Dow Jones Soars on Bank Earnings Boom While Trump Defends Powell—For Now

Wall Street's favorite pastime—printing money—got a turbocharge today as banking giants posted earnings that sent the Dow Jones screaming past resistance levels. Meanwhile, in a shock to absolutely nobody, Trump denied rumors he'd fire Fed Chair Powell... this week.

Banking on chaos

JPMorgan and Goldman Sachs flexed their Q2 numbers like a Wall Street bro at a Hamptons cocktail party. The Dow ate it up, climbing steadily as traders ignored the looming specter of rate cuts and political theater.

The Powell paradox

Trump's latest 'very stable genius' moment saw him walking back threats to oust the Fed chair—probably because someone explained what 'market panic' means. The dollar barely flinched, proving once again that political noise is just background static for institutional money printers.

Closing thought: Nothing boosts markets like banks making money from money while politicians pretend they're in charge. Some things never change—until the next tweet.

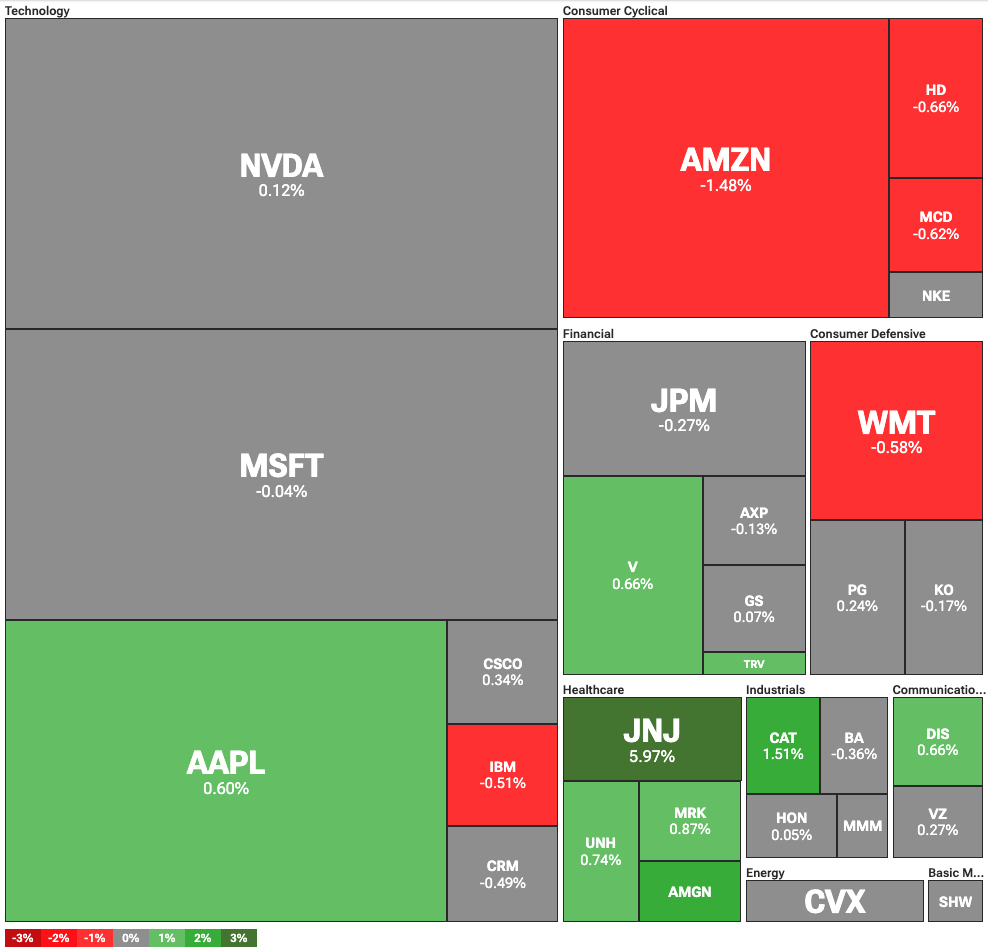

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

raders turned their attention to renewed tensions between the WHITE House and the Federal Reserve. On July 16, President Trump denied earlier reports that he planned fire Fed Chair Jerome Powell. He stated that he is “not planning” to remove Powell, though he reiterated that the Chair was doing a “terrible job.”

Trump has continued to pressure the Fed to lower interest rates in an effort to stimulate the economy and lift the stock market. Most recently, the White House criticized the central bank over a $2.5 billion renovation project for two buildings in Washington.

The Fed remains hesitant to adjust interest rates due to persistent inflation concerns. The latest CPI data added to those fears, showing that consumers are beginning to feel the impact of Trump’s tariffs. In this environment, rate cuts appear unlikely, unless there is a significant shift in the Fed’s leadership.

Big banks profit despite fears over inflation

Strong earnings from major banking giants helped lift the stock market. Goldman Sachs, Bank of America, and Morgan Stanley all posted better-than-expected results. The banks also reported growing market share, fueled by positive loan growth.

This suggests that the current environment continues to favor large financial institutions with significant exposure to capital markets. Notably, Goldman Sachs is up 22% year to date, while JPMorgan has gained 19% over the same period.