Ethereum (ETH) Price Alert: Mike Novogratz Doubles Down on $4,000 Target as Wall Street Goes All-In

Galaxy Digital CEO Mike Novogratz just threw gasoline on Ethereum's bull run—reiterating his $4,000 price target as institutional money floods in. Here's why smart money's betting against the crypto skeptics.

### The Institutional Stampede

BlackRock's ETH ETF approval was just the starting gun. Whale wallets now hold 22% of circulating supply—a five-year high that screams 'accumulation phase.'

### Liquidity Tsunami Ahead

With $15B in Bitcoin options expiring today, traders are rotating profits into ETH futures. Open interest just hit $9B... and those are just the CME numbers.

### The Novogratz Effect

When the guy who called Bitcoin's 2017 top says 'ETH at $4K is conservative,' it's time to pay attention. Even if his timing's occasionally worse than a DeFi yield farmer's.

TLDR

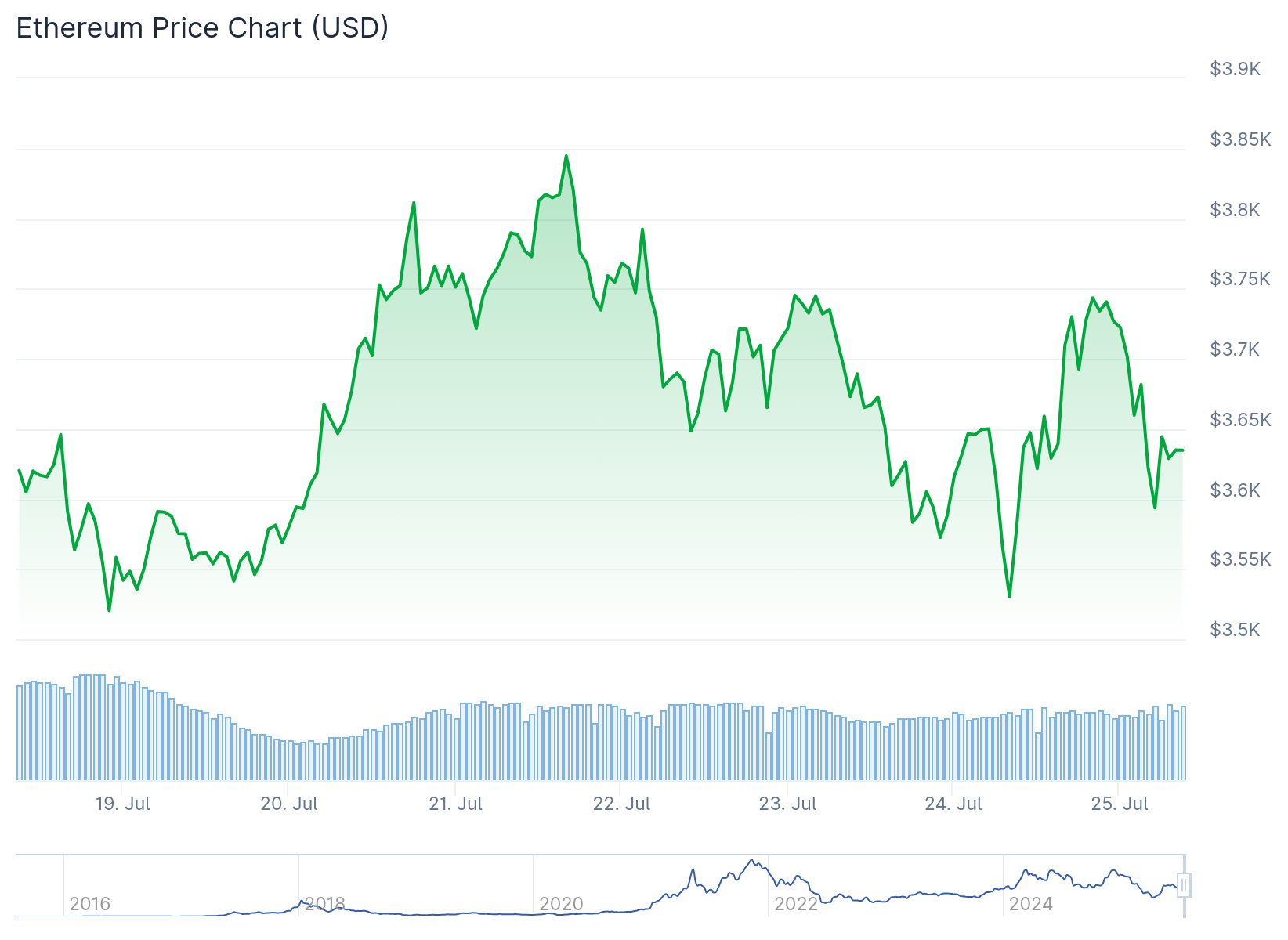

- Ethereum reclaimed $3,600 after briefly dropping to $3,500, with analysts seeing room for further growth

- Galaxy Digital CEO Mike Novogratz predicts ETH could hit $4,000 driven by institutional accumulation

- Major companies like BitMine, Sharplink Gaming, and Ether Machine collectively hold over 1.3 million ETH

- ETH/BTC ratio jumped 36% in the past month, showing stronger momentum than Bitcoin

- Key resistance sits at $4,500 while support levels range between $2,000-$3,000

Ethereum price recovered to $3,600 levels after a brief dip to $3,500 during Asian trading hours on Thursday. The drop represented a 9% decline from seven-month highs, but market analysts maintain that ETH’s uptrend remains intact.

Galaxy Digital CEO Mike Novogratz told CNBC that institutional interest could push ethereum past $4,000 in the coming months. He described this surge in corporate adoption as the “secret sauce” driving price momentum.

Companies including BitMine, Sharplink Gaming, and The Ether Machine now hold over 1.3 million ETH collectively in their treasuries. These firms increasingly view ETH as a strategic reserve asset and yield-bearing investment rather than just a utility token.

Novogratz emphasized that limited ETH supply makes it easier for large purchases to move the price. He believes Ethereum is “destined” to reach $4,000 and potentially enter price discovery territory if it breaks through that level.

The ETH/BTC exchange inflows ratio suggests continued outperformance potential for Ethereum. CryptoQuant data shows the ratio remains well below extreme levels, indicating less selling pressure on ETH compared to Bitcoin.

Institutional Momentum Building

Spot Ethereum ETFs recorded their seventh-best day ever with $332.2 million in inflows on Wednesday. This contrasts with Bitcoin ETFs, which experienced three consecutive days of outflows totaling $285.2 million.

Ethereum ETFs have attracted nearly $8.7 million in net inflows since launch and now manage over $16.6 billion in assets. The ETH/BTC ETF holding ratio increased to 0.12 from 0.02 in May, showing growing relative exposure to Ethereum.

Stablecoin reserves in the Ethereum ecosystem doubled to $131 billion in recent months. Total value locked climbed to 22.2 million ETH, reflecting increased DeFi activity.

Technical Levels in Focus

Glassnode analysts identified key support levels between $2,000 and $3,000 using Ethereum’s cost basis model. The realized price sits at $2,100, true market mean at $2,500, and active realized price at $3,000.

Major resistance appears at $4,500, representing the active realized price plus one standard deviation. This level historically served as resistance during March 2024 and the 2020-21 cycle.

The ETH/BTC ratio gained 36% over the past month, showing stronger momentum than Bitcoin. While Novogratz remains long-term bullish on bitcoin with a $150,000 target, he expects Ethereum to lead in the short term.

Market cap-to-stablecoin ratio dropped to 3.4x, suggesting ETH may be undervalued relative to available liquidity. Bulls need to push price above $3,860 to open doors for a rally toward $4,000.

Companies preparing for public listings like Ether Machine continue accumulating ETH, potentially creating supply constraints. Novogratz warned that unexpected shifts in U.S. interest rate policy could alter his bullish outlook.