Solana (SOL) Defies 14% Weekly Plunge as Long-Term Hodlers Double Down

Blood in the streets? Not for Solana's diamond-handed brigade.

While retail traders panic-sold last week's double-digit drop, SOL's smart-money cohort kept stacking sats—proving once again that crypto's real gains go to those who ignore the hourly charts (and CNBC).

The accumulation game

Chain data reveals wallets holding SOL for 12+ months actually increased positions during the selloff. Because nothing makes a crypto bro fomo harder than watching others get rich slowly.

Market mechanics at work

That 14% weekly haircut? Just another discount day for believers in Solana's throughput supremacy. Though let's be real—after the fifth 'Ethereum killer' narrative this cycle, even Vegas oddsmakers wouldn't touch this bet.

So while paper hands chase the next shiny meme coin, OGs remember: The fastest way to lose money in crypto is by constantly trying to make money. Now excuse us while we check our staking rewards.

TLDR

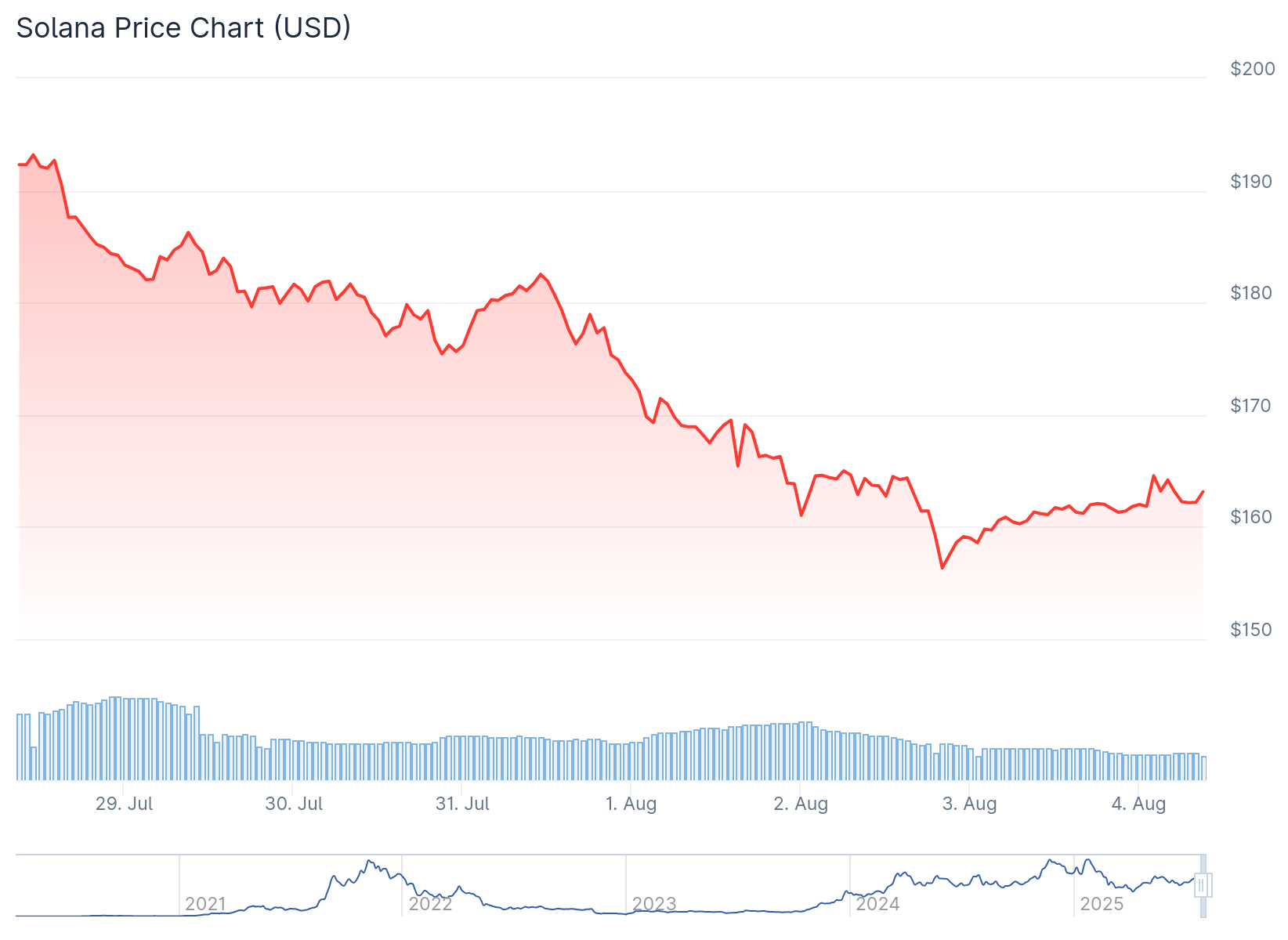

- SOL dropped 14% in the past week, falling below $165 and currently trading around $160.55

- Long-term holders increased accumulation by 102% since July 30, moving coins into cold storage

- Realized Profit/Loss Ratio hit 30-day low of 0.15, showing most sellers are exiting at a loss

- Liveliness metric declined to 0.76, confirming reduced selling pressure from long-term holders

- Key support level at $158.80 is being tested, with potential upside target at $176.33

Solana has faced downward pressure over the past week, declining 14% from recent highs. The cryptocurrency struggled to maintain momentum after reaching a cycle high of $206 on July 22.

Solana price currently trades at $160.55, testing a crucial support level at $158.80. Short-term investor confidence has weakened as the price action disappointed many traders.

Despite the price decline, on-chain data reveals a different story unfolding behind the scenes. Long-term holders are taking advantage of the lower prices to increase their positions.

Accumulation Pattern Emerges

Glassnode data shows a 102% surge in Hodler Net Position Change since July 30. This metric tracks the 30-day net change in holdings by long-term participants.

The increase indicates more coins are moving into cold storage rather than being sold. This behavior suggests strategic positioning by experienced investors who view current prices as attractive entry points.

The Liveliness metric has steadily declined since July 25, reaching a weekly low of 0.76. This measurement tracks the movement of previously dormant tokens.

When Liveliness falls, it indicates that long-term holders are moving assets off exchanges and choosing to hold. The metric confirms reduced selling activity among seasoned SOL investors.

Capitulation Signals Appear

The Realized Profit/Loss Ratio dropped to 0.15 on August 2, marking its lowest point in 30 days. This figure shows that most recent sellers exited their positions at a loss.

Such capitulation-style events often occur NEAR cycle bottoms in cryptocurrency markets. When traders sell at losses, it typically indicates panic selling has reached extreme levels.

With fewer holders willing to sell underwater positions, downward pressure on the price may begin to ease. Historical patterns suggest these moments can mark the final phase of a drawdown.

Technical Indicators Show Mixed Signals

The Relative Strength Index sits at 41.65, approaching oversold territory. This level suggests the selling momentum may be losing steam.

On-Balance Volume has flattened after a steady decline, indicating that selling volume is decreasing. While not yet signaling a reversal, the data shows sellers are becoming exhausted.

The daily price chart shows SOL struggling below the $165 level. However, recent candles hint at a potential pause in the downward movement.

If buying pressure increases, SOL could target the $176.33 resistance level. This WOULD represent a meaningful recovery from current levels.

Should the $158.80 support fail, the next potential floor sits at $145.90. This level would mark a deeper correction for the cryptocurrency.

Market participants are watching these key levels closely. The support at $158.80 faces a serious test as trading continues.

Long-term holders continue their accumulation strategy despite the price weakness. Their behavior suggests confidence in SOL’s future prospects.

The current price action reflects broader cryptocurrency market conditions. Many digital assets have experienced similar pressure in recent weeks.

Trading volume patterns support the thesis that selling pressure is decreasing. This could create conditions for price stabilization in the near term.

Long-term holders increased their SOL positions by 102% since July 30, showing confidence despite the 14% weekly price decline.