Ethereum Bulls Charge: 4.47% Surge Sets Stage for $4,060 Breakout

Ethereum’s price action tightens like a coiled spring—up 4.47% this week—as traders eye a decisive push past $4,060. The bullish structure isn’t just humming; it’s screaming ’overbought’ in a way that’d make even Wall Street’s most reckless algo traders blush.

Technical indicators flash green, but let’s be real—since when did crypto care about fundamentals? If the breakout holds, ETH could print fresh highs. If not? Well, there’s always another ’generational buying opportunity’ around the corner.

Key technical points

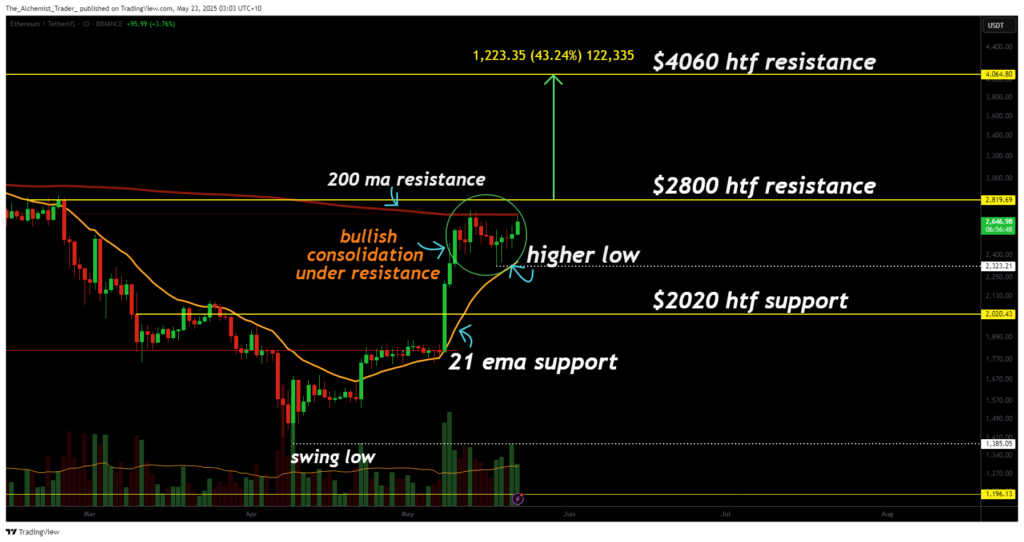

- Support Holding at 21EMA: Ethereum has respected the 21-day exponential moving average throughout its recent consolidation phase, signaling strength.

- $2,800 Resistance Is Key: This level is the major overhead hurdle. A confirmed breakout above it would clear the way for further upside.

- Upside Target at $4,060: The next major resistance lies at $4,060, representing a potential 43% rally from current levels.

Ethereum has gained 4.47 percent in recent sessions, forming a clear series of higher lows. This bullish structure, building just below a major resistance level, is typically a sign of mounting pressure and potential breakout energy.

The 21EMA continues to provide dynamic support, with price repeatedly bouncing off this moving average. Despite the earlier rejection at the 200-day moving average, ETH established a new higher low, reinforcing its bullish structure.

Price remains compressed beneath the 2,800 dollar resistance. A break and sustained close above this level, especially with strong volume, could catalyze a rapid MOVE toward 4,060 dollars. There is little resistance between these two price zones, which further supports the possibility of a swift rally once the breakout is confirmed.

What to expect in the coming price action

If Ethereum maintains its current bullish structure and breaks above the 2,800 dollar resistance with solid volume confirmation, a rally toward the 4,060 dollar level becomes increasingly likely. Traders should look for continued higher lows and a strong daily candle close above resistance to validate the breakout.