Nasdaq Shakes Up Finance: Files to Trade Tokenized Equities in Landmark Move

Wall Street's sleeping giant just woke up—and it's holding a blockchain.

Nasdaq drops regulatory paperwork to launch tokenized equity trading, bridging traditional finance with digital assets in one seismic shift. The move signals institutional acceptance isn't just coming—it's already here.

Why This Changes Everything

Tokenization slashes settlement times from days to seconds. It democratizes access to equity markets while boosting liquidity through fractional ownership. Traditional brokers now face an existential threat from their own infrastructure provider.

The Fine Print Revolution

Expect resistance from legacy players clinging to outdated clearing systems. But the genie's out of the bottle—efficiency always wins over bureaucracy. Even the SEC can't slow this momentum forever.

Wall Street's worst nightmare? Finally having to innovate beyond charging 2% management fees for index fund replication.

Nasdaq has submitted a regulatory filing to trade tokenized securities as Galaxy Digital, the digital asset and data center infrastructure firm, has tokenized its Nasdaq-listed stock and crypto firms have launched tokenized versions of U.S equities.

President of NASDAQ announces they have submitted an SEC filing to facilitate trading tokenized securities on the NASDAQ Stock market.

This has so many implications, will cover off in details but yes have no doubt SEC will give their blesssing as well. pic.twitter.com/w2PU9ohuIK

— XXIM – Decentralise Capitalism (@xximpod) September 8, 2025

Tal Cohen, president of Nasdaq, said in a LinkedIn post that blockchain technology opens the door to shorter settlement cycles, modernized proxy voting, and programmable means to manage corporate actions.

![]()

Tal Cohen, Nasdaq

“While these advancements are exciting, they should not come at the expense of the resiliency, security, and strong governance that currently exists in the U.S. equities markets,” added Cohen. “Therefore, we stand ready to work with both existing and new providers of critical trade infrastructure services to innovate together, while maintaining the Core tenets of trust that underpin our markets today.”

Chuck Mack, senior vice president of North American Markets for Nasdaq, said in a Q&A that the filing enables trading of tokenized equities and ETFs under the existing regulatory frameworks, with the Depository Trust Corporation (DTC) clearing and settling trades in token form.

When an order is entered, a participant can select to clear and settle in regular or tokenized form, and Nasdaq will communicate the participant’s instruction to the DTC. All shares will be traded on Nasdaq with the same order entry and execution rules, have the same identification number (CUSIP), and give the holder the same rights and benefits as a traditional share.

![]()

Chuck Mack, Nasdaq

Mack said: “That’s a key point we make in our filing: the U.S. has existing rules that don’t preclude different types of representation of a security. If you’re trading a stock and we’re having DTC tokenize it after the trade, then nothing is different from the perspective of how the market functions, how you trade, how you get your best execution, or how you buy or sell on your trading platform.”

Security Token Market said in its newsletter What’s drippin: “The bottleneck lies in the SEC’s approval and the DTCC’s infrastructure being ready for this to MOVE forward (more likely a 2026 launch). Nonetheless, this is more forward momentum for the year and instills further confidence in the future of markets living onchain.”

Daniel Shapiro, analyst at Blockworks Research, said:

Tokenized securities traded in the SAME ORDER BOOK with SHARED EXECUTION on NASDAQ has a single critical implication:

> NASDAQ will create a blockchain themselves and somehow convince 100+ and increasing number of teams to use their blockchain for native tokenization

> NASDAQ… https://t.co/TGnRWeJN6h pic.twitter.com/bTRQ8toe8d

— Daniel Shapiro (@_dshap) September 8, 2025

Galaxy Digital has become the first Nasdaq-listed company to tokenize its SEC-registered equity directly on a major blockchain. On 3 September 2025 Galaxy said in a statement that it has partnered with fintech Superstate, which provides tokenization services, to allow stockholders to tokenize and hold Galaxy shares on the solana blockchain

In a WHITE paper Galaxy said: “Every few decades, a new technology arrives that doesn’t just improve an industry or practice, but transforms it. We believe that tokenization will do for value what the internet did for information.”

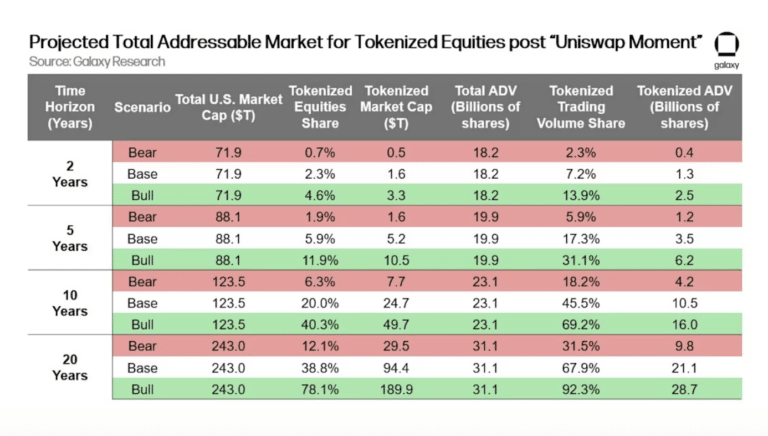

The firm estimated the potential size of the onchain equity markets assuming 7% nominal growth for U.S. equity market cap and 3% growth in total share trading activity.

Source: Galaxy Digital

Other tokenized stock offerings have caused controversy as they rely on a wrapper or synthetic model and are often done without the involvement of the issuer.

Galaxy highlighted that Superstate works directly with companies to enable tokenization of their SEC-registered shares as these tokens are not derivatives or representations – they are Galaxy Digital Class A Common Stock, with all the rights that confers. Superstate is the SEC-registered transfer agent and records legal ownership onchain in real time as tokens are transferred. Peer-to-peer trading is possible between investors who have passed Know Your Customer checks.

The onchain Galaxy shares remain fully compliant and legally equivalent to traditional equity, but can be traded 24/7 market potential and have near-instant settlement.

![]()

Michael Novogratz,

Galaxy Digital

Mike Novogratz, founder and chief executive of Galaxy, said in a statement: “Our goal is a tokenized equity that brings the best of crypto – transparency, programmability, and composability – into the traditional world.”

This is “just the first step in what we expect will become a capital markets revolution” according to Galaxy. The firm has not enabled direct trading of these tokens within automated market makers (AMMs) or other fully permissionless decentralized exchange mechanisms on Solana, as the regulatory treatment of such trading remains uncertain, and is discussing this with the SEC. An AMM is a DeFi protocol that uses algorithms to price and trade crypto assets without an order book.

“Importantly until these more durable, transparent, persistent secondary market venues are available, there is no guarantee that onchain shares of GLXY will have any onchain liquidity, though it is possible to trade GLXY bilaterally between addresses that have onboarded with Superstate,” added the white paper.

Superstate said in a statement the Galaxy’s tokenization differs from other tokenized equity models like Robinhood, the retail broker, because the platform works directly with issuers to tokenize real shares—not synthetic products or wrapped representations.

The latest example of a wrapped structure comes from Ondo Finance and the Ondo Foundation, who tokenize real-world assets. On 3 September 2025 they launched Ondo Global Markets which enables non-U.S. investors to access over 100 tokenized U.S. stocks and ETFs on the ethereum blockchain. The tokens provide exposure to the total economic return of U.S. stocks and ETFs and are fully backed and secured by those assets held at one or more U.S.-registered broker-dealers and cash in transit.

For Galaxy’s onchain equities, Superstate is the SEC-registered transfer agent, recording legal ownership on-chain with full compliance and permissioning. Superstate said in a statement: “We believe the compliant, issuer-first path is the most durable and scalable way forward for public capital markets to go on-chain.”

Will Peck, head of digital assets at asset manager WisdomTree, said in a blog that the industry needs a new framework to understand tokenized securities. He explained that onchain securities can be wrappers of offchain shares, solely onchain shares or tokenized cash flows. Wrappers that are common in traditional finance include exchange-traded funds, ETFs, that allow a market participant to access assets on one ledger that are otherwise tracked on another.

![]()

Will Peck, WisdomTree

“Tokenized securities are meeting a similar need, bringing securities from one ledger onto a blockchain to enable new distribution or create a new user experience,” added Peck.

However, he highlighted that tokenized security or fund models may strip out some of an investor’s legal claim and rights, depending on the jurisdiction and wrapper design. In addition, Peck also highlighted that ownership in a wrapped asset is only as good as the price you can get for it in the secondary market or via primary market redemption.

“Tokenizing a security does not magically bring it liquidity in the secondary market – just because something can be traded does not mean it will be traded,” said Peck.

U.S. Treasuries or large cap U.S. stocks may transfer their liquidity onchain more easily but a well structured market is still required.

“Beyond the secondary market, the tokenholder could have a redemption right with the issuer for cash or the underlying asset,” added Peck. “The utility of that right depends on the holder’s ability to accept delivery of the underlying asset and, also, sell that asset.”

Security Token Market said the Nasdaq filing also addresses recent concerns over different types of tokenized stocks as multiple issuers have introduced the market to different structures.

“Some are mirrors, some are natively tokenized, and some may not be backed by the underlying at all,” added the newsletter. “With that in mind, native tokenization guarantees the same investor rights while mirror tokens give non-US investors exposure to our markets with less hassle – each of these have their own value adds.”

Nasdaq has filed with the SEC to allow listing and trading of tokenized stocks.

Coinbase, Robinhood, Kraken all are racing to bring equities onchain.

All three are building an L2 on Ethereum. Massive W. pic.twitter.com/1rtmRplMjJ

— fabda.eth (@fabdarice) September 8, 2025