Crypto Market Slump: Decoding Today’s Dip & What Comes Next

Crypto's nosediving? Blame the usual suspects—macro tremors, whale sell-offs, and that one hedge fund manager who still thinks 'blockchain is just for Bitcoin.'

Here’s the breakdown:

1. Fed FUD Strikes Again: Rate hike whispers sent traders scrambling for stablecoins like liferafts. Thanks, Powell.

2. Miner Capitulation: Bitcoin’s hash rate dipped as rigs went offline—proof that even machines get cold feet.

3. DeFi Dominoes: Aave and Compound TVL dropped 12% in 24 hours. Yield farmers suddenly remembering what 'impermanent loss' means.

Silver lining? Every crash plants seeds for the next bull run. Just ask the diamond-handed degenerates buying this dip (and the VC vultures circling distressed assets).

Remember: The market moves in cycles, but Wall Street still can’t tell a hardware wallet from a Rolodex.

TLDR

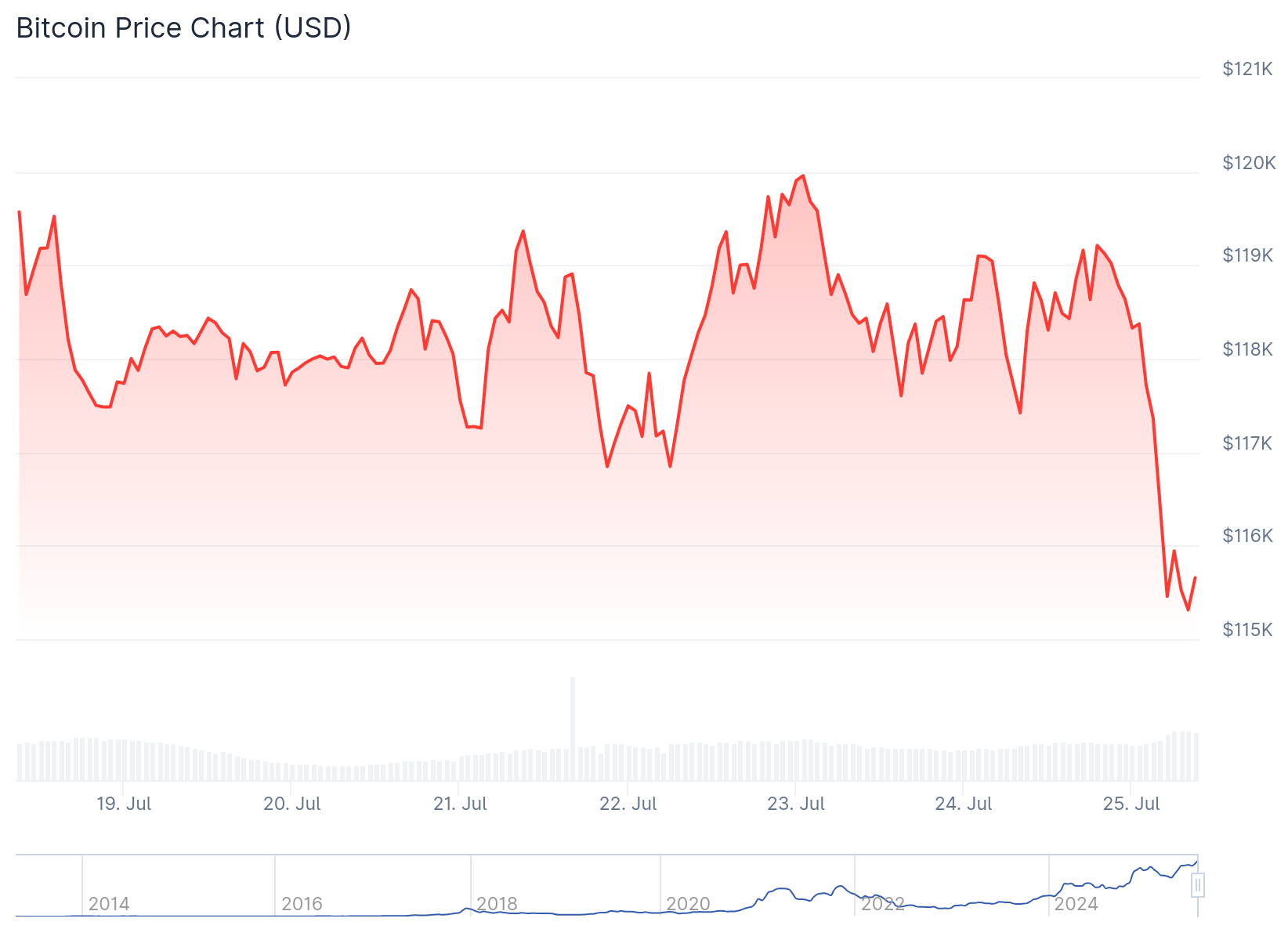

- Crypto market cap dropped $105-117 billion to $3.72 trillion as Bitcoin fell 2.7% to $115,458 and broke key support levels

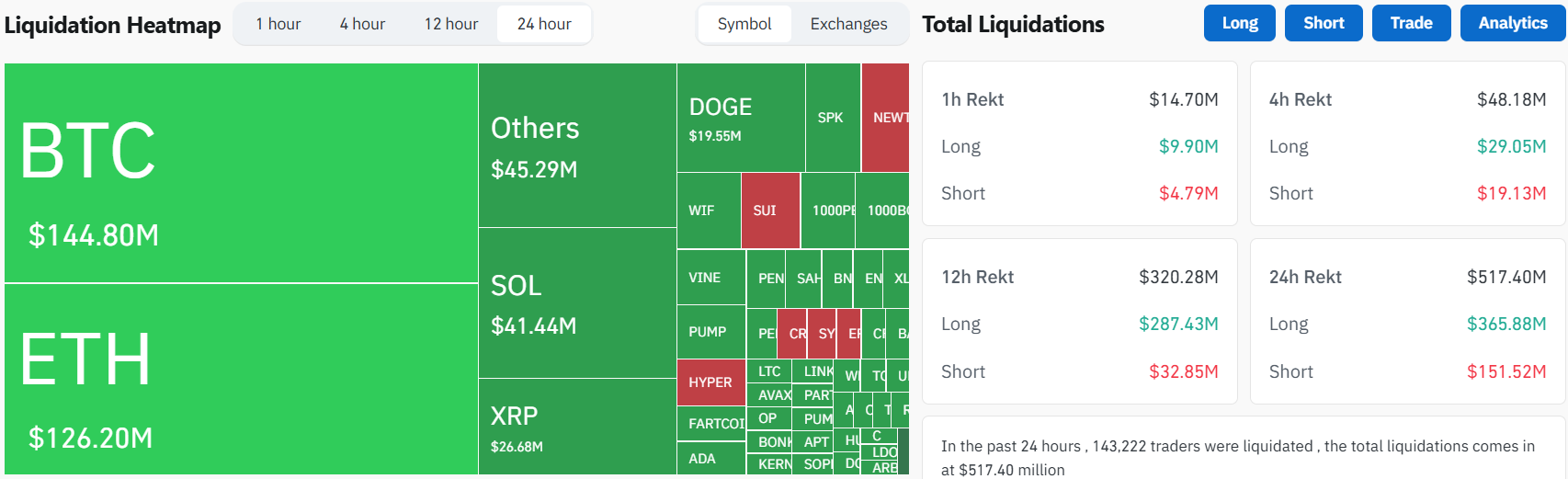

- Over $700 million in leveraged long positions were liquidated, with XRP losing $89 million in single-day liquidations alone

- Despite record US M2 money supply reaching $22.02 trillion, liquidity remains parked in money markets rather than flowing into crypto

- Ethereum faces validator exit pressure with $2.3 billion worth of ETH waiting to be unstaked, while XRP dropped 12% after Ripple co-founder transferred 50 million tokens

- Analysts view the decline as a healthy correction following a 33% rally since late June, with leveraged altcoin positions driving forced selling

The cryptocurrency market experienced a sharp decline today, shedding over $100 billion in market capitalization despite record levels of global liquidity. Bitcoin dropped 2.7% to $115,458 while the total crypto market cap fell to $3.72 trillion.

The selloff comes as over $700 million in Leveraged long positions were liquidated across the market. Bitcoin’s break below the $117,261 consolidation level triggered a cascade of forced selling that spread throughout the ecosystem.

XRP led major cryptocurrency losses with a 12% decline to around $3.06. The drop followed reports that Ripple co-founder Chris Larsen transferred 50 million XRP tokens, with approximately $140 million worth sent to centralized exchanges according to blockchain investigator ZachXBT.

Ethereum also faced downward pressure, falling 2-3% to trade NEAR $3,600. The second-largest cryptocurrency is dealing with validator exit pressure as over $2.3 billion worth of ETH awaits unstaking from the network.

Liquidity Paradox Puzzles Markets

Despite the US M2 money supply reaching a record $22.02 trillion, crypto markets continued their retreat. The broad money measure grew 4.5% year-over-year in June, typically a positive signal for risk assets.

However, Derek Lim from crypto trading firm Caladan explained that this liquidity is “currently pooled, not deployed.” Much of the $22 trillion sits in money markets or short-duration Treasury securities rather than flowing into risk assets like cryptocurrencies.

Daniel Liu, CEO of Republic Technologies, noted elevated options activity and increasing liquidation risk in current market conditions. Small price movements can now trigger cascading liquidations or short squeezes depending on market direction.

Altcoins faced particular pressure from leveraged positions unwinding. Lim pointed to XRP’s $89 million single-day long liquidation as an example of forced selling accelerating market declines.

Technical Breakdown Signals Further Weakness

Bitcoin’s break below $117,261 support after nearly two weeks of consolidation signals potential weakness ahead. If the current trend continues, Bitcoin could fall below $115,000 and potentially reach $111,187.

The total crypto market cap broke through support levels at $3.80 trillion and $3.73 trillion. Further weakness could push the market cap down to $3.61 trillion if selling pressure persists.

Solana dropped 6.2% while facing what Liu described as increased liquidation risk. The analyst noted that leverage is currently outpacing spot demand for the ethereum competitor.

Dogecoin posted some of the steepest losses among major cryptocurrencies, falling 10-18% over the past two days to trade near $0.23.

Pump.fun (PUMP) led altcoin declines with a 21% drop in 24 hours. The meme coin platform token has lost 63% of its value since launch and now trades with support at $0.00212.

Despite the selloff, analysts remain cautiously optimistic about longer-term prospects. The decline follows a 33% rally since late June, with many viewing the current weakness as a healthy correction rather than a trend reversal.

MicroStrategy announced plans to expand its STRC offerings from $500 million to $2 billion to purchase more Bitcoin, with the company aiming to hold 1 million BTC total.