$MSFT Soars Past $4 Trillion: Microsoft’s Q4 Earnings Crush Expectations

Redmond’s empire strikes back—hard. Microsoft Corp. just joined the $4 trillion club, flexing its cloud muscles after a monster Q4.

The Numbers Don’t Lie

No fluffy guidance here. Azure, Office, and that OpenAI partnership printed money—Wall Street’s models got steamrolled.

Ballmer’s Ghost Grins

Remember when analysts called Satya’s cloud bet reckless? Today’s earnings call was a victory lap—with extra zeros.

Cynic’s Corner

Sure, $4 trillion buys a lot of LinkedIn influencers. But can it buy a stock split? (Asking for retail traders.)

TLDR

- Microsoft ($MSFT) stock jumped 5% after beating Q4 earnings estimates

- Market cap reached $4.1 trillion, becoming second firm after Nvidia

- Azure cloud revenue rose 34% to $75 billion, disclosed for the first time

- Intelligent Cloud revenue hit $29.8 billion, above analyst expectations

- Analysts project AI investments to drive major growth in fiscal 2026

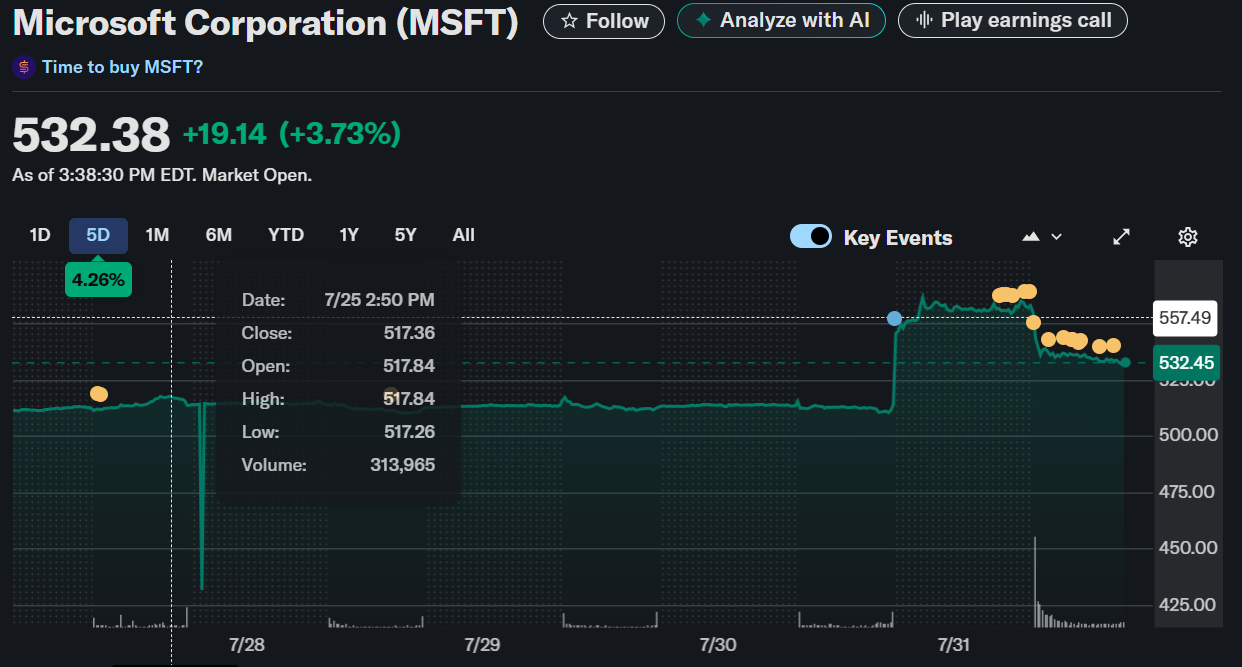

Microsoft Corp. ($MSFT) surged more than 5% in early Thursday trading after beating fiscal Q4 expectations, pushing its market capitalization past $4.1 trillion.

Microsoft Corporation (MSFT)

The stock’s rally makes Microsoft the second publicly traded firm, after Nvidia, to cross the $4 trillion threshold. The earnings date was July 25, 2025. Microsoft’s cloud and AI strength were central to its performance, as the company delivered adjusted EPS of $3.65 on revenue of $76.4 billion, compared to consensus estimates of $3.37 EPS and $73.89 billion revenue.

Breaking news: Microsoft has hit $4tn in market capitalisation in a US tech share surge that also pushed Meta stock up https://t.co/VkgYWFbwHn pic.twitter.com/R77YLlRHgp

— Financial Times (@FT) July 31, 2025

Azure Revenue Disclosed for the First Time

Microsoft, for the first time, disclosed standalone revenue for its Azure cloud business, reporting $75 billion for fiscal 2025, an increase of 34% year-over-year. This move gave Wall Street more transparency into how Azure stacks up against rivals Amazon Web Services (AWS) and Google Cloud, which reported annual run rates of $111 billion and $50 billion respectively. Intelligent Cloud revenue, which includes Azure, came in at $29.8 billion for the quarter, surpassing analysts’ $29.09 billion expectation.

Capex Surge and AI Outlook

Microsoft is preparing for even larger capital investments going forward. CFO Amy Hood told analysts that Q1 fiscal 2026 capital expenditures will exceed $30 billion. Azure is expected to post 37% growth in Q1. CEO Satya Nadella emphasized Microsoft’s AI leadership, citing its continued innovation across the tech stack. This includes its Azure OpenAI integration and the growing popularity of AI-powered tools like Copilot.

AI Momentum Builds Despite Competitive Frictions

Analyst Dan Ives from Wedbush noted that Microsoft’s AI momentum will see its true breakout in fiscal 2026, with CIOs across industries allocating more budget toward AI deployments. Microsoft’s early bet on OpenAI is viewed as a critical piece of its strategy, although the companies are currently at odds over OpenAI’s corporate structure and Microsoft’s equity stake.

Wall Street Sentiment and Market Position

Microsoft has rebounded sharply in 2025 after lagging peers earlier in the year. Among the Magnificent Seven tech stocks, Microsoft now ranks as one of the top performers, along with Meta. Of 72 analysts covering the company, 68 rate it a “Buy” and just one a “Sell.” Investors remain optimistic, especially as cloud and AI are seen as the primary engines of long-term growth.

Microsoft’s earnings beat and its new transparency on Azure revenue give it fresh credibility in the cloud race and a stronger foundation for the AI age.