XRP’s $2 Standoff: Make-or-Break Moment for the Crypto Veteran

XRP traders white-knuckle their portfolios as the embattled token flirts with the $2 support level—a threshold that could trigger either a bullish resurgence or a cascading sell-off. Market sentiment hangs in the balance while ’institutional-grade blockchain solutions’ get stress-tested by good old-fashioned panic.

Technical indicators scream indecision. The 50-day and 200-day moving averages coil like springs, while RSI hovers at a neutral 45—classic chartist Rorschach test material. Meanwhile, Bitcoin maximalists smugly adjust their tinfoil hats.

Regulatory ghosts still haunt the halls. Despite Ripple’s partial legal wins, the SEC’s shadow looms large enough to spook institutional money—the same whales who apparently need ’protection’ from assets they’re barred from buying.

Will $2 hold? The order books whisper yes, but the crypto gods demand their volatility sacrifice. Either way, hedge funds will spin the outcome as ’price discovery’ while retail traders eat the losses.

XRP price prediction

XRP broke out of its consolidation phase on April 27. Since then the altcoin has attempted to rally closer to resistance at $2.39, R1 in the XRP/USDT price chart. XRP is currently trading 15% under its target resistance at $2.50, the 50% Fibonacci retracement level of the decline from the peak of $3.40 to a low of $1.61.

Two technical indicators on the daily price chart support a bullish thesis for XRP. The RSI and MACD, RSI reads above 54, the neutral level and MACD flashes green histogram bars.

The $3 level is a key target for XRP in May 2025, a daily candlestick close above R1 and R2 could confirm the altcoin’s uptrend and bring the target in play for the token.

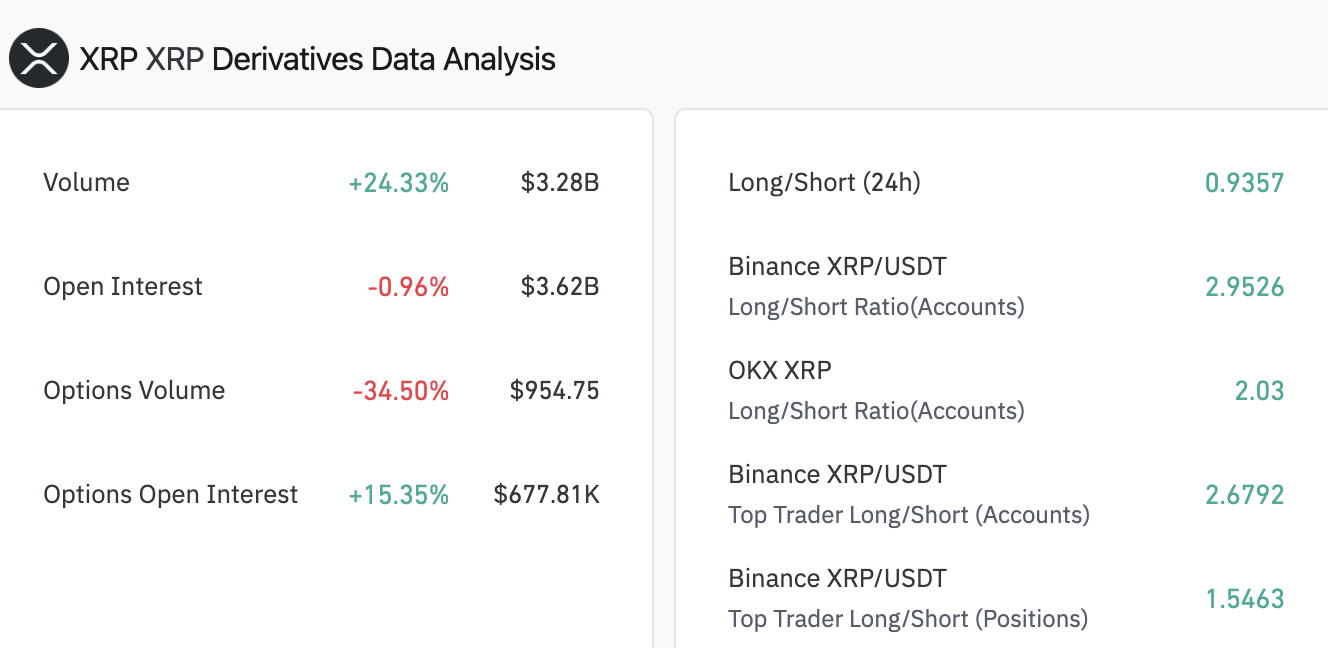

XRP derivatives data analysis

Data from Coinglass shows, XRP volume is up 24% and open interest, the net volume of all open derivatives contracts is down less than 1% in the last 24 hours. The long/short ratio is under 1, meaning derivatives traders are not yet bullish, at the start of the week.

Derivatives analysis implies sidelined buyers should proceed with caution when opening a position in XRP as market uncertainty prevails. The 24 hour liquidation is $5.24 million, and a majority $4.89 million is long positions, the rest is short. Meaning traders that are bullish on XRP were punished for their bets and paid for short positions on derivatives exchanges.

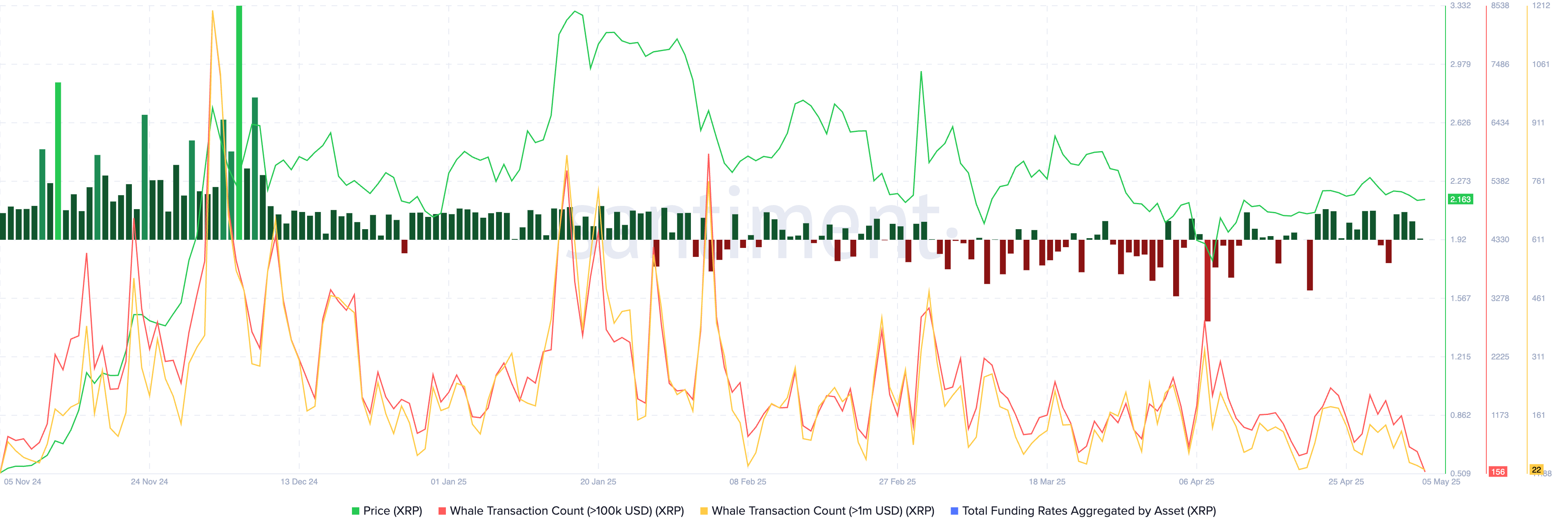

On-chain analysis and prediction

XRP whale transactions in two segments, valued at $100,000 and higher and greater than $1 million declined, as seen on on-chain intelligence platform Santiment. A decline in whale transactions typically signals a loss in interest, however aggregate funding rates by XRP flash a green histogram bar, supporting a thesis that there is demand for XRP.

Funding rate turned positive on May 1 after closing April with two consecutive days of negative funding rate readings. Typically, positive funding rate implies that the price of derivatives contracts is higher than the spot market price of the asset, and this is bullish for the token in the medium to short-term.

SEC vs. Ripple lawsuit- Tying loose ends

The closure of the SEC vs. Ripple lawsuit and the delay of the XRP ETF filing are likely related events. Bill Morgan, a renowned lawyer told followers on X that the deadline of the Ripple lawsuit appeal is delayed from April 16 to June 15.

The SEC has delayed Franklin Templeton’s XRP ETF approval to June 17, 2025, just after the expiry of the 60-day wait period for the Ripple lawsuit. According to Morgan, this is “potentially strategic” timing, expressing his bullish sentiments towards an ETF approval in 2025.

Oddly, the delay of the ETF approval to 17 June 2025 is to a date that falls just after the expiry of the 60 day period by which a status report must be filed by the SEC in the SEC v Ripple appeal pursuant to the court order dated 16 April 2025. https://t.co/Rrn0MAHwBv pic.twitter.com/gmVDOSg74H

— bill morgan (@Belisarius2020) April 30, 2025Expert commentary

Forest Bai shared his insights on whether XRP will gain digital Gold status or face regulatory challenges. The co-founder of Foresight Ventures told Crypto.news,

“I believe XRP is unlikely to become digital gold due to its primary design as a payment protocol, not a store of value like gold. Its centralized structure and regulatory challenges further limit its potential to achieve gold-like status.”

Dan Tapiero of 10T Holdings bullish on XRP ETF launch told CoinDesk that despite early criticism of XRP, the altcoin is resilient and the team has been through a lot (Tapiero likely refers to the lawsuit and the delisting across major exchanges).

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.