MARA Rides Bitcoin’s Bull Run to $808M Profit—Mining Giant Cashes In on BTC Rally

Bitcoin's relentless surge isn't just padding crypto portfolios—it's minting mining megaprofits. Marathon Digital (MARA) just posted a staggering $808 million windfall, proving once again that pickaxe sellers thrive in gold rushes.

Hashrate meets payday

While traders sweat over candle charts, MARA's mining rigs quietly converted BTC's price explosion into record revenue. No fancy derivatives, no leverage—just raw computational power turning electricity into eight-figure returns.

Wall Street's crypto FOMO grows

The numbers will make traditional finance squirm. A mining operation—dismissed as 'digital alchemy' during bear markets—outperformed 90% of S&P 500 companies last quarter. Maybe those energy bills aren't so ridiculous after all.

As BTC flirts with new highs, MARA's haul exposes an open secret: in crypto's volatile ecosystem, the surest bets often come from selling the shovels, not digging for treasure.

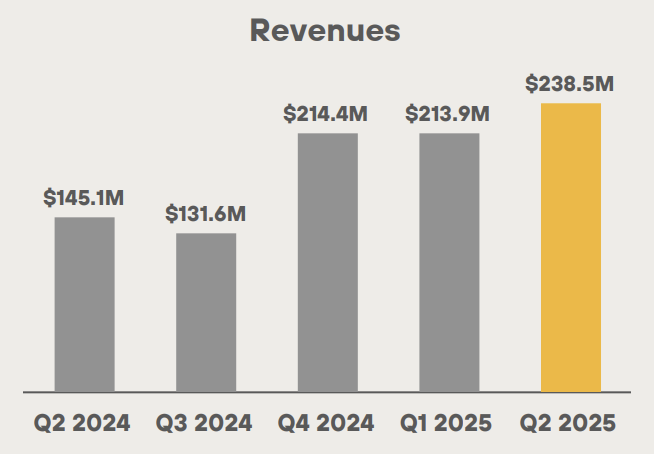

MARA holdings quarterly revenues | Source: MARA

MARA holdings quarterly revenues | Source: MARA

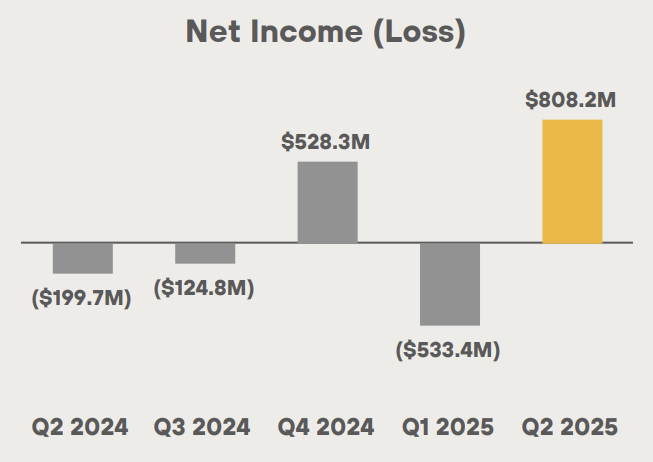

The company reported even stronger net income, at $808.2 million, compared to a $199.7 million loss in Q2 of 2024. This was largely due to a non‑cash gain on Bitcoin holdings, amounting $1.2 billion, largely due to unrealized profits on Bitcoin holdings.

MARA Holdings continues to accumulate BTC

The company’s Bitcoin holdings also ROSE by 170%, now totaling 49,951 BTC. Shortly after the quarter-end, MARA’s BTC holdings surpassed 50,000 BTC. This makes it the second-largest BTC treasury firm, only trailing Strategy.

Unlike most Bitcoin miners, MARA Holdings doesn’t sell the BTC it mines. Instead, the firm leverages its BTC as a strategic reserve asset to boost its share price long-term. The company also uses stock offerings to acquire additional Bitcoin reserves.

Since the regulatory changes in the U.S., Bitcoin has become a popular treasury asset. More and more companies are leveraging their Bitcoin reserves to enable investors to gain exposure to the biggest crypto asset.