🚀 SPARK Soars: Whale & Smart Money FOMO Triggers Bullish Breakout

Whales are piling in—and the charts are screaming buy.

### The Big Money Bet

On-chain data reveals a surge in accumulation by deep-pocketed investors, fueling SPARK's breakout past key resistance. This isn’t retail hype—it’s institutional-grade FOMO.

### Liquidity Hunt

Smart money’s playing chess while day traders check price alerts. The move mirrors classic breakout patterns seen in assets before parabolic runs (and before the inevitable ‘correction’ that crushes overleveraged degens).

### The Cynic’s Corner

Funny how ‘whale accumulation’ always gets reported *after* the pump. Almost like someone wants you to buy the top.

What’s driving Spark’s rally?

Spark’s recent rally has been fueled by several key factors.

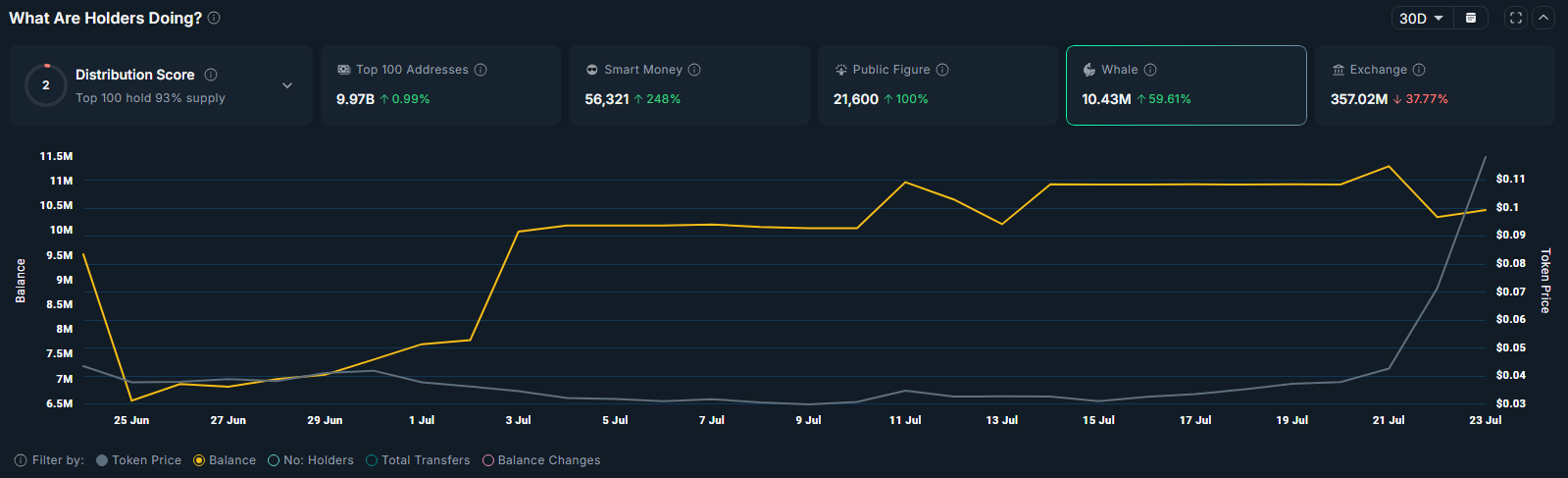

First, data from DeFiLlama shows whales and smart money have continued to accumulate Spark. Whales have purchased 3.9 million SPK tokens over the past 30 days, increasing their total holdings to more than 10.4 million.

Meanwhile, smart money wallets, typically known for their strong track record in identifying early opportunities, have boosted their exposure by 250% to over 56,000 tokens during the same period.

When large players position themselves heavily in an asset, it often draws in retail traders and momentum buyers, helping to drive the related assets’ price higher.

Second, Spark balances on exchanges have fallen by 37% over the past month, now standing at approximately $357 million at the time of writing.

A drop in exchange balances typically indicates that investors are moving tokens into self-custody or staking them within protocols, reducing the readily available supply for trading. This supply squeeze can create upward pressure on price, especially when paired with rising demand, as seen with the recent surge in whale and smart money accumulation.

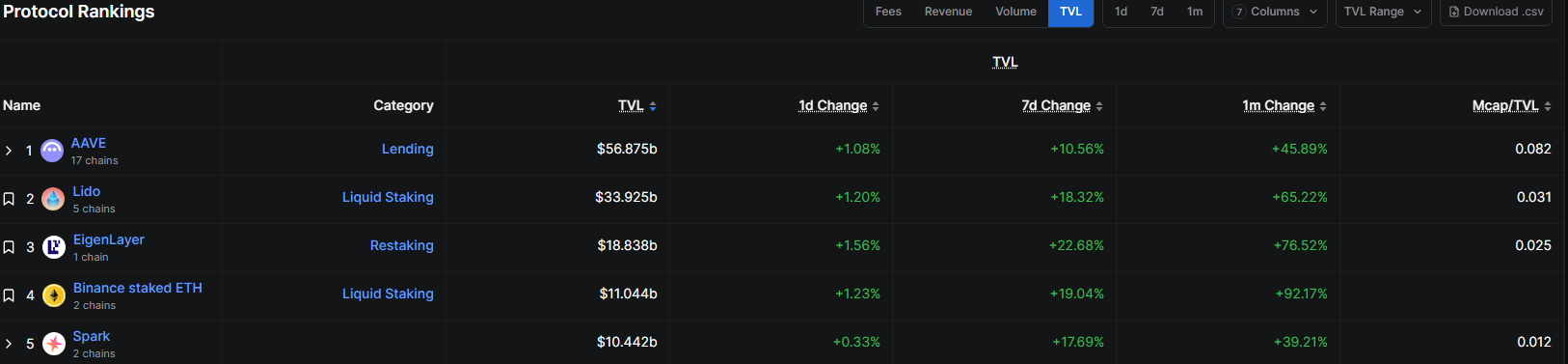

As previously covered on crypto.news, DeFi on Spark has been booming lately. The total value locked in the protocol hit an all-time high of $10.48 billion on Wednesday after surging over 40% from the previous month to become the fifth largest player in DeFi.

When TVL rises, it’s often a sign that increased platform utility, which subsequently increases demand for the protocol’s native token and drives its price higher.

Descending triangle breakout

On the daily chart, SPK has broken above the upper boundary of a descending triangle.

A descending triangle usually signals that prices might keep falling, as it forms with lower highs and a flat bottom. But if the price breaks above the top line instead, it can mean the trend is changing, and buyers are starting to take control, pushing the price higher.

As visualised in the chart above, SPK’s price has moved above the upper trendline of the pattern, which confirms the bullish reversal.

The token has also reclaimed the 20-day exponential moving average at $0.050, a level now acting as dynamic support.

Hence, if the price continues to hold above the 20 EMA, SPK could retest the top of the previous wick NEAR $0.125.

A successful breakout above that level WOULD likely open the door to a rally toward $0.1840, a move that would mark a new all-time high and 60% above the current level.

Conversely, if bears regain control and push the price back below the 20 EMA, SPK could decline toward $0.056. A deeper correction may bring the price down to $0.040, a historically significant support level that previously anchored the market during prior selloffs.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.