Bitcoin Soars to New Heights While Strategy Stock Languishes in the Dust

As Bitcoin smashes through another all-time high, one corner of the market isn’t getting the memo. Strategy stock—the darling of over-leveraged hedge funds and CNBC talking heads—remains stuck in neutral.

The Great Decoupling

While crypto rockets into the stratosphere, traditional ’smart money’ plays can’t seem to catch a bid. Maybe those algorithmic models need a blockchain upgrade.

Wall Street’s Reality Check

Turns out your Ivy League quant can’t outpace a decentralized network of meme-trading degenerates. Who could’ve predicted? (Besides everyone who’s been paying attention since 2020).

As the suits scramble to explain why their carefully backtested strategies are underperforming a ’magic internet money’ index, one thing’s clear: the future’s moving fast—and it’s leaving slow money in the dust.

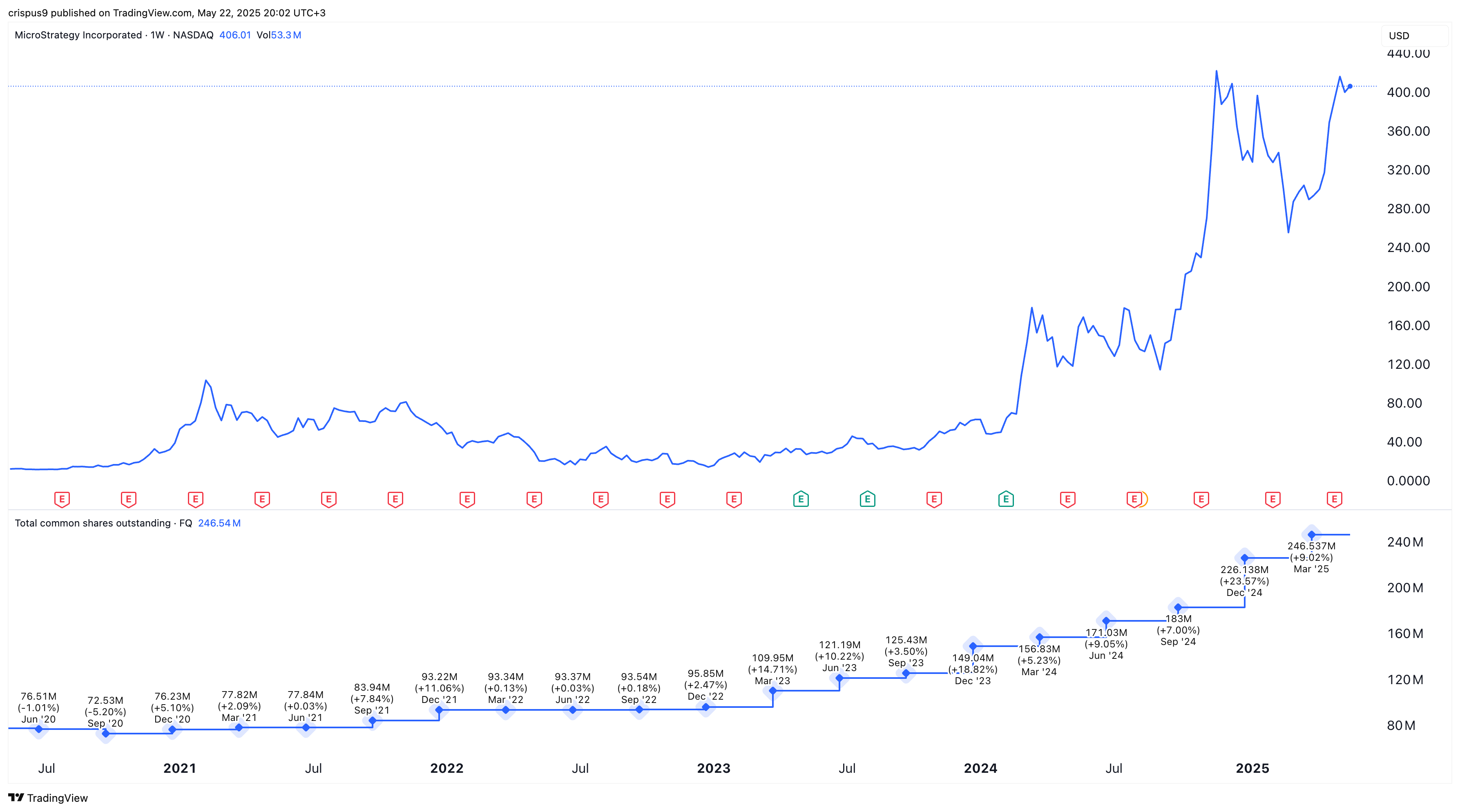

MSTR stock dilution | Source: TradingView

MSTR stock dilution | Source: TradingView

This dilution will continue as Strategy revealed that it was selling $2.1 billion in preferred stock sales to fuel Bitcoin purchases.

In the long term, the company also plans to raise up to 84 billion dollars, equivalent to 76 percent of its current market capitalization. While most of this capital will go toward Bitcoin purchases, some will support broader corporate initiatives.

MSTR stock has underperformed Bitcoin as investors question its valuation and mounting losses. The company currently holds 576,230 coins valued at over 64 billion dollars, while its market cap stands at 110 billion dollars. Some analysts believe the valuation gap will eventually narrow, with MSTR’s stock price aligning more closely to the value of its Bitcoin holdings.

Meanwhile, Strategy’s soaring losses have added pressure. In its most recent quarterly report, operating expenses jumped to 6 billion dollars, while the net loss widened to 4.1 billion dollars. Revenue fell 3.6 percent year-over-year to 111 million dollars, missing analyst expectations.

Investor skepticism has also been fueled by short-sellers. Jim Chanos, a well-known short-seller, revealed a short position in MSTR, alleging that the company is artificially inflating its stock price. Andrew Left of Citron Research issued a similar warning last year, claiming the company operates like a pyramid scheme.

MSTR stock price analysis

The daily chart shows that Strategy stock has been trading sideways in recent days, although it remains above the 50-day and 100-day exponential moving averages, which is typically viewed as a bullish signal. The price has formed a bullish pennant pattern, made up of a flagpole and a converging triangle. Before this, it developed a double-bottom formation with support at 237 dollars and a neckline at 343 dollars.

Given the improving sentiment in the crypto sector, a breakout to the all-time high of 542 dollars remains a possibility. That move would represent a potential upside of 33 percent from current levels.