Corporate ETH Buying Spree: $162M Ethereum Splurge Signals Booming Adoption

Wall Street meets crypto—without the awkward small talk. Companies just dumped $162 million into ETH, proving even suits can’t ignore blockchain’s siren song.

Why the frenzy? Treasury strategies now include ‘hodling’ alongside T-bills. CFOs finally realizing 8% yields beat 0.5% money markets—who knew?

The kicker? This isn’t VC play money. These are real businesses hedging against dollar decay with digital gold 2.0. Cynics whisper ‘late-stage FOMO’—but try telling that to their balance sheets.

TLDR

- SharpLink purchased another 15,822 ETH worth $53.9 million, bringing total holdings to 480,031 ETH ($1.65 billion)

- The company spent $108.57 million USDC over 48 hours to acquire 30,755 ETH at average price of $3,530

- The Ether Machine bought 15,000 ETH for $56.9 million, increasing holdings to 334,757 ETH

- Corporate Ethereum purchases are accelerating as companies view ETH as essential digital infrastructure

- Ethereum hosts 58.1% of the $13.4 billion real-world asset market through tokenized assets and stablecoins

Corporate adoption of Ethereum continues to grow as major companies expand their cryptocurrency holdings. Two firms recently made substantial purchases totaling over $162 million in ETH.

SharpLink executed its latest buying spree over several hours, acquiring 15,822 ETH worth approximately $53.9 million. The purchases occurred through multiple transactions, with the largest single transfer involving 6,914 Ether valued at $23.56 million according to Arkham Intelligence data.

SharpLink Gaming again bought $53,900,000 $ETH.

They bought $108,570,000 ethereum in the past 2 days. pic.twitter.com/GRexgdvOaC

— Ted (@TedPillows) August 3, 2025

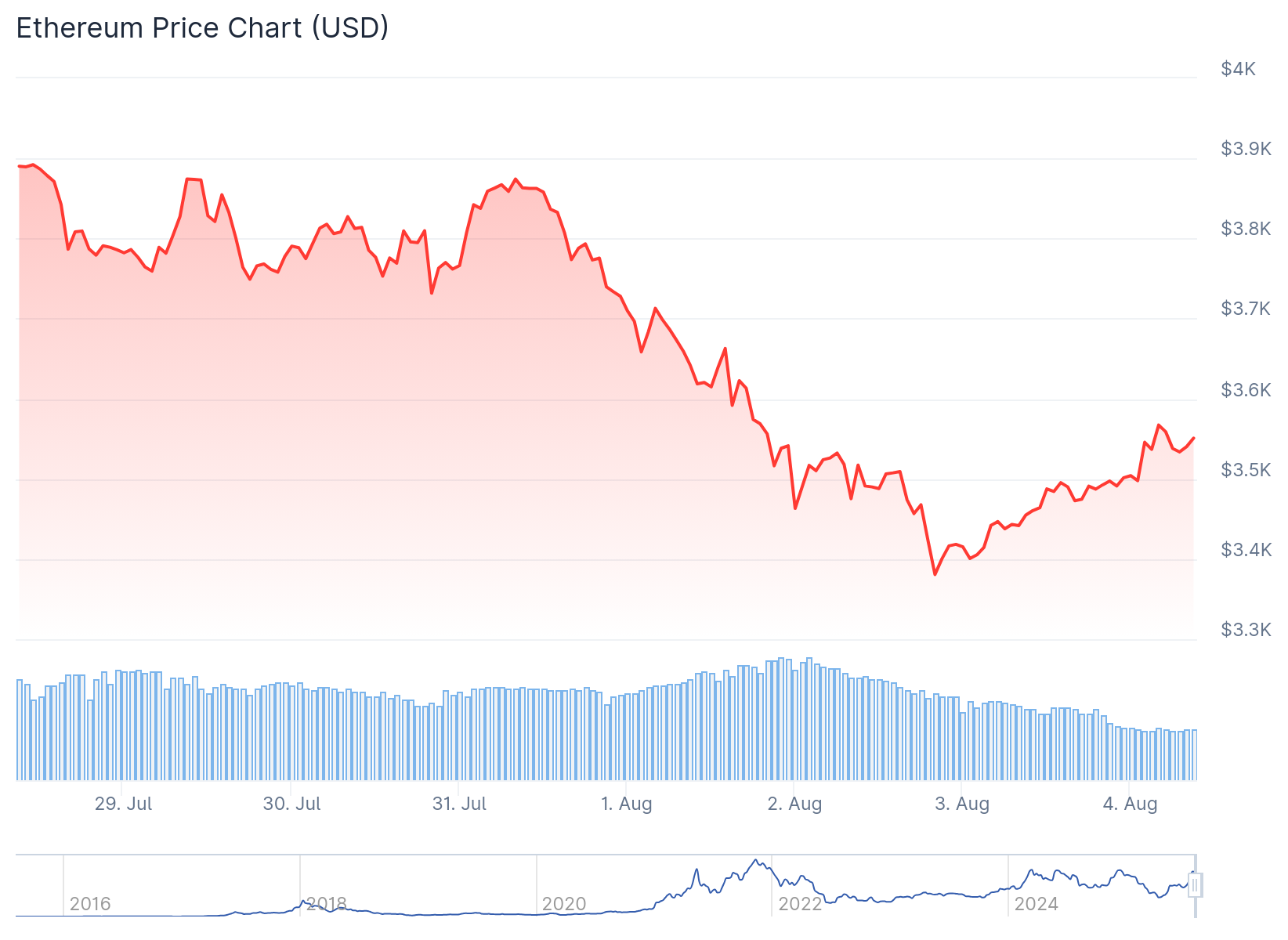

This recent acquisition follows an intensive 48-hour period where SharpLink spent $108.57 million USDC to purchase 30,755 ETH. The average purchase price during this period was $3,530 per token.

The company’s total Ethereum holdings now stand at 480,031 ETH, worth around $1.65 billion at current market prices. On Thursday alone, SharpLink deployed $43.09 million USDC to acquire 11,259 ETH at an average price of $3,828.

Corporate Ethereum Holdings Expand

The Ether Machine also made substantial additions to its treasury last week. The company purchased 15,000 ETH for $56.9 million, timing the acquisition with Ethereum’s 10th anniversary celebration.

The purchase was executed at an average price of $3,809 per ETH. With this addition, The Ether Machine’s holdings increased to 334,757 ETH, surpassing the Ethereum Foundation’s 234,000 ETH reserve.

The firm now ranks as the third-largest corporate ETH holder globally. Only BitMine and SharpLink maintain larger corporate Ethereum positions according to StrategicETHReserve data.

The Ether Machine formed earlier this year through a merger with Nasdaq-listed Dynamix Corp. The company is targeting a $1.6 billion fundraising round and plans to go public under the ticker ETHM later this year.

Growing Appeal as Digital Infrastructure

NoOnes CEO RAY Youssef described the trend of corporate Ethereum adoption as companies recognizing the network’s role as essential digital infrastructure. He characterized Ethereum as a “hybrid between tech equity and digital currency.”

Treasury strategists are increasingly attracted to ETH’s utility features beyond passive value storage. The cryptocurrency offers staking yields, programmability, and regulatory alignment that appeal to forward-looking companies.

Ethereum currently dominates the tokenized asset space, hosting the majority of stablecoins and tokenized financial products. The network commands 58.1% of the $13.4 billion real-world asset market.

Companies operating in tokenized finance are viewing Ethereum as a reserve currency option. The network’s growing dominance in enterprise use cases supports this corporate adoption trend.

SharpLink’s latest purchase brings the company’s 48-hour spending total to $108.57 million USDC for 30,755 ETH acquired at an average price of $3,530 per token.