XRP Primed for a $5 Surge This July: Here’s Why

XRP's gearing up for a moonshot—and the stars might just align this month.

Four catalysts could send the crypto screaming past $5 before August hits. Buckle up.

1. Regulatory tailwinds finally cutting through the FUD

The SEC's losing streak against crypto just hit three. Judges aren’t buying their ‘everything’s a security’ act—and XRP’s the poster child for this shift.

2. Whale accumulation at levels not seen since pre-bull run

On-chain data shows addresses holding 10M+ XRP added another 3% supply last week. Somebody’s betting big on fireworks.

3. Liquidity patterns mirroring 2021’s breakout setup

That ascending triangle on the weekly chart? Textbook. The 50-week MA just crossed the 200-week. Technicals haven’t looked this juicy since the last ATH.

4. Payment corridors quietly going live

Three Middle Eastern banks flipped the switch on RippleNet last week. Real utility meets speculative frenzy—a combo that tends to move markets.

Will it actually happen? Who knows—this is crypto, where fundamentals occasionally matter between memecoin pump-and-dumps. But the setup’s undeniably spicy.

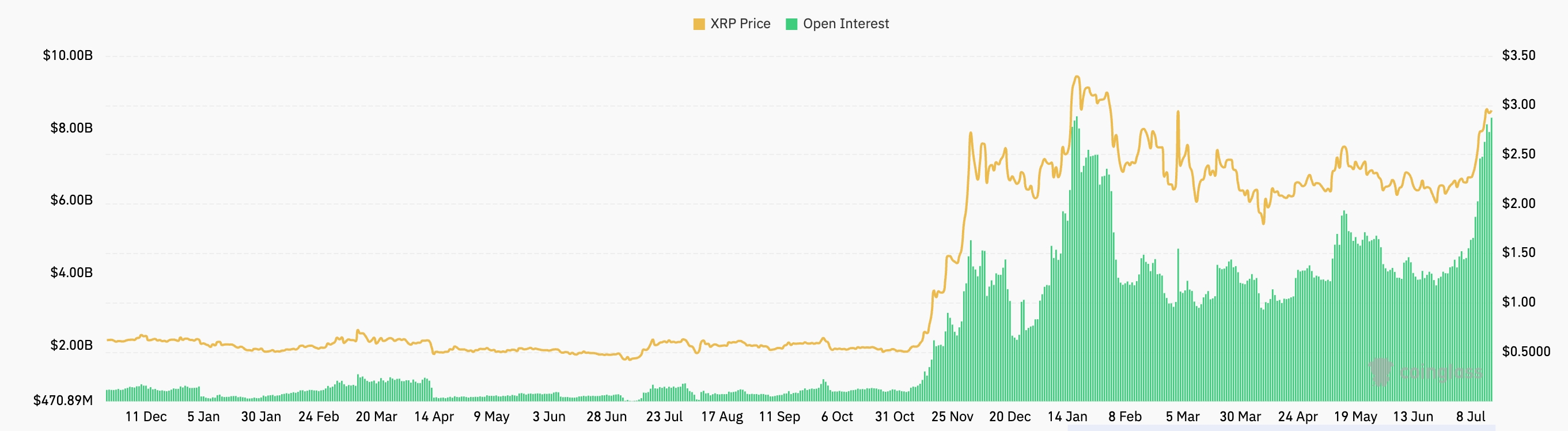

XRP futures open interest and funding rate

There are signs that XRP demand in both spot and futures markets is on a strong upward trajectory. CoinGlass data shows that futures open interest jumped to a record high of $8.3 billion this week—a significant rise from under $1 billion just a few months ago.

The weighted funding rate has remained positive since June 28 and has reached its highest point in over a week. A rising funding rate is typically a sign that traders expect the coin’s future price to be higher than it is today.

XXRP ETF inflows are soaring

Meanwhile, the Teucrium 2x Long Daily XRP ETF, which offers Leveraged exposure to the token, has continued to grow. Its assets have risen to over $285 million in under three months, an impressive figure for a fund with a 1.89% expense ratio.

This trend suggests that more mainstream XRP ETFs, such as those proposed by Bitwise and Franklin Templeton, could attract inflows from Wall Street investors. The odds of these ETFs being approved by the Securities and Exchange Commission have jumped to nearly 90%, according to Polymarket.

XRP Ledger ecosystem growth

Ripple Labs is also working to expand the XRP Ledger ecosystem. Recently, the company partnered with Ctrl Alt and the Dubai Land Department to provide scalable and secure storage for tokenized real estate title deeds. This follows Ripple’s receipt of a license to operate in the UAE.

In partnership with Ctrl Alt and the Dubai @Land_Department, Ripple Custody will deliver scalable and secure storage for the Dubai Land Department’s tokenized real estate title deeds, which have been issued on the XRP Ledger – enabling fractional ownership, transparency, and…

— Ripple (@Ripple) July 16, 2025Ripple has partnered with companies like Bank of New York Mellon, AMINA Bank, and OpenPayd, among others. At the same time, the Ripple USD (RLUSD) market cap has jumped to over $517 million, a trend that may accelerate after the GENIUS Act passes.

XRP price has strong technicals

The daily chart shows that XRP has broken above the upper boundary of a symmetrical triangle that formed over the past seven months. This pattern is part of a bullish pennant, a classic continuation signal.

XRP remains above the 50-day and 200-day Exponential Moving Averages, indicating that bulls remain in control. The next major level to watch is the all-time high of $3.3815. A breakout above this level could pave the way for gains toward the psychological resistance at $5.