Will Walmart Stock Continue to Ring Up Investor Returns in 2025’s Volatile Market?

Walmart's cash registers keep ringing—but are investors getting their money's worth?

The retail giant's stock faces its toughest test yet as consumer spending patterns shift dramatically. While traditional retail struggles to adapt, Walmart's massive scale gives it unique advantages in the current economic landscape.

Digital Transformation or Die

Walmart's e-commerce push can't come fast enough. The company's racing to catch Amazon while fending off discount rivals—all during the most unpredictable consumer environment in decades.

Inflation's Double-Edged Sword

Higher prices mean bigger receipts but thinner margins. Walmart's playing a dangerous game of passing costs to budget-conscious shoppers who might just walk.

The bottom line? Walmart's survival isn't in question—but its growth story might need a rewrite. Another quarter of 'meets expectations' could send institutional investors chasing hotter opportunities. Because nothing makes finance types happier than abandoning a steady performer for the next shiny object.

Image source: Getty Images.

Where Walmart stands today

At first glance, the Walmart growth story may have appeared to run its course. At a market cap of more than $815 billion, it is unlikely to experience the growth levels of its early days.

But in other ways, it looks poised for continued success. Approximately 90% of U.S. consumers live within 10 miles of a Walmart location, and outside of, its Sam's Club division is the most successful warehouse retailer in the U.S.

Even as many of its expansion efforts outside of North America sputtered, Walmart has found success in online retailing as more international consumers warm to its approach of low prices.

Investors should not ignore its dividend. At $0.94 per share in annual payments, the current dividend yield is a modest 0.9%.

Nonetheless, longer-term returns are much more impressive. Its 52 years of consecutive annual payout hikes are just above the 50-year minimum threshold for Dividend King status.

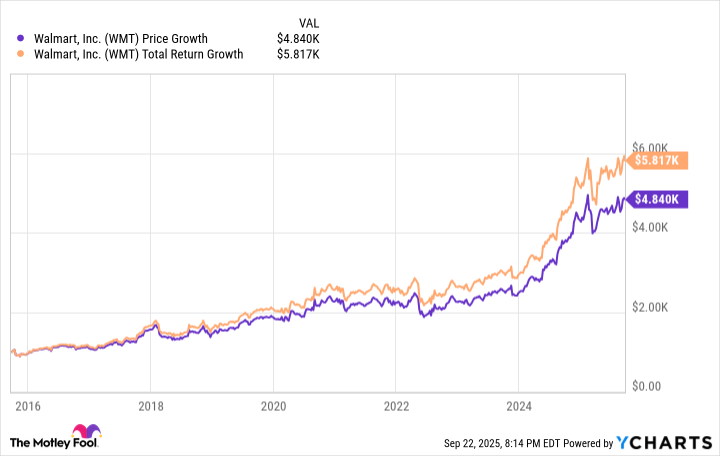

Such track records tend to make dividends a significant portion of returns. For example, $1,000 invested in Walmart stock 10 years ago yields total returns exceeding $5,800, with around $1,000 coming from dividend payments. That means those investors had their $1,000 returned to them without selling a single share.

WMT data by YCharts

Continued financial growth

There's no guarantee that Walmart stock will match that growth 10 years from now, and its results are unlikely to excite investors. Still, its continued improvement could put it on track for market-beating returns.

In the first half of fiscal 2026 (ended July 31), Walmart reported revenue of $343 billion, a 4% increase from year-ago levels. Although its operating income dropped slightly, the company earned more than $2.1 billion from investment gains, taking the net income for the first two quarters of the fiscal year to $11.5 billion, up 20% from one year ago.

Its financials also appear to be on track for gradual improvement, as Walmart has raised its fiscal third quarter outlook. It now expects net sales, which account for nearly all of its revenue, to rise between 3.75% and 4.75% annually.

The problem may come with its valuation. At a 39 P/E ratio, its stock is more expensive thanat 35 times earnings and its troubled competitorat a 10 P/E ratio. That could lead investors to question whether it is worth such a cost.

Should investors buy Walmart stock?

Walmart could continue beating the market, but investors may be better off putting money to work elsewhere.

Walmart continues to grow despite turning into a mature company, and its improved success and e-commerce-focused strategy could drive meaningful revenue increases for years. But 4% revenue growth is not significantly above inflation plus the natural growth of the population. Also, while Walmart did grow its profits in recent quarters, rising operating expenses are a concern, and its investments may or may not continue to increase in value.

Amid such conditions, investors might pass on Walmart's 39 P/E ratio and instead look to potentially higher returns in Amazon or even take a chance on Target since its P/E ratio is so low.

Ultimately, Walmart's long-term track record and rising dividend make it an excellent holding, but now is probably not a great time to add shares.