

Nebius could be a compelling AI investment, but despite the $4.2 billion in funding it achieved this month, its lofty share price valuation and growing debt make it a bit of a gamble at this point. Therefore, only investors with a high risk tolerance should consider an investment in Nebius, and ideally, after the stock price drops.