Crypto Carnage: $1 Billion Evaporates in 24-Hour Market Meltdown

Digital assets got steamrolled today as panic selling triggered a billion-dollar liquidation event—proof once again that crypto winters arrive faster than Wall Street bonuses.

Blood in the streets? More like red on the screens as leveraged longs got obliterated in the sharpest downturn since the 2022 Terra collapse. Market makers scrambled to cover positions while 'HODL' memes aged like milk left in a Bitcoin miner's dorm room.

The usual suspects took hits: BTC sliced through key support levels like a hot wallet exploit, while altcoins performed their traditional function as exit liquidity for smart money. Meanwhile, CEX order books showed more gaps than a DeFi protocol's audit report.

Silver lining? At least the crash came midweek—gives traders three full days to liquidate their remaining assets before traditional finance bros start Monday-morning quarterbacking from their Hamptons rentals.

TLDR

- Crypto derivatives market suffered $967 million in liquidations over 24 hours, with $829 million from long positions

- XRP and Dogecoin both crashed about 10% while Bitcoin remained relatively stable

- Ethereum led liquidations with $200 million, followed by XRP at $115 million

- Bitcoin’s Index Cycle Indicators show market in “Distribution” zone but not at full saturation levels

- Open interest for top altcoins doubled from $26 billion to $44 billion since early July

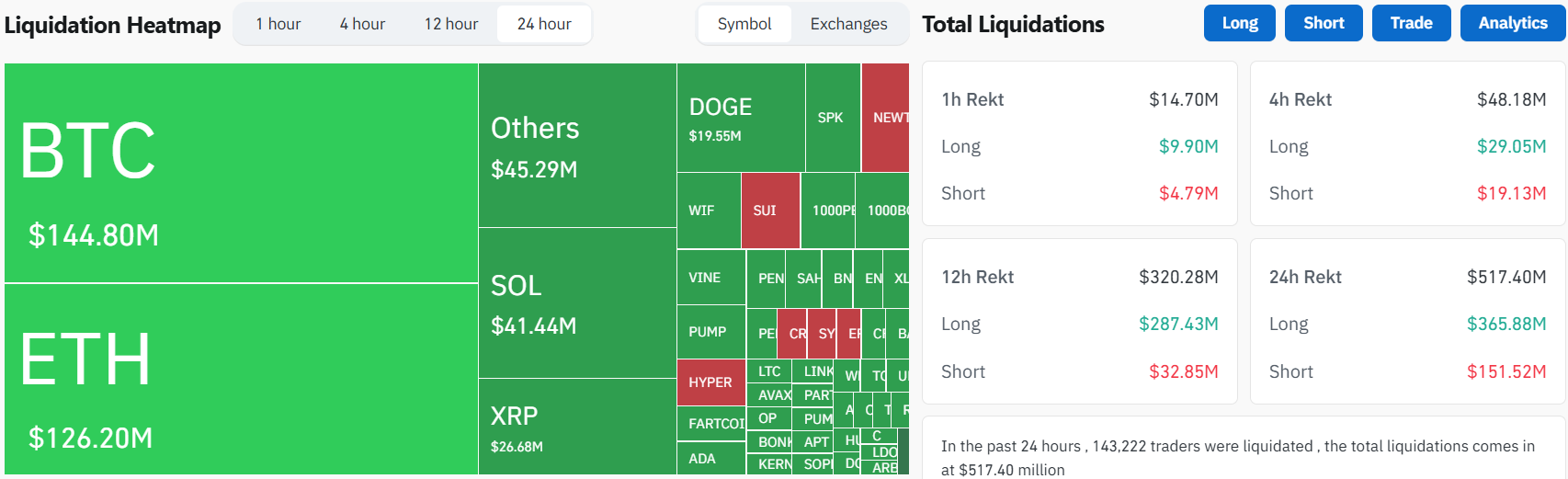

The cryptocurrency market experienced a harsh reality check as nearly $1 billion worth of derivatives positions were liquidated in a single day. According to CoinGlass data, exactly $967 million in contracts were forcefully closed as traders faced massive losses.

Long positions bore the brunt of the damage, accounting for $829 million of the total liquidations. This means traders betting on price increases suffered the most as altcoins like XRP and Dogecoin plummeted approximately 10% each.

Bitcoin showed resilience during this market turmoil, remaining relatively flat while altcoins crashed. The leading cryptocurrency traded between $117,422 and $119,197 over the past 24 hours, settling at $118,578.

This stability suggests investors may be rotating capital out of altcoins and back into Bitcoin. The rotation pattern explains why Bitcoin avoided the severe liquidation events that hit other major cryptocurrencies.

Ethereum topped the liquidation charts with nearly $200 million in forced closures. XRP followed with $115 million in liquidations, while bitcoin still managed $84 million despite its stable price action.

Solana and Dogecoin rounded out the top five with $58 million and $56 million in liquidations respectively. These figures highlight how Leveraged positions across altcoins created vulnerability during the price decline.

Market Cycle Analysis

CryptoQuant analyst Gaah provided insight into Bitcoin’s current market phase through the Index Bitcoin Cycle Indicators (IBCI). The composite tool returned to the “Distribution” zone, historically associated with late-stage bull markets.

However, the IBCI reached only 80% of the zone’s upper boundary. This moderate level suggests Bitcoin remains in an expansion phase without typical overheating signs.

Two key IBCI components, the Puell Multiple and Short-Term Holder Spent Output Profit Ratio, remain below midpoint levels. This indicates short-term speculation and aggressive profit-taking haven’t fully emerged yet.

The Puell Multiple continues hovering NEAR the “Discount” range, showing miner profitability remains moderate despite Bitcoin’s recent all-time highs above $123,000. This suggests network participants haven’t entered the excess phase that typically precedes major corrections.

Leveraged Positions Drive Volatility

Glassnode data reveals open interest across top altcoins doubled since early July. Combined positions for Ethereum, Solana, XRP, and dogecoin grew from $26 billion to $44 billion.

This massive increase in leveraged positions created the perfect storm for liquidations. When prices began declining, over-leveraged traders faced margin calls and forced position closures.

Another CryptoQuant analyst, Amr Taha, noted Bitcoin maintained stability near the realized price for short-term holders at around $118,300. This level serves as dynamic support reflecting the average cost basis for recent buyers.

The absence of capitulation among newer holders suggests recent market entrants remain confident. This reinforces the current price range as both psychological and technical support.

Open interest data shows the derivatives market had become overheated before the liquidation event, with excessive leverage building across major altcoins throughout July.