Why Smart Money is Ditching Uber for Lyft Stock in 2025

Ride-hailing showdown reaches tipping point as Lyft gains strategic momentum.

Market Dynamics Shift

Lyft's platform innovations cut through urban transportation noise while Uber spreads resources thin across global markets. The focused approach delivers cleaner unit economics—something Wall Street finally notices.

Regulatory Tailwinds

Recent gig economy rulings favor Lyft's operational structure over Uber's complex international footprint. Localized compliance beats bureaucratic tangles every time.

Technical Execution

Lyft's rider retention metrics bypass Uber's churn problems. Simplified pricing algorithms and driver incentives create sticky ecosystems—the kind that actually generate sustainable margins.

Investor Calculus

While Uber chases moon-shot ambitions, Lyft dominates core markets with surgical precision. Sometimes the tortoise wins—especially when the hare's distracted by fifteen different business verticals. Because nothing says 'visionary leadership' like burning cash on food delivery while your core business stagnates.

Image source: Getty Images.

Which one is growing faster?

One of the first items any investor should look at is revenue growth. When looking at Uber and Lyft, it is clear which one as a whole is growing faster: Uber.

Uber's revenue grew 18% year over year last quarter to $12.7 billion. Lyft was still growing at a double-digit rate, but only by 11% year over year to $1.6 billion. Not only is Uber significantly larger than Lyft, it is actually growing much faster. That is notch one on Uber's belt.

While Uber's revenue as a whole is outpacing Lyft's, this may be due to its exposure to international markets that Lyft does not operate in, as well as its food and grocery delivery business. Lyft CEO Dave Risher says that Lyft's share of rides in the United States has grown from 26% to 27% when he joined in 2023 to 30% to 31% today. This is a fantastic sign, albeit one that may have come from reduced fares on Lyft rides since Uber's revenue growth has not missed a beat even with this reduction in market share.

Uber's increased optionality

Both rideshare operators have membership programs, partnerships with autonomous driving companies, and deals with credit cards to drive customer loyalty to their respective services.

What Uber has that Lyft doesn't is optionality. This is a term that means how easily a company can add on new products or services to sell to existing customers. Lyft is known as simply an operator of rideshare services in the United States. Uber operates globally and also offers food delivery, grocery delivery, rental cars, and other services for its app users. Customers expect to be able to order virtually anything they want on the Uber app, while Lyft is restricted to just ridesharing at the moment.

Lyft may be able to add new products over time, but Uber has proven a better ability to scale beyond its original business.

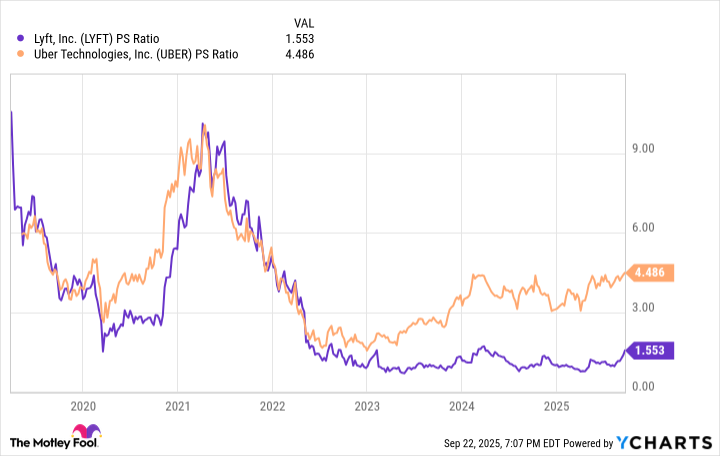

LYFT PS Ratio data by YCharts.

Lyft is cheaper, but does that make it a buy?

Uber wins the battle on both revenue growth and optionality (which can drive future revenue growth). Another important variable investors need to look at is valuation.

Lyft is not very profitable today, although it has made some major improvements in the last few years. In order to do an apples-to-apples comparison, investors can look at both stocks' price-to-sales (P/S) ratios. With similar business models, a P/S ratio will show the valuation in comparison to future profit potential for these respective businesses.

Today, Lyft has a P/S of 1.55, compared to 4.49 for Uber. Uber trades at a P/S of over 3x its rival, which throws a wrench in the works when deciding which stock is a better buy. As duopoly players in the lucrative North American rideshare market, I think both stocks will do fine for investors over the long haul. But if I had to pick one to buy today, it WOULD be Lyft. The company has plenty of room to expand its profitability, is still growing in the double digits, and has a significantly cheaper valuation.

That gives Lyft the edge over Uber, for now.