🚀 xStocks Smashes $2B Milestone: TSLAx Fuels Record Trading Volume

xStocks just crossed the $2 billion cumulative volume mark—and Tesla's tokenized twin TSLAx is leading the charge. Here's why traders are piling in.

## Synthetic Assets Eat Traditional Markets for Breakfast

While Wall Street still settles trades in three days, xStocks' blockchain-powered platform settles in three seconds. TSLAx volume alone now rivals some NYSE-listed ETFs—ironic for an asset that 'doesn't exist' according to the SEC.

## The Numbers Don't Lie

$2,000,000,000 in cumulative volume. Zero physical shares. 100% cryptographic proof. Traders clearly prefer their stocks with side orders of DeFi yield and 24/7 trading.

## Watch Out, Citadel

When tokenized equities start outpacing their real-world counterparts, you know the game's changed. Just don't tell the boomers still waiting on their T+2 settlements—they might short-circuit.

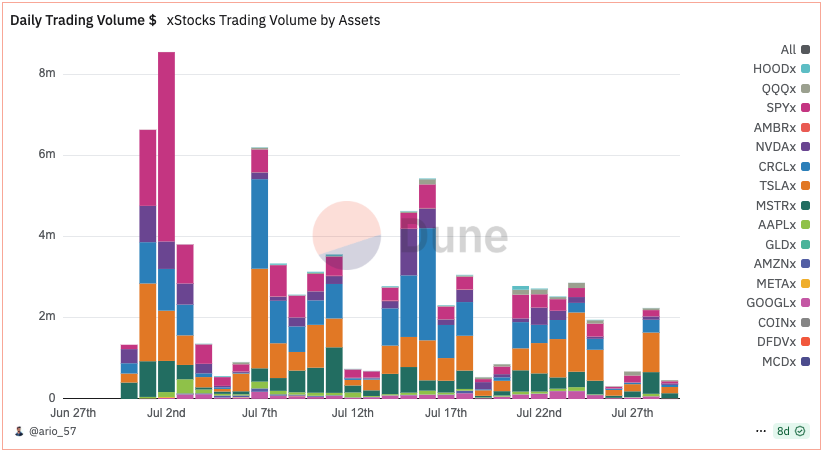

xStocks trading volume by asset | Source: Dune Analytics

xStocks trading volume by asset | Source: Dune Analytics

The biggest assets by volume were xTSLA, Circle, and SPYx, tracking Tesla and Circle stocks as well as the S&P 500 index. For instance, cumulative trading volume in xTSLA reached $20.9 million by July 27.

On the other hand, most of the volume came from centralized exchanges, with $1.92 billion of cumulative volume. On the other hand, on-chain and DEX trading reached $100 million since the xStocks launch in late June.

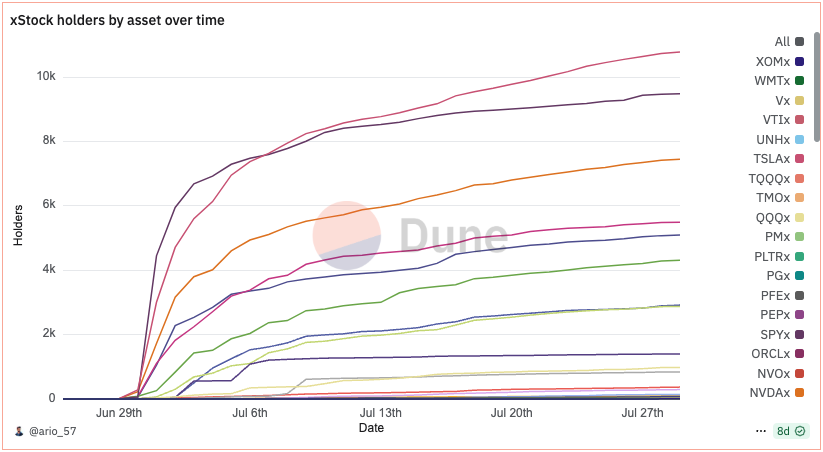

Tesla tokenized stock ownership rises to 10k

This milestone coincided with an increase in Tesla tokenized stock ownership. On August 6, the total holders of xStocks tokenized stocks were at 24,542, with TSLAx with 10,777 holders. The S&P 500 tokenized asset was in second place, with 9,483 holders.

Since its launch in late June, Solana-based (SOL) xStocks has dominated tokenized stock trading. At the same time, it also contributed to the dominance of the solana network in the tokenized stock market. The network accounts for around 95% of the total market, largely due to xStocks.

xStocks has also secured several major partnerships, including with Raydium, Jupiter, and XT.com. What is more, the service is also listed on a centralized exchange, including Kraken, Gate, among others.