Aethir Price Skyrockets 43% as DePIN Tokens Ignite Fresh Market Rally

Aethir just ripped through the market with a staggering 43% surge—DePIN tokens are back in the spotlight, and traders are scrambling for position.

What’s Driving the Rally?

It’s not just hype. DePIN—decentralized physical infrastructure—is having a moment. Think real-world assets meeting crypto agility. Aethir’s leap mirrors renewed confidence in blockchain-based infrastructure plays, the kind that make traditional VCs squirm.

Timing, Liquidity, and a Dash of Greed

Volume spiked right as momentum kicked in. That’s no coincidence—smart money piled in early, retail chased. Classic crypto behavior, really. Even by volatile standards, a 43% move in this space turns heads and empties wallets.

Not Just Aethir—The Whole Category’s Heating Up

DePIN isn’t a one-token story. The entire segment’s buzzing, and Aethir’s leading the charge. When infrastructure tokens run, they often run hard. And this looks like the start of something bigger—or just another excuse for over-leveraged degens to blow up their accounts.

So, is DePIN the next big narrative or just a pump waiting for a dump? Either way, it’s moving—and in crypto, that’s often all that matters. Just remember: what goes up 43% in a day can do the opposite faster than you can say 'physical infrastructure'.

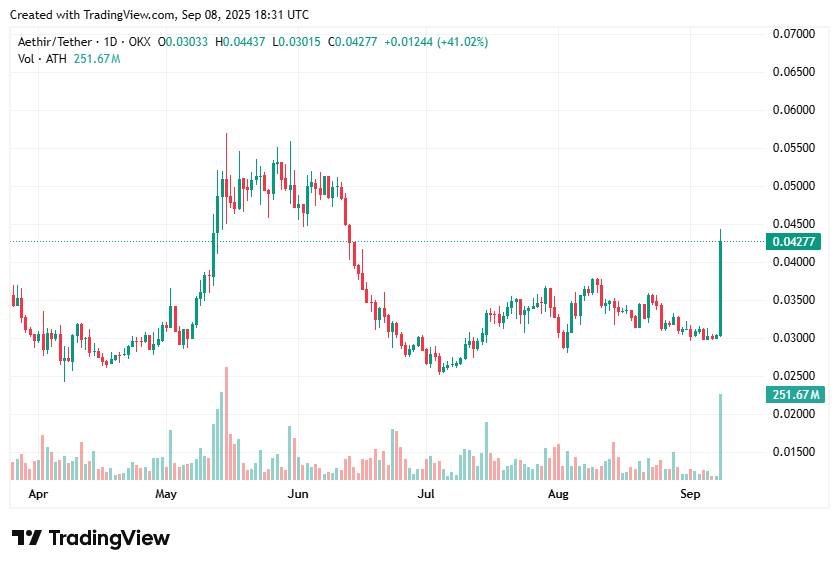

Aethir price chart. Source: crypto.news

Aethir price chart. Source: crypto.news

While the token’s price nosedived to lows of $0.025 in mid-July, bulls failed to capitalize on a rebound in late July and again in mid-August as bears held around $0.037. However, the latest bounce sees buyers breach this technical barrier, a supply wall that could now act as support after the price also pierced the $0.040 mark.

Price sees Aethir outpace DePIN peers

Aethir price surged on Sept.8 alongside bullish performance across crypto.

Bitcoin (BTC) crossed back above $112k and ethereum (ETH) moved above $4,330. Mainly, cryptocurrencies remain upbeat as risk assets trend higher ahead of the highly anticipated Federal Reserve meeting, where the central bank is expected to cut interest rates for the first time in months. Experts say recent macroeconomic data suggest the odds of a 50-basis-point cut have increased.

The upbeat market activity for top coins thus also saw DePIN tokens rise. Bittensor (TAO) Render (RENDER) and Arweave (AR) are among DePIN tokens to push weekly gains into double-digit territory, while the segment’s market capitalization rose 3% to over $34.8 billion and daily volume increased 25% to more than $4.2 billion.

For Aethir, which offers a GPU-as-a-service network, the 24-hour trading volume reached $95.7 million, up more than 1,300%. The token’s market cap ROSE to $473 million. Elsewhere, data from Coinglass showed open interest at $65.29 million.

The all-time high for Aethir is $0.29, reached in June 2024.