BONK Price Explodes 100% in July – Is This Meme Coin Rally Just Getting Started?

BONK, the Solana-based meme coin that refuses to die, just ripped past a 100% gain this month—leaving skeptics scrambling. Dog-themed tokens aren’t supposed to rally in a bear market, yet here we are.

### The Anatomy of a Meme Coin Surge

No fundamental news. No major exchange listings. Just pure, unfiltered degenerate momentum. Retail traders are piling in, fueled by FOMO and the eternal hope of finding the next DOGE.

### Will the Rally Hold?

Technical indicators scream 'overbought,' but since when did that stop a meme coin? Liquidity is thin, whales are circling, and the usual suspects on Crypto Twitter are already calling for a 10x. Meanwhile, institutional investors pretend not to watch—while secretly tracking the charts.

### The Cynic’s Corner

Let’s be real: this is the same asset that bled 90% during the last crypto winter. But in a market where 'utility' is just a buzzword and liquidity flows to the loudest hype, BONK’s rally makes perfect sense. Buckle up.

BONK price, Supertrend and MACD chart — July 15 | Source: crypto.news

BONK price, Supertrend and MACD chart — July 15 | Source: crypto.news

Despite being a bearish reversal pattern, Bonk still has room to rise before encountering resistance at $0.000040, where a potential reversal may occur. The target lies nearly 43% above the current price level.

Technical indicators seem to favor the positive outlook. The Supertrend line lies below the price and has turned green, indicating bulls are still in control and could push prices further in the short term. Momentum indicators like MACD and RSI are trending upwards, which is also seen as a buy signal by traders.

Some analysts have set an even more bullish target for BONK at $0.000060, citing the recent breakout above the upper trendline of an ascending triangle pattern.

$BONK Season Ahead 🚨

BONK rally will be non stop till $0.000060. Easy more 2.5X from here! pic.twitter.com/T9d8mBKG9e

Bullish catalysts at play

A few catalysts could support Bonk’s rally in the short term. According to data from CoinGlass, BONK’s weighted funding rate has continued to remain positive for the last 9 days.

A positive funding rate means long traders are paying short traders to hold their positions, which shows that most futures traders are betting on the price going up. If this keeps up, it could attract more retail investors, fueling Bonk’s price ahead.

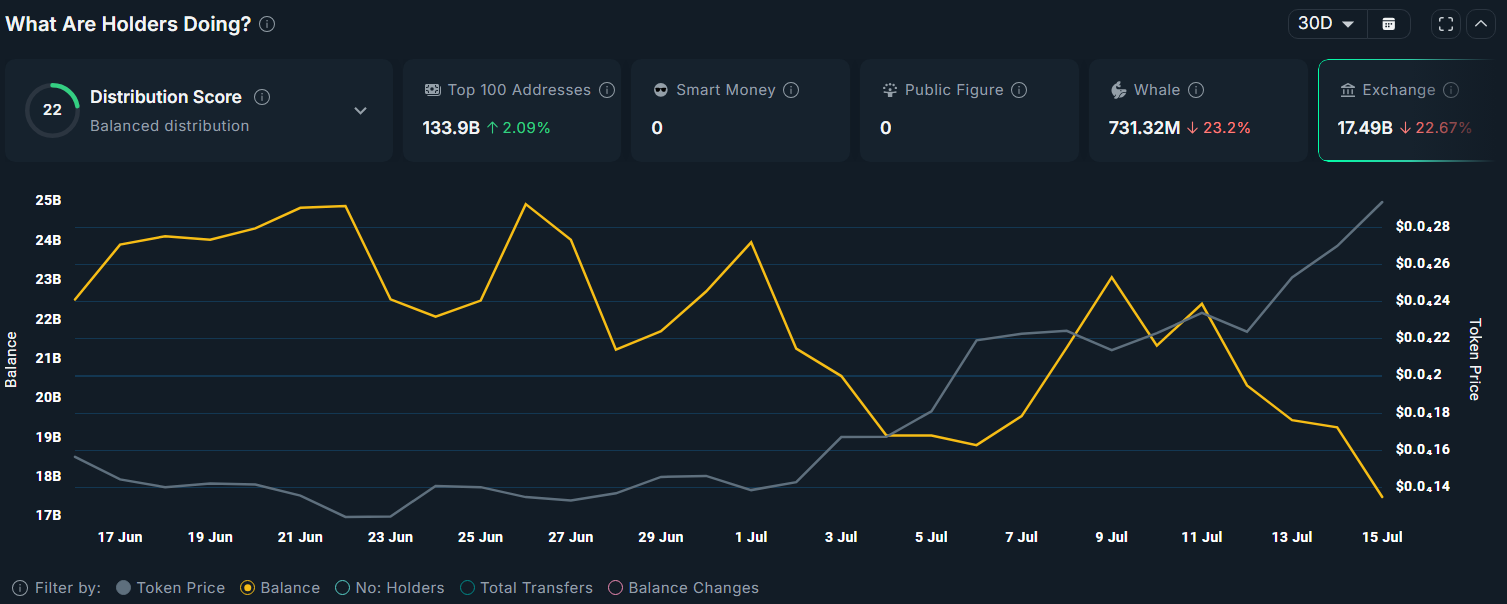

Additional data from Nansen shows that the total amount of BONK held by exchanges fell 22% over the past 30 days to 17.63 billion tokens. A drop in exchange balances could mean that traders are opting to transfer their holdings to private wallets, indicating they are less likely to sell them in the short term. Such outflows help reduce immediate sell-off risk while reducing supply.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.