Ethereum Investors Rush Into ETH as Weekly Gains Explode—Is $10K Next?

FOMO hits overdrive as Ethereum's price rockets—again. Retail and whales alike pile into ETH, betting the surge isn't done yet. But hey, since when has chasing green candles ever backfired?

Why the frenzy? ETH's weekly chart looks like a SpaceX launch. No fancy jargon needed—when numbers speak this loud, even Wall Street 'experts' pay attention (between martini lunches, of course).

The real question: Is this sustainable growth or just another crypto sugar high? Either way, hodlers aren't waiting to find out—they're buying the rumor, the news, and probably the T-shirt.

Joe Lubin’s SharpLink is the treasury king

Meanwhile, Joseph Lubin’s gaming platform, SharpLink, acquired another 10,000 ETH on July 11, 16,370 ETH on July 13, and a further 24,371 ETH for $73.2 million on Monday, bringing its total to over 255,000 ETH and making it the largest corporate Ethereum treasury.

Consensys founder Lubin has even referred to himself as a “self-appointed representative of The League of Extraordinary ETH Accumulator Gentlemen,” tipping his hat to BitMine and others for their recent accumulation acceleration.

Expanding list of Ethereum treasuries

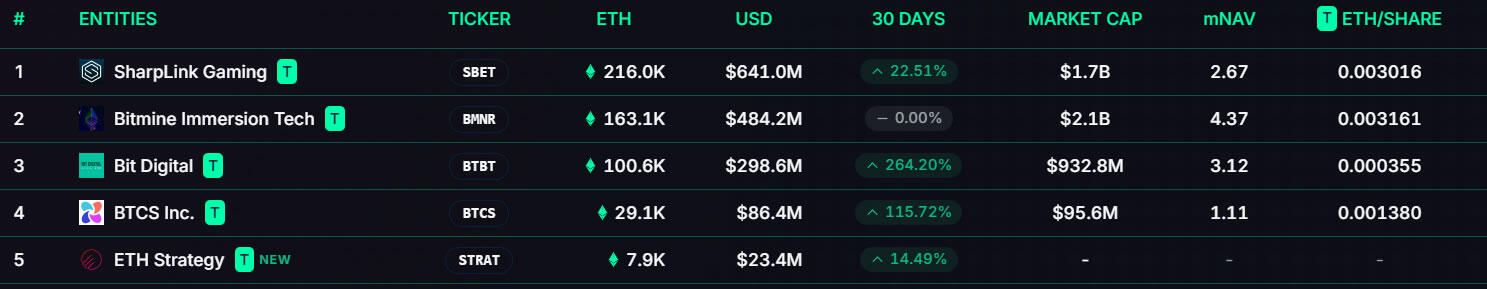

Other companies that have recently acquired Ethereum for corporate treasuries include digital asset platform Bit Digital, with more than 100,000 ETH, and Blockchain Technology Consensus Solutions (BTCS), which raised $62.4 million to expand its ETH holdings to 29,122 ETH this month.

Meanwhile, GameSquare announced a strategic plan for a $100 million Ethereum treasury on July 8.

Top corporate Ethereum treasuries. Source: Strategicethreserve.xyz

Almost $1 billion in Ether fund inflows

It comes as Ethereum-based digital investment funds posted their 12th consecutive week of inflows, totalling $990 million, the fourth largest weekly inflow on record, reported asset manager CoinShares on Monday.

Ethereum products have seen more than $4 billion in inflows so far this year, and almost 30% of that has come in the last two weeks as institutions pile into the asset.

In relative terms, Ethereum’s inflows over the past 12 weeks account for 19.5% of the total assets under management for all global Ether funds, compared to 9.8% for Bitcoin funds, CoinShares noted.

ETH prices topped $3,000 for the first time since February on July 11, but have pulled back below it at the time of writing with a 17% gain on the week.