Institutional vs. Retail Crypto Divide Hits Record High in H1 2025 – Wintermute Sounds Alarm

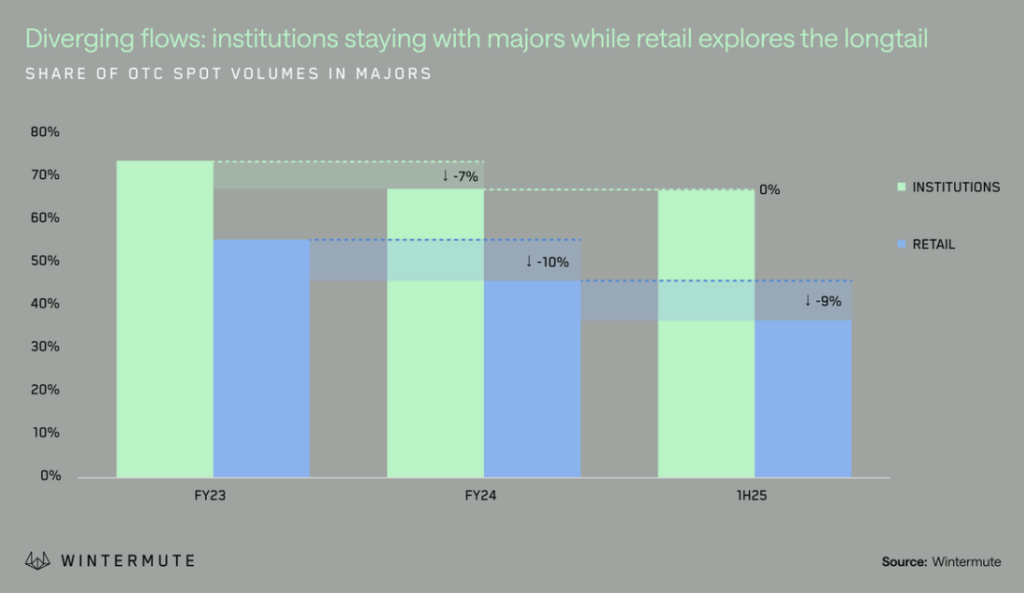

The crypto market's great divide just got wider. Institutional and retail investors haven't been this misaligned since 2023, according to fresh data from Wintermute.

Wall Street whales vs. Main Street minnows

While hedge funds pile into structured derivatives, retail traders keep chasing meme coin pump-and-dumps – a classic case of 'smart money' versus 'dumb money.' The gap hit its widest point in the first half of 2025, proving once again that crypto markets run on two completely different playbooks.

Liquidity crunch incoming?

When big players zig while retail zags, liquidity pools start looking dangerously thin. Wintermute's data suggests we're heading for volatile territory – just what crypto needed after that boring stretch of regulatory clarity and institutional adoption.

As always in finance, someone's about to get rich off someone else's FOMO. Place your bets on who blinks first.

Source: @Wintermute_T

Source: @Wintermute_T

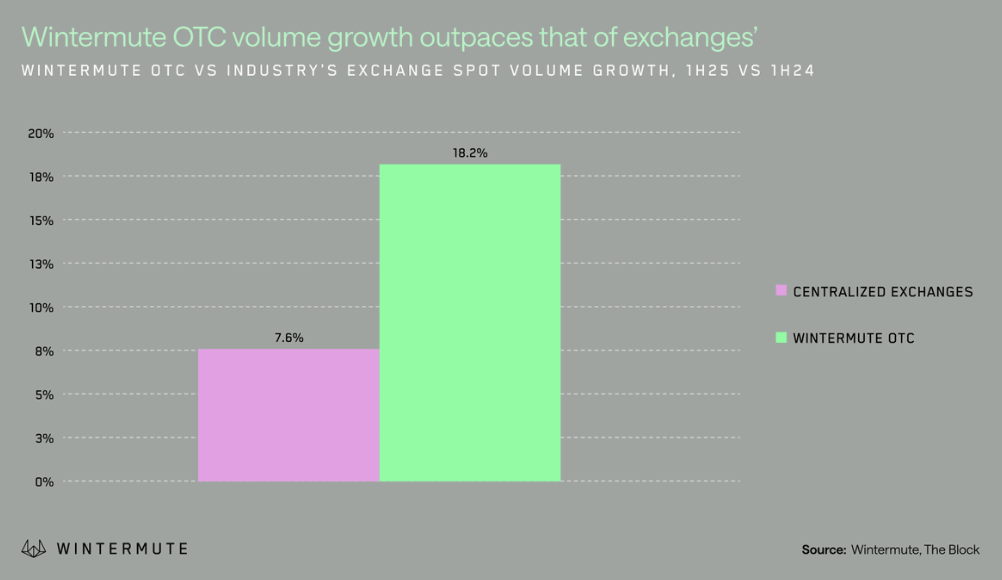

Beyond portfolio allocations, institutional adoption is reshaping crypto trading dynamics. According to the report, OTC trading volumes have surged to grow 2.4 times faster than CEX volumes in the first half of this year, driven by institutional players seeking large, discreet trades without exposing assets on exchanges.

“Counterparties continue to seek efficient ways to execute larger trades, and as institutional participation grows, there’s a rising preference to trade without the need to hold assets on exchange platforms,” Wintermute wrote.

The report also noted a 412% jump in options trading centered on BTC and ETH, compared to the first half of 2024, alongside a twofold increase in traded CFD underlyings, including newly launched index products.

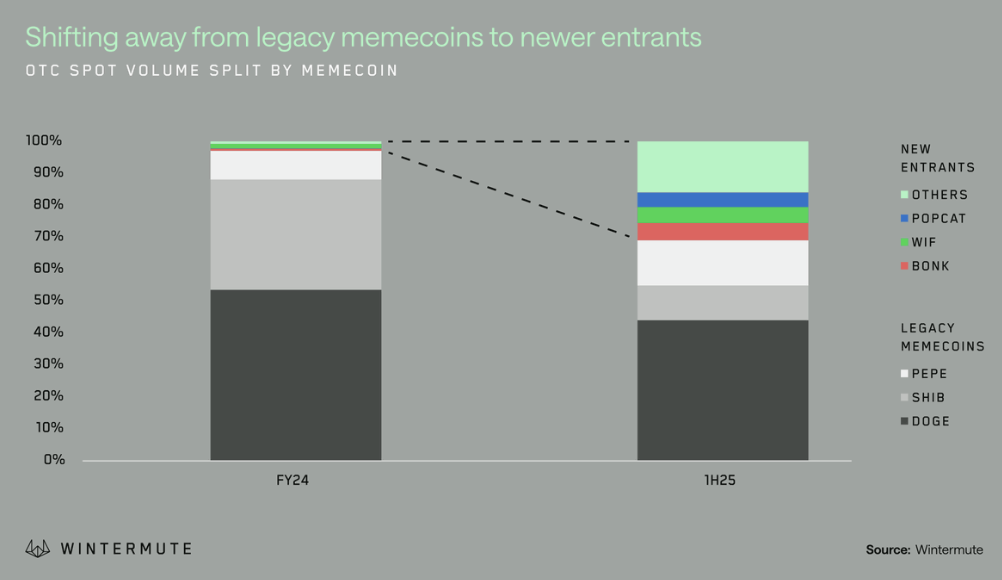

Wintermute’s report shows that legacy memecoins like Dogecoin (DOGE) , Shiba Inu (SHIB), and Pepe Coin (PEPE) lost ground to newer entrants like Bonk (BONK), dogwifhat (WIF), and Popcat (POPCAT). As a result, the share of long-tail memecoins surged dramatically, rising from 0.7% to 16.1% of total trading flow.