Solana’s Treasury Swells Amid Market Turmoil—Why Isn’t the Price Keeping Up?

Solana’s coffers are overflowing—so why are investors still sweating?

Treasuries Up, Sentiment Down

While Solana’s treasury growth hints at long-term strength, the token’s recent price slump has traders questioning the disconnect. Is this a buying opportunity or a red flag?

The Cynic’s Take

Another day in crypto: fundamentals improve, but the market reacts like a spooked herd. Maybe Wall Street’s ‘buy the rumor, sell the news’ playbook is contagious.

Corporate Solana Treasuries

In the race for corporate crypto acquisition, Bitcoin is the most popular asset, but other tokens are becoming more prominent. Earlier this week, two new standouts became clear: ethereum and Solana are the most popular altcoins for private treasury firms.

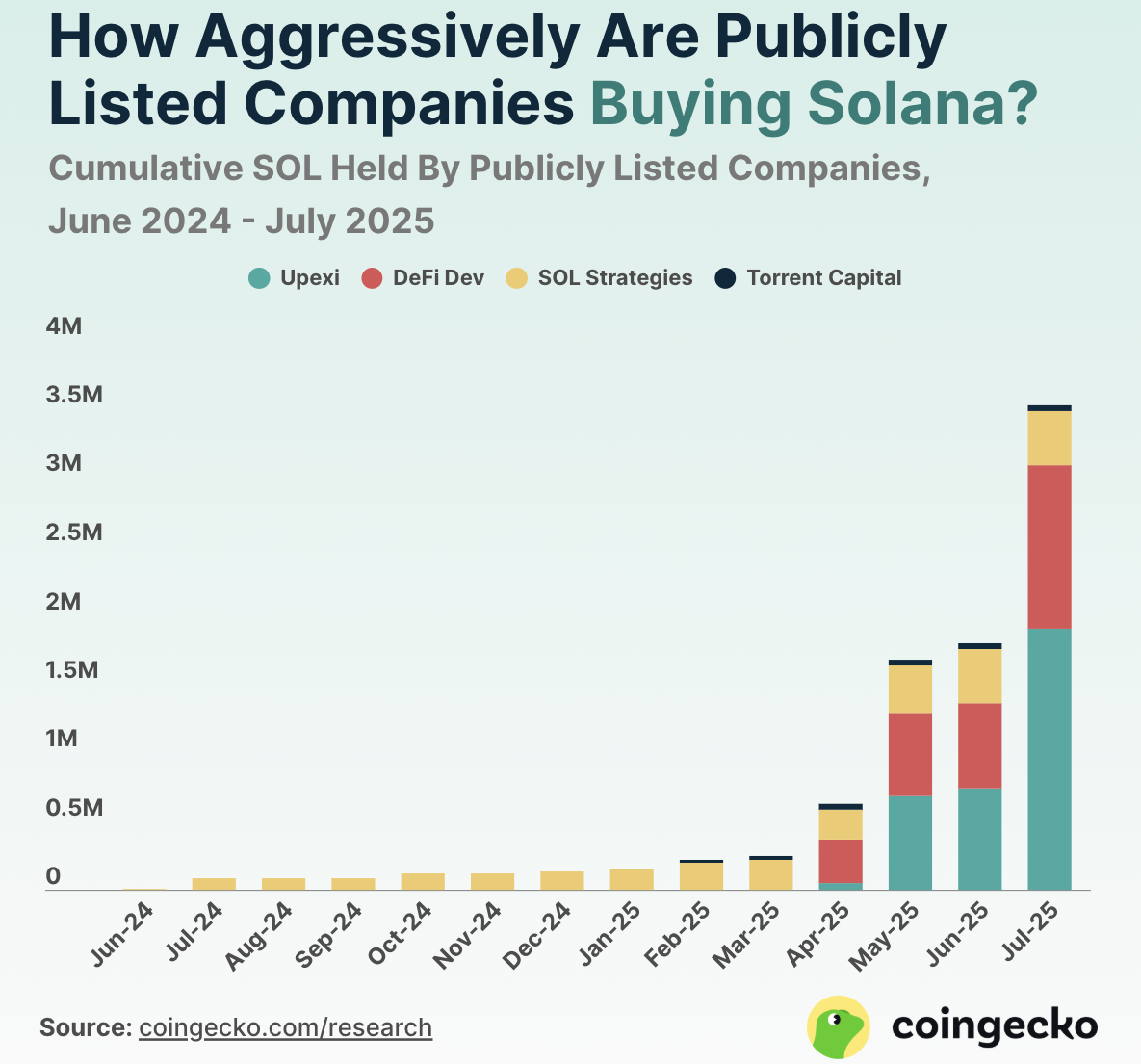

According to a report from CoinGecko, the rate of corporate SOL acquisition is increasing dramatically.

As this data shows, newcomers have repeatedly disrupted this market sector. SOL Strategies is by far the oldest player in this space, making substantial investments before this tactic was on anyone’s radar.

By April 2025, however, DeFi Development rebranded to become a Solana treasury firm, immediately surpassing the other company’s consumption.

Taking the moniker of ‘Solana’s MicroStrategy’, DeFi Development’s purchases have been accelerating.

Meanwhile, Upexi started small with its own Solana treasury, but supercharged its spending in July. The firm currently holds 1.9 million SOL, towering above DeFi Development’s 1.1 million.

Solana’s Volatility Remains a Challenge

Clearly, the Solana treasury market is defined by fierce competition, but it remains quite small. There are only four serious stockpilers, and Torrent Capital holds only 40,000 SOL.

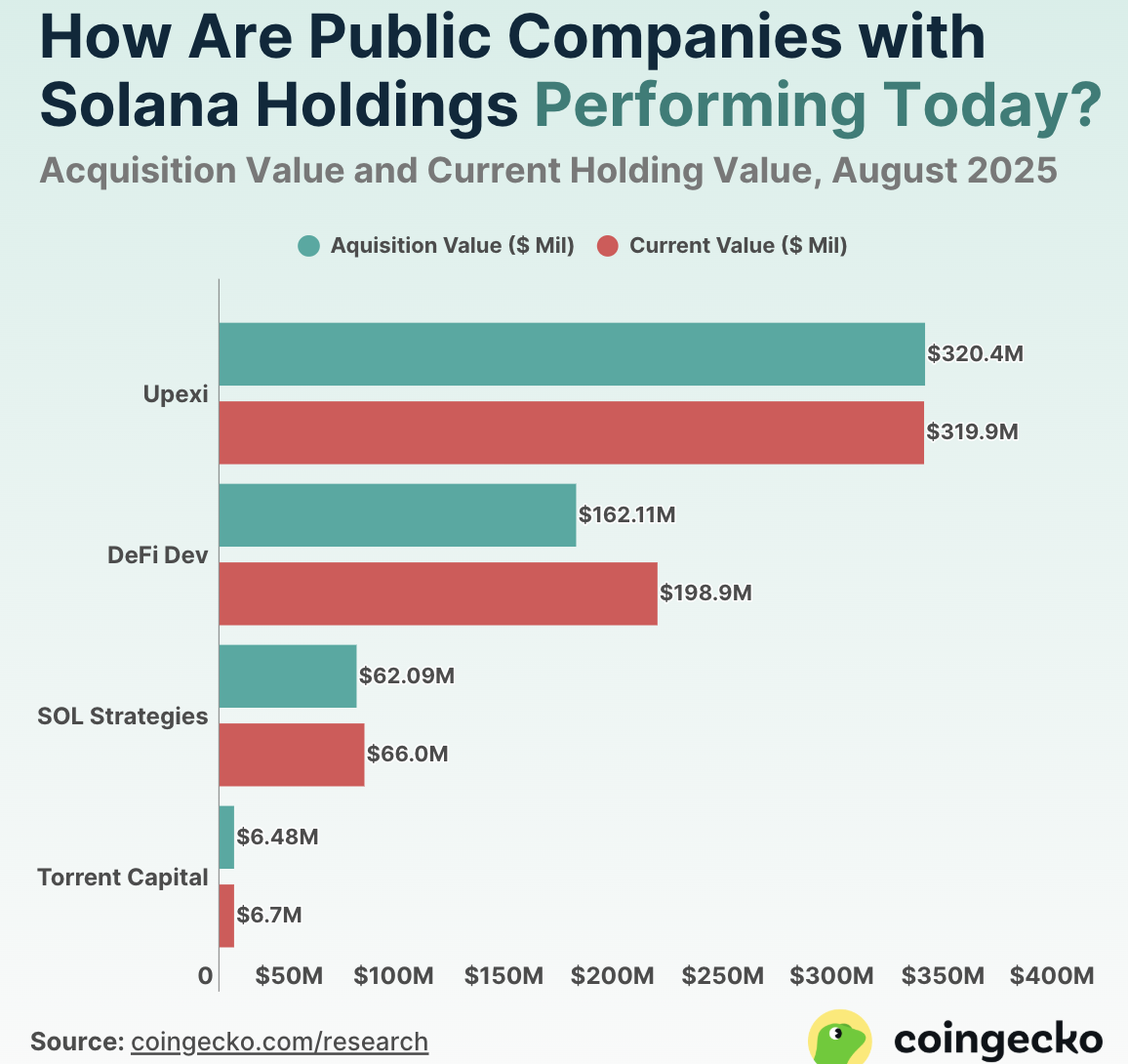

This begs a simple question: are these Solana buys a good investment? Prices have fallen considerably since late July, and it’s unclear when a rebound might happen.

So far, Upexi’s aggressive expansions have come at a cost. By stockpiling so much Solana directly before a downturn, the firm actually lost around $0.9 million.

The other companies performed better, but nothing like MicroStrategy’s wild returns. BTC treasury investors frequently expect a stellar performance, but Solana isn’t there yet.

These metrics have provided some valuable information about Solana as a potential treasury asset. Ethereum has returned a better performance, but there’s no shortage of corporate investors.

Meanwhile, these SOL maximalists have a commanding head start in a tiny market. If Solana jumps back up soon, these firms could become trendsetters.