Dow Jones Climbs 150 Points as Stocks Edge Higher—Wall Street Distracted by Debt Drama

Another day, another debt-ceiling showdown—but hey, at least the Dow’s playing along. Stocks creep upward like a hesitant intern approaching the coffee machine, while traders pretend the U.S. debt pile isn’t a ticking time bomb. Classic Wall Street: buy first, ask questions never.

Markets shrug off fiscal Armageddon (again) as the blue-chip index notches modest gains. Because nothing says ’healthy economy’ like celebrating a 150-point rally fueled by Congress kicking the can down the road.

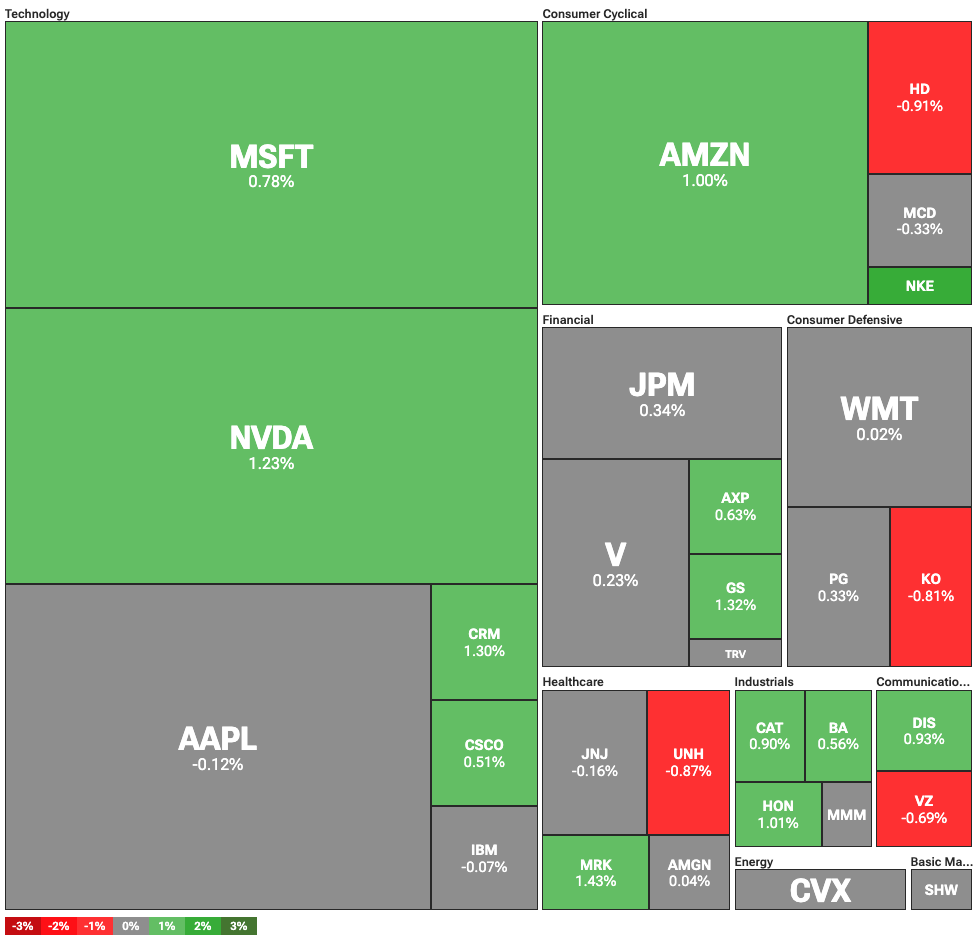

Dow Jones Industrial Average heatmap | Source: TipRanks

Dow Jones Industrial Average heatmap | Source: TipRanks

Tech giants Nvidia, Amazon, and Microsoft were among the key drivers of the Dow’s performance, while Apple posted modest losses.

The market’s positive MOVE came despite a climb in bond yields, which have failed to attract significant investor demand. Long-term U.S. Treasury yields crossed the 5 percent threshold, with the 30-year bond yielding 5.128 percent.

Typically, rising bond yields pull capital away from equities as investors seek stable, fixed returns. However, the attractiveness of Treasuries has declined, largely due to growing concerns over U.S. dollar-denominated debt and the expanding federal deficit.

Are bonds, or Bitcoin, a safe haven?

Uncertainty around U.S. fiscal policy has intensified after proposed tax cuts by former President Donald TRUMP were projected to significantly expand the national deficit. Combined with elevated Treasury yields, the cost of servicing government debt is expected to climb, prompting some investors to reconsider the role of bonds as a traditional safe haven.

Higher Treasury yields are also driving up mortgage rates. As of May 22, the average 30-year fixed mortgage reached 6.86 percent, the highest level since February. This rise in borrowing costs could reduce housing affordability and weigh on consumer spending, especially for homeowners with variable-rate loans.

Instead, an increasing number of traders are turning to alternative assets like gold and Bitcoin (BTC). Bitcoin rose 4 percent on May 22, reaching a new all-time high of 111,970 dollars. Gold, on the other hand, slipped 0.49 percent and was trading at 3,298 dollars per ounce.