French Property Firm’s Stock Rockets 800% After Ethereum Treasury Pivot—Because Nothing Says ’Stable Value’ Like Crypto Volatility

A little-known French real estate company just turned Wall Street’s head—by betting big on Ethereum. Shares skyrocketed 800% overnight after announcing they’d allocated 40% of their treasury to ETH. Traders are calling it ’the most aggressive corporate crypto play since MicroStrategy.’

From bricks to blockchain

The firm—previously focused on Parisian commercial properties—now holds more digital assets than physical ones. Their CFO shrugged: ’We’re hedging against inflation. Also, our interns kept sending us CoinMarketCap screenshots.’

Institutional FOMO kicks in

Three hedge funds have already filed 13F disclosures showing new positions. Meanwhile, traditional asset managers are muttering about ’speculative mania’ between sips of $8 artisanal coffee.

One thing’s certain: when a 150-year-old property group suddenly outperforms tech stocks by embracing crypto, even the Boomers are checking CoinGecko. Just don’t ask about their 2022 NFT portfolio.

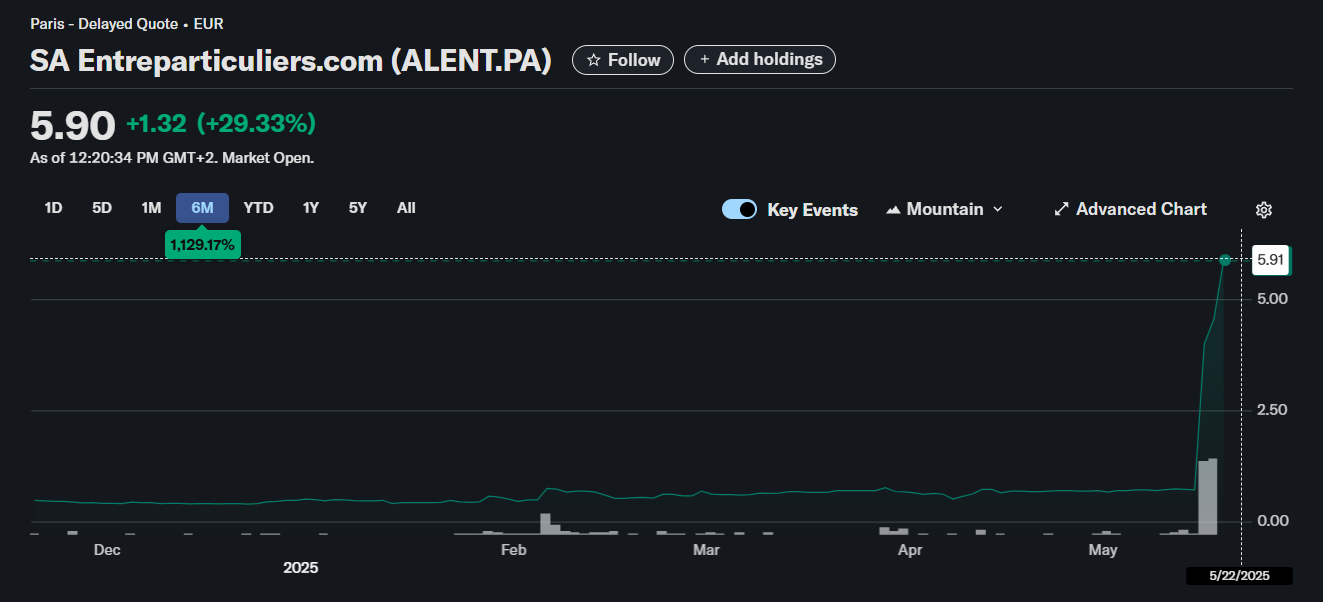

Entreparticuliers shares | Source: Yahoo Finance

Entreparticuliers shares | Source: Yahoo Finance

To support the continued growth of this strategic Ethereum reserve, Entreparticuliers said it’s structuring various financial instruments aimed at professional investors and financial partners. However, the company and Romanyszyn ruled out the “use of excessively dilutive instruments such as equity lines.”

Entreparticuliers said its further capital contributions are subject to approval at the general meeting on June 18, with resolutions covering up to €150 million in funding.

Founded in 2000 by Stéphane Romanyszyn, Entreparticuliers has historically operated as a real estate search platform since its listing on Euronext Growth in 2007. The platform connects private individuals to buy, sell, or rent properties without intermediaries.

The move is part of a broader transformation. According to the company’s separate crypto-focused website, it’s shifting “from a real estate platform to a pioneer in digital finance, real estate tokenization, and asset management.” It markets itself as a way to gain “simple and regulated exposure to Ethereum through a publicly listed stock on Euronext Growth.”

The firm’s new direction seems to be focused on ETH investments, staking, and building tokenization tools for real-world assets like real estate and bonds.