Cardano Whales Bail: Is ADA’s Price Floor Cracking?

Big players dump holdings as Cardano’s support levels wobble—just another day in crypto’s casino economy.

Whales offload ADA bags: The so-called ’Ethereum killer’ bled out as major holders triggered sell-offs. Market depth? More like market shallow.

Retail left holding the bag: When the big fish flee, minnows get stranded. Classic crypto Darwinism at work—adapt or get liquidated.

Bonus cynicism: Meanwhile, traditional finance bros sip lattes while watching this unfold like a slow-motion car crash they predicted in 2017.

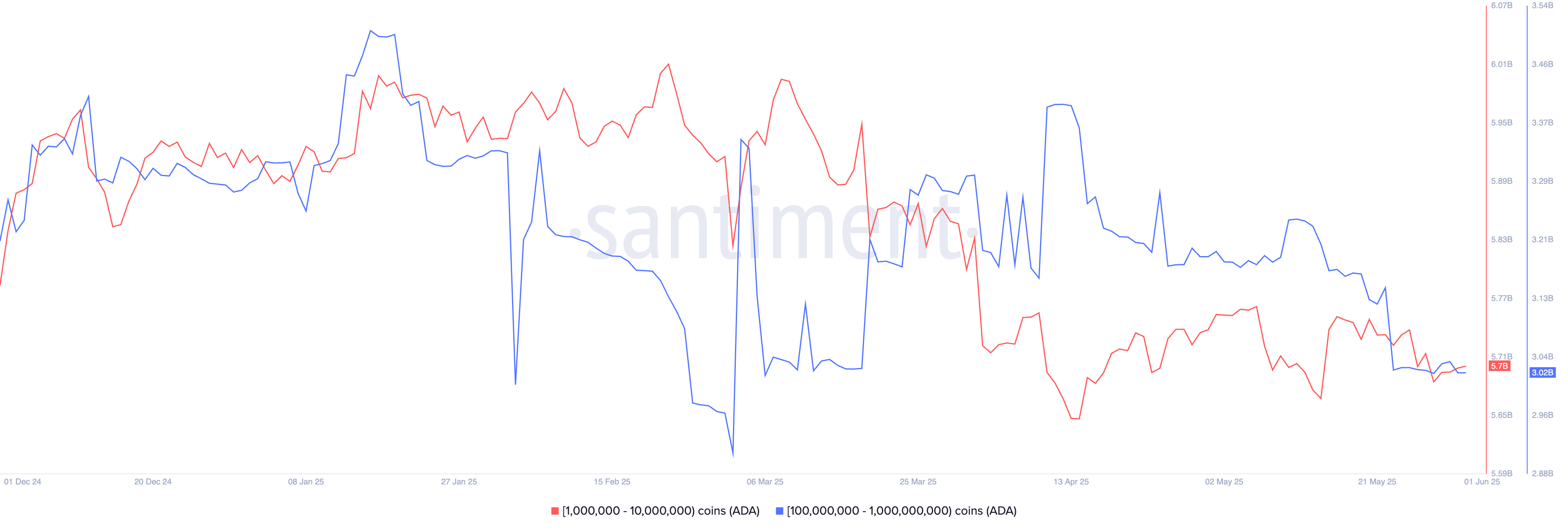

Cardano whale transactions | Source: Santiment

Cardano whale transactions | Source: Santiment

Similarly, those holding between 1 million and 10 million have reduced their holdings to 5.7 billion from the year-to-date high of 6 billion. These sales happened as the number of ADA tokens in profit dropped to 22.69 billion from 27 billion in April.

Cardano, once touted as a viable alternative to Ethereum, has continued to underperform across all areas. Its total value locked in decentralized finance has dropped to $391 million, while its cumulative DEX transactions stand at $4 billion.

In contrast, Unichain has a TVL of over $702 million, and its DEX volume has jumped to over $14 billion, a few months after its launch.

Cardano is now pegging its growth to its integration with Bitcoin (BTC), a move it expects will boost its TVL by billions. The argument is that incorporating Bitcoin will enable BTC holders to stake their holdings and earn rewards. However, this technology already exists, and Bitcoin staking platforms like SolvProtocol and Lombard Finance hold billions in assets.

Cardano price technical analysis

The daily chart shows that the ADA price has crashed in the past few days. This sell-off continued after it formed a double-top pattern at $0.839. It has now moved below this pattern’s neckline at $0.710, confirming its bearish bias.

Cardano has also plunged below the 50-day and 200-day moving averages, and is at risk of forming a death cross.

Therefore, the coin will likely continue falling as sellers target the psychological point at $0.50, down by 25% below the current level.

Cardano audit

Cardano also finds itself on the receiving end of damning allegations made by non-fungible token artist Masato Alexander.

Founder Charles Hoskinson, Alexander alleges, misappropriated $619 million in ADA tokens. Hoskinson denied the allegations.

An audit is currently in the works to debunk the claims, he said. If the audit clears the project of these accusations, investors’ confidence could be restored, triggering a strong rebound in Cardano. However, if the findings raise further concerns, ADA may continue in its recent downtrend.

The allegations center on a 318 million ADA transfer during the 2021 Allegra hard fork.

Hoskinson, one of the co-founders of Ethereum, launched the project in 2015. The Cardano blockchain officially went live on Sept. 29, 2017.

Hoskinson founded the cardano protocol through IOHK, or Input Output Hong Kong, a blockchain research and engineering company he co-founded with Jeremy Wood. The project was named after Gerolamo Cardano, a 16th-century Italian mathematician, and its native cryptocurrency, ADA, was named after Ada Lovelace, a 19th-century mathematician often credited as the first computer programmer.