NFT Lending Craters: 97% Drop Signals Crypto Winter Deep Freeze

Once-hot NFT lending markets now resemble a ghost town—volume nosedived 97% from its frothy peak. Turns out borrowing against cartoon apes wasn’t the ’financial revolution’ some VC decks promised.

Where’d all the ’number go up’ believers go? Probably repositioning their pitch decks for the next hype cycle. Meanwhile, actual builders keep shipping while the tourists flee.

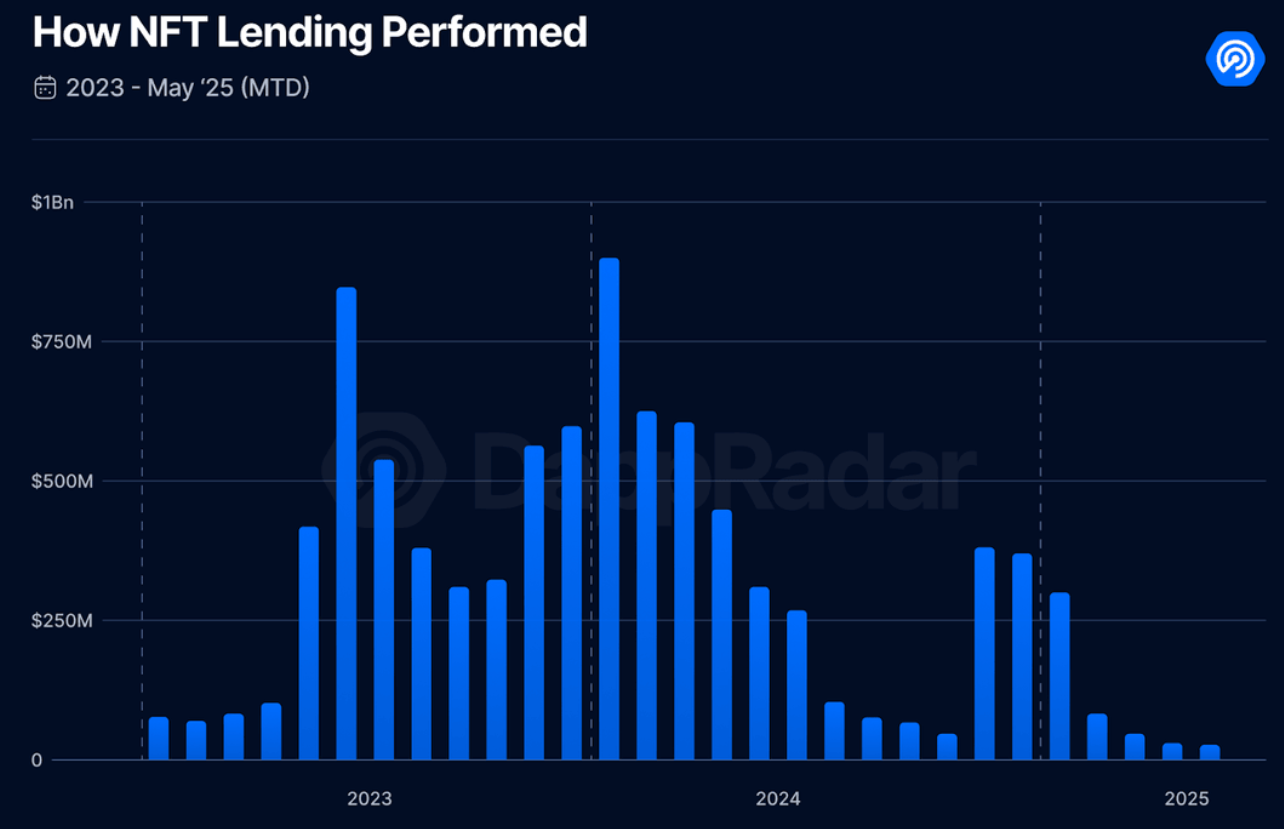

NFT lending market performance | Source: DappRadar

NFT lending market performance | Source: DappRadar

Pudgy Penguins stand out as one of the only NFT collections still seeing strong lending activity, with $203 million in loans this year, the report notes. Meanwhile, NFT marketplace Blur‘s Blend protocol, which once commanded over 90% market share, now accounts for just 30% of outstanding loans. Smaller lending platforms like NFTfi and Arcade continue operating but with significantly reduced activity.

Weekly trading volumes have been falling like dominoes for weeks, scaring off capital and dragging the market back to levels not seen since its explosive 2020 debut. In 2024, trading volume dropped nearly 20% from the year prior, while total sales declined 18%, crypto.news reported earlier. As Gherghelas put it in her 2025 research, it was “one of the worst-performing years since 2020.”