This Artificial Intelligence (AI) Stock Trades at Just 2 Times Sales -- Is It Too Cheap to Ignore?

AI Stock Trading at Fire-Sale Prices: 2x Sales Multiple Sparks Investor Frenzy

The Valuation Anomaly Every Tech Investor Is Watching

Forget waiting for Black Friday—the AI sector just dropped what might be the most compelling valuation story of 2025. We're talking about a company trading at just two times sales while competitors command multiples that would make even the most bullish analyst blush.

Why This Multiple Demands Attention

That 2x sales figure isn't just low—it's borderline suspicious in today's AI-crazed market. Either this company's financials contain hidden landmines, or Wall Street's obsession with shiny objects has created the buying opportunity of the decade. The math doesn't lie: when comparable AI plays trade at 10-20x sales, a 2x multiple either signals catastrophic failure or monumental mispricing.

The Contrarian's Dream Scenario

While hedge funds chase overhyped AI darlings, this stock sits quietly with a valuation that suggests the market either knows something terrifying or has completely missed the plot. The beauty of that 2x sales multiple? It leaves almost no room for further downside while positioning perfectly for the sector's inevitable maturation.

Sometimes the best AI investment isn't the flashiest algorithm—it's the company trading at what appears to be a spreadsheet error. Because nothing says 'opportunity' like Wall Street pricing a tech stock like it's about to be disrupted by blockchain. Again.

Data by YCharts.

Let's explore what's going on with Intel and assess the factors driving its depressed valuation. Is Intel a classic value trap or a sneaky buy hiding in plain sight?

What has caused Intel to fall behind in the chip landscape?

The heart of Intel's challenges lies in its foundry division. Once a global leader in semiconductor manufacturing, Intel has steadily ceded ground to overseas competitors such asand. This market erosion has carried two major consequences.

First, Intel has stumbled in executing on its foundry roadmap, ultimately delaying progress on next-generation GPUs and CPUs. This has weakened the company's credibility with leading chip designers. As a result, industry giants like, Nvidia, and AMD now overwhelmingly rely on Taiwan Semi for their most advanced fabrication needs, given its ability to produce cutting-edge nodes at scale.

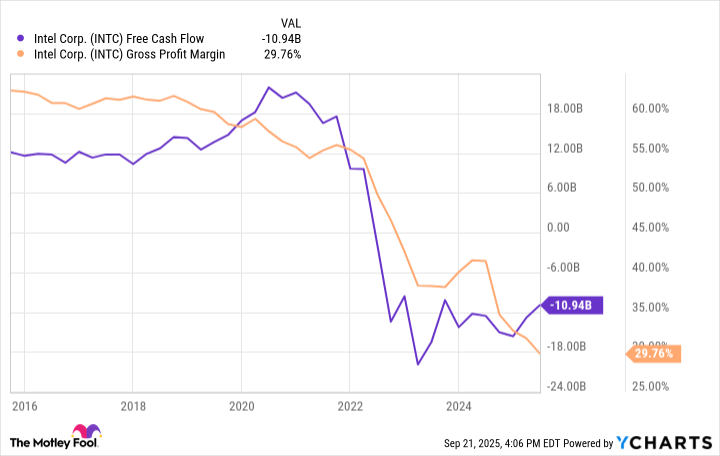

Second, these delays have taken a visible toll on Intel's financial profile. In an effort to catch up, the company is embarking on a challenging and costly turnaround strategy. The massive capital expenditures required to reignite its foundry capabilities are pressuring both profit margins and free cash flow.

Data by YCharts.

As a result, Wall Street appears to be pricing in this uncertainty. While trading at just 2.4 times sales may give the appearance of a bargain, Intel's steep discount reflects clear investor skepticism about whether the company can truly stage a credible comeback in an industry where execution missteps have cost billions of dollars.

Intel investors just got some great news

In the modern AI era, semiconductors are no longer commoditized pieces of hardware tied to cyclical booms and busts; they are critical infrastructure.

The U.S. government recently acquired a 10% stake in Intel -- a clear vote of confidence in the company's role as a strategic asset for national security and domestic supply chains. This support from Washington suggests that Intel is simply too important to be left behind as a technological relic.

Adding to the intrigue, Nvidia recently invested $5 billion into Intel as well. This is striking, given the two companies are, in some ways, competitors. Nvidia's move underscores just how powerful demand is for advanced foundry capacity.

If Intel can reestablish itself as a credible alternative to TSMC, its addressable market could expand dramatically. Even modest gains in market share WOULD translate into billions of incremental revenue.

Image source: Getty Images.

Why Intel might be a sneaky buy

These developments outlined matter. A government-backed turnaround plan, reinforced by validation from Nvidia, creates a floor under Intel stock and a compelling narrative for the business. Simply put, the company is too strategically important to be written off entirely -- suggesting that today's depressed valuation leaves room for upside.

That said, expectations should remain tempered. Intel is unlikely to blossom into the next AI darling overnight. The company still trails rivals in advanced foundry technology, and reclaiming a meaningful foothold could take years.

Even so, Intel trades at one of the cheapest valuations in the semiconductor industry. For contrarian investors willing to bet on improvements in execution and secular AI-driven tailwinds, Intel may represent one of the most overlooked -- and potentially rewarding -- ways to gain exposure to the AI opportunity.

Despite all the turbulence, Intel might not be the falling knife that many bears assume it is.