Berachain Plummets to Record Lows Ahead of $2.7B Token Unlock—Is This the Bottom or Just the Beginning?

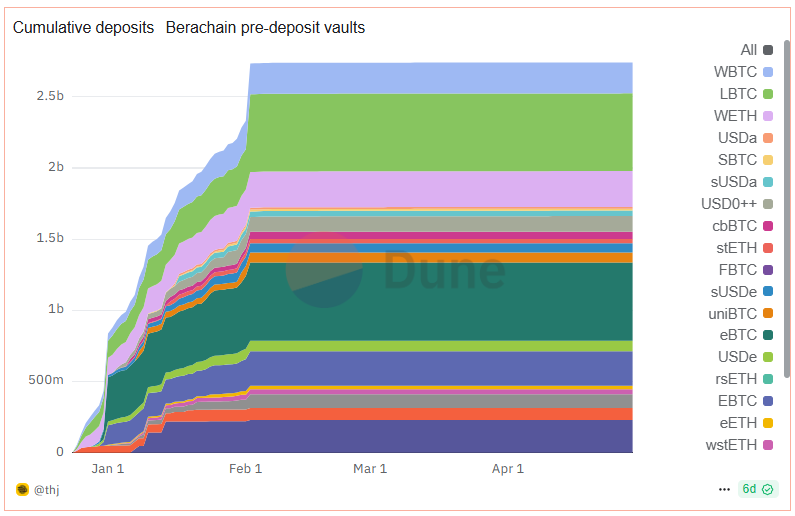

Berachain’s token price just nosedived to its worst level ever—right as a $2.7 billion token unlock looms on May 6. The timing couldn’t be worse for holders already nursing losses.

Why it matters: Liquid supply is about to explode. Early investors, team members, and protocol treasuries will finally cash in their chips after months of lockup. History says this rarely ends well.

The cynical take: Another ’decentralized’ project proving that tokenomics often just means ’dumping on retail.’ But hey—at least the VC pitch decks looked pretty.

What’s next? Either the market prices this in and finds a floor... or we’re witnessing the first act of a full-blown capitulation event. Grab the popcorn.

Source: TradingView

Source: TradingView

However, on May 3, the $3.20 support was broken, with a daily close below it at around $3.14 confirming a bearish breakdown. The sell-off accelerated further on May 4, pushing the price down to its all-time low of $2.82. The price has since rebounded slightly, currently trading at $2.95.

Berachain‘s token has been trading well below both the EMA 20 and SMA 50 since early April, and the recent breakdown of the $3.20 support level has driven the price even further beneath these downward-sloping moving averages, reinforcing the bearish trend.

RSI sits at 29, deep in the oversold zone and not yet rebounding, indicating ongoing weakness. The MACD histogram is slightly positive, but both lines are still below zero and flat, indicating negative and low momentum. ATR suggests low volatility while Bollinger Band Width is very narrow, indicating squeeze conditions—often followed by sharp moves.

With the recent breakdown of a key support level and price trading below EMA 20 and SMA 50, combined with BBW squeeze conditions, a further breakdown is likely—especially with the looming $2.7 billion TVL unlock from Boyco Vaults scheduled for tomorrow, May 6.

The next likely breakdown zones are the psychological levels of $2.50, then $2.00, and potentially $1.50 if the liquidity from the TVL unlock unleashes extreme sell pressure.