SPARK (SPK) Price Slumps—But a Break Past This Critical Level Could Fuel a 70% Rally

Crypto traders, brace yourselves—Spark (SPK) is teetering on the edge of a make-or-break moment.

After a recent dip, all eyes are on a key resistance level. Break it? Bulls could be riding a 70% surge. Fail? Well, another 'buy the dip' opportunity for bagholders, we suppose.

The Setup:

SPK’s price action is coiled like a spring. Technicals hint at pent-up demand—if buyers step in now, the rally could be explosive.

The Catch:

Crypto moves fast. Miss the breakout, and you’re left chasing. Jump in too early, and you’re catching knives. Classic decentralized finance drama.

Bottom Line:

Whether this is the next moonshot or just another 'vaporware pump' depends entirely on whether SPK can smash through that wall. No pressure.

Exchange Outflows Suggest Selling Might be Slowing Down

One of the first signs that sellers might be backing off is the recent drop in exchange balances. In the last 24 hours, SPK exchange holdings fell by 5.33%, or nearly 21 million tokens. That suggests fewer tokens are available for immediate sale.

At the same time, the top 100 wallets increased their holdings by 0.3%, pushing their combined balance to 9.97 billion SPK. Whales have also entered the mix, courtesy of a small 0.08% uptick in buying interest.

This shift implies that most whales may have already completed their profit-taking, creating a setup where fresh selling could dry up unless the price drops further.

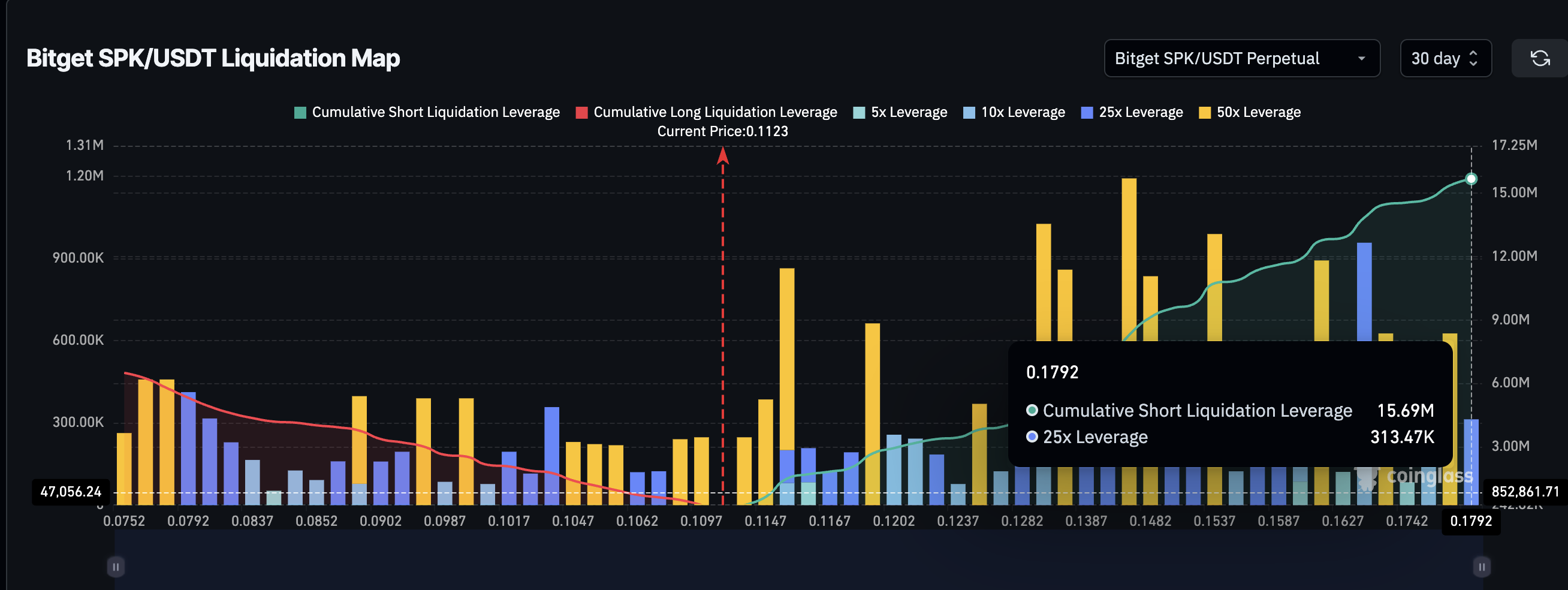

Metrics Signal a Potential Short Squeeze Above $0.13

Spark (SPK) price is hovering around $0.11, but a breakout above $0.13 could trigger a powerful short squeeze. The reason lies in how traders are positioned across Leveraged products and what the liquidation map reveals.

The map shows dense clusters of short liquidation levels beginning at $0.11, thickening between $0.13 and $0.17. These clusters are where high-leverage short positions (25x to 50x) are most likely to get liquidated. If SPK climbs into this range, these liquidations can create a chain reaction of forced buying, pushing the price even higher.

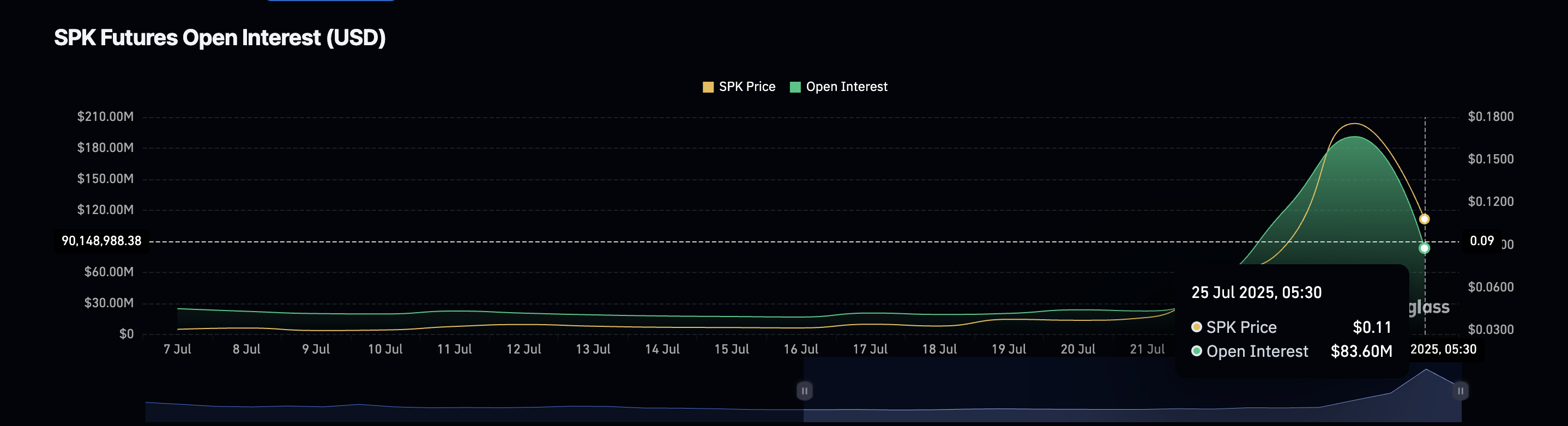

Open interest supports this possibility. It has dropped from $190 million to $83.6 million in recent days, a 60% decline, but remains elevated. This suggests many traders are still active in the market, and a large portion are likely holding shorts (per the liquidation map). That sets the stage for a liquidation-driven rally if key resistances break.

Together, these indicators, liquidation clusters above $0.13 and still-high open interest, point toward the possibility of a breakout that traps late bears. If $0.13 gives way, Spark (SPK) could ignite another leg higher, driven not just by fresh demand but by shorts forced to buy back.

: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily crypto Newsletter here.

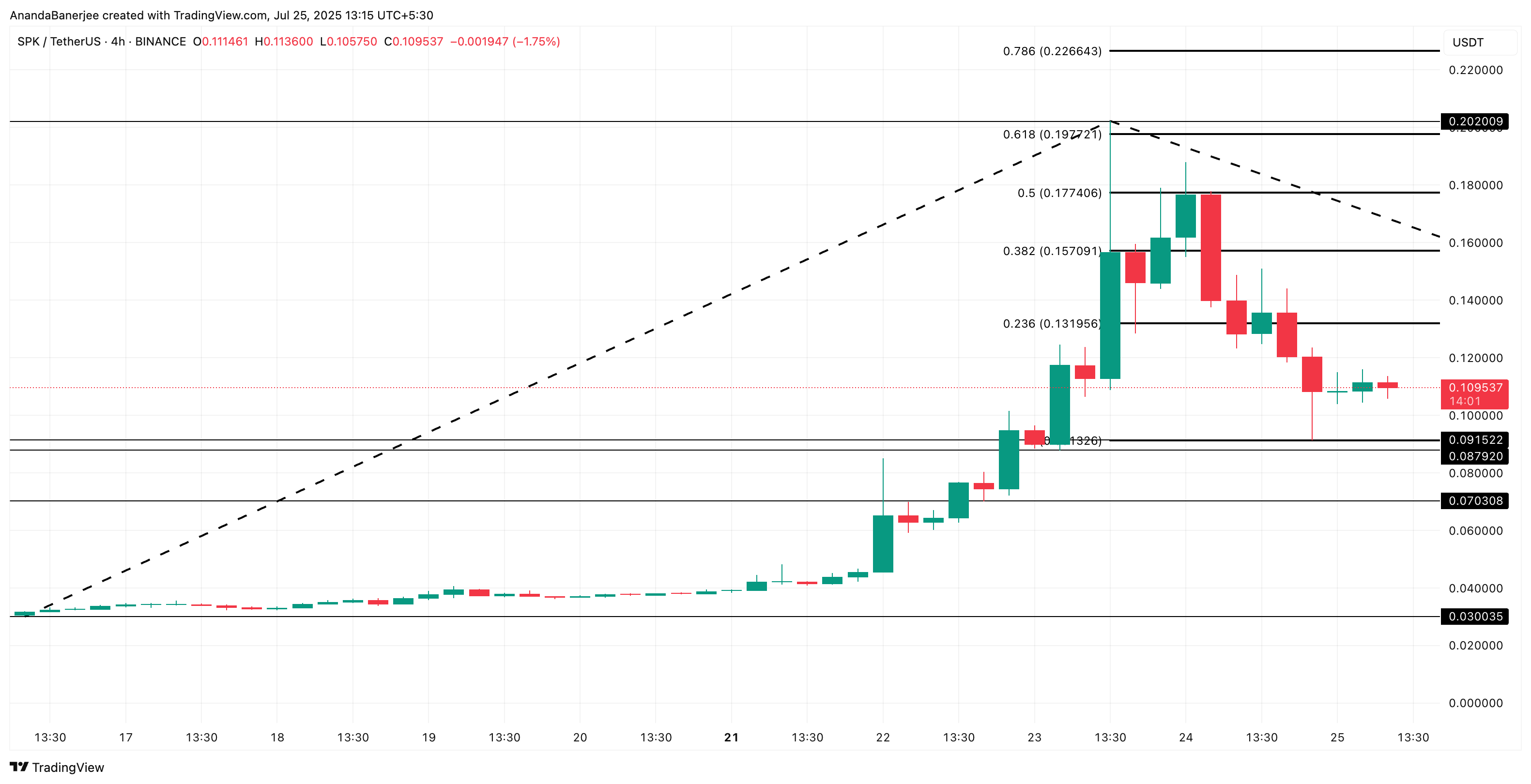

Spark (SPK) Eyes The Key Breakout Zone

On the 4-hour chart, the 0.236 Fibonacci extension level lies at $0.13, the same level where intense liquidation triggers begin. Above that, resistance sits at $0.15 and $0.17, with a potential extension to $0.202 if the breakout accelerates.

Do note that the $0.15 resistance didn’t hold much weight during the past rally, but $0.17 did offer considerable resistance as Spark (SPK) attempted another move.

If the SPK price clears $0.13 with momentum, short liquidations could fuel a rapid 70% move toward the $0.17 zone. However, a dip under $0.09, a key support zone, and even the retracement level used to draw the Fib extension WOULD invalidate the bullish hypothesis.