Bitcoin (BTC) at Critical Support: Millionaire Analyst Doubles Down on $200K Price Target

Bitcoin teeters on a knife's edge—testing key support levels as bulls and bears clash. One high-profile trader isn't flinching: his $200K price target still stands, defying the market's short-term jitters.

The Make-or-Break Moment

BTC's current consolidation mirrors historic accumulation phases. Every dip below $30K last cycle sparked panic—now those levels seem laughable. This time? The smart money's buying, not selling.

Wall Street's Worst Nightmare

While traditional finance scrambles to 'understand' Bitcoin, crypto natives stack sats. The irony? The same institutions that mocked BTC at $5K now pay $500K for mining rigs—only to underperform hodlers. Some things never change.

The $200K Gambit

Our millionaire analyst's prediction hinges on one brutal truth: adoption always wins. Whether through ETFs, nation-state adoption, or pure speculation, demand will eclipse supply. The math hasn't changed—only the timeline.

Bottom line: This isn't 2018. The infrastructure, liquidity, and institutional interest now backing Bitcoin make $200K more inevitable than outrageous. But hey—what do we know? We're just the idiots who bought at $60K and slept like babies.

TLDR

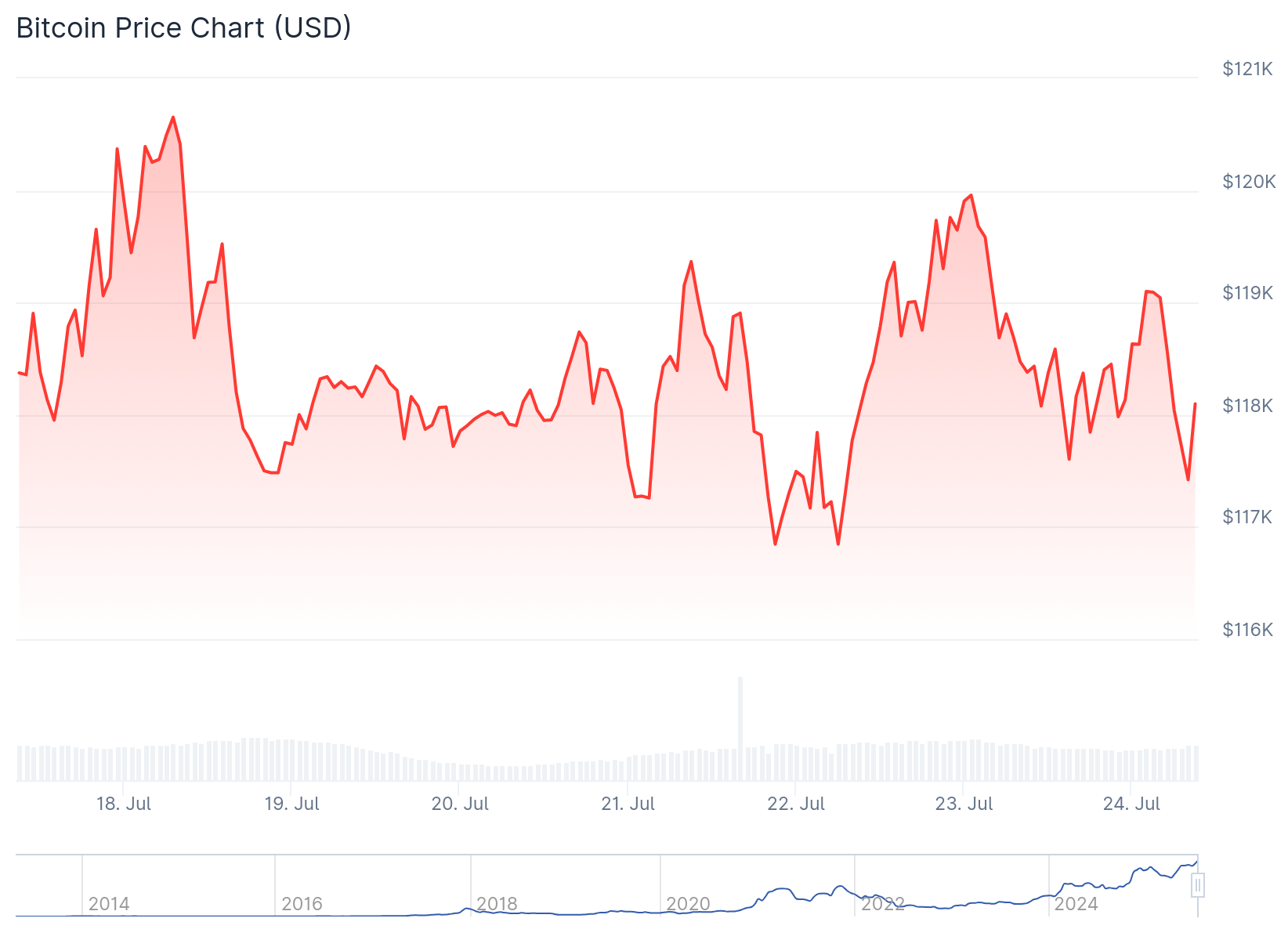

- Bitcoin price is consolidating around $118,000-$118,600 after reaching recent highs near $123,000

- Analyst Tom Lee predicts Bitcoin could reach $200,000-$250,000, representing 25% of gold’s market cap

- Key resistance levels are at $120,000 and $120,250, with support at $118,200 trend line

- RSI at 48.88 suggests room for further gains without entering overbought territory

- Bitcoin maintains bullish flag pattern with potential targets at $140,000 if it holds above $112,000

Bitcoin price continues to trade above $118,000 as the cryptocurrency consolidates after reaching recent peaks near $123,000. The world’s largest digital asset is showing resilience in its current range.

Prominent analyst Tom Lee has reinforced his bullish outlook for Bitcoin. The Fundstrat Capital Chief Investment Officer appeared on CNBC Squawk Box to discuss his price predictions.

Lee highlighted Bitcoin’s role as “Digital Gold” and suggested the cryptocurrency could reach $200,000 to $250,000. This target WOULD represent approximately 25% of gold’s current market capitalization.

TOM LEE: " I think Bitcoin is more valuable than gold–it could be 2-3 million long term." 🚀 pic.twitter.com/nZJUZZhg6I

— Swan (@Swan) June 2, 2025

The analyst pointed to recent regulatory developments as potential catalysts. He specifically mentioned the approval of the GENIUS Act as a positive factor for the digital asset ecosystem.

Technical Picture Shows Mixed Signals

Bitcoin currently trades at $118,160, down 0.20% from its all-time high of $123,000. The price action shows the cryptocurrency holding above key technical levels.

Technical analysis reveals immediate resistance at $119,300, followed by the crucial $120,000 level. A break above $120,250 could open the path to $122,500 and potentially $123,200.

The 100-hour simple moving average provides support below current levels. A bullish trend line has formed with support at $118,200 on the hourly chart.

If bitcoin fails to break higher, support levels include $118,500 and the trend line at $118,200. Deeper support sits at $117,200, which aligns with the 76.4% Fibonacci retracement level.

The Relative Strength Index currently reads 48.88, placing it in neutral territory. This reading suggests Bitcoin has room for additional gains without entering overbought conditions.

Bitcoin Price Prediction

The “Digital Gold” narrative has gained traction beyond Lee’s endorsement. Early in 2025, the US Treasury Department published a report officially recognizing Bitcoin as digital gold.

President Donald Trump has publicly referred to Bitcoin as “digital gold.” crypto Czar David Sacks has described the US strategic reserve as “a digital Fort Knox” for the asset.

MicroStrategy Chairman Michael Saylor predicted during a Bloomberg interview that Bitcoin could reach $1 million. Saylor suggested bear market cycles are behind the cryptocurrency.

Crypto analyst “Crypto Busy” confirmed Bitcoin maintains strength above its bullish flag breakout pattern. The analyst believes maintaining support above $112,000 could drive Bitcoin price toward $140,000.

The MACD indicator on the hourly chart shows gaining pace in the bullish zone. The hourly RSI for BTC/USD sits above the 50 level, indicating positive momentum.

Major support levels include $118,250 and $116,250. Key resistance levels are positioned at $119,250 and $120,250.

Bitcoin’s price prediction – current price action suggests the cryptocurrency is preparing for its next directional move. The technical setup and analyst predictions point to potential upside targets in the coming months.