Ethereum (ETH) Surges Toward $4,000 as Institutional FOMO Kicks Into High Gear

Wall Street's crypto crush just got serious—Ethereum bulls are charging the $4,000 resistance like a hedge fund manager chasing performance fees.

Institutional demand fuels ETH rally

BlackRock's ETH ETF approval last quarter opened the floodgates. Now pension funds and family offices are piling in—better late than never for the suits who mocked crypto in 2021.

Technical breakout underway

The $4,000 level isn't just psychological resistance—it's the last major hurdle before ETH challenges its all-time high. Options traders are betting big on a breakout by August.

DeFi activity spikes alongside price

TVL in Ethereum protocols jumped 22% this month. Apparently even institutional investors finally figured out how to use MetaMask (with help from their millennial interns).

Regulators scramble to keep up

The SEC's 'regulation by lawsuit' approach looks increasingly pathetic as ETH's market cap flirts with $500B. Gary Gensler's frown deepens with every basis point gain.

Smart money knows what's coming—the only question is whether ETH punches through $4,000 before or after the next round of 'crypto is dead' think pieces drop.

TLDR

- Ethereum spot funds gained $3.28 billion in July, showing strong institutional interest from companies and whales

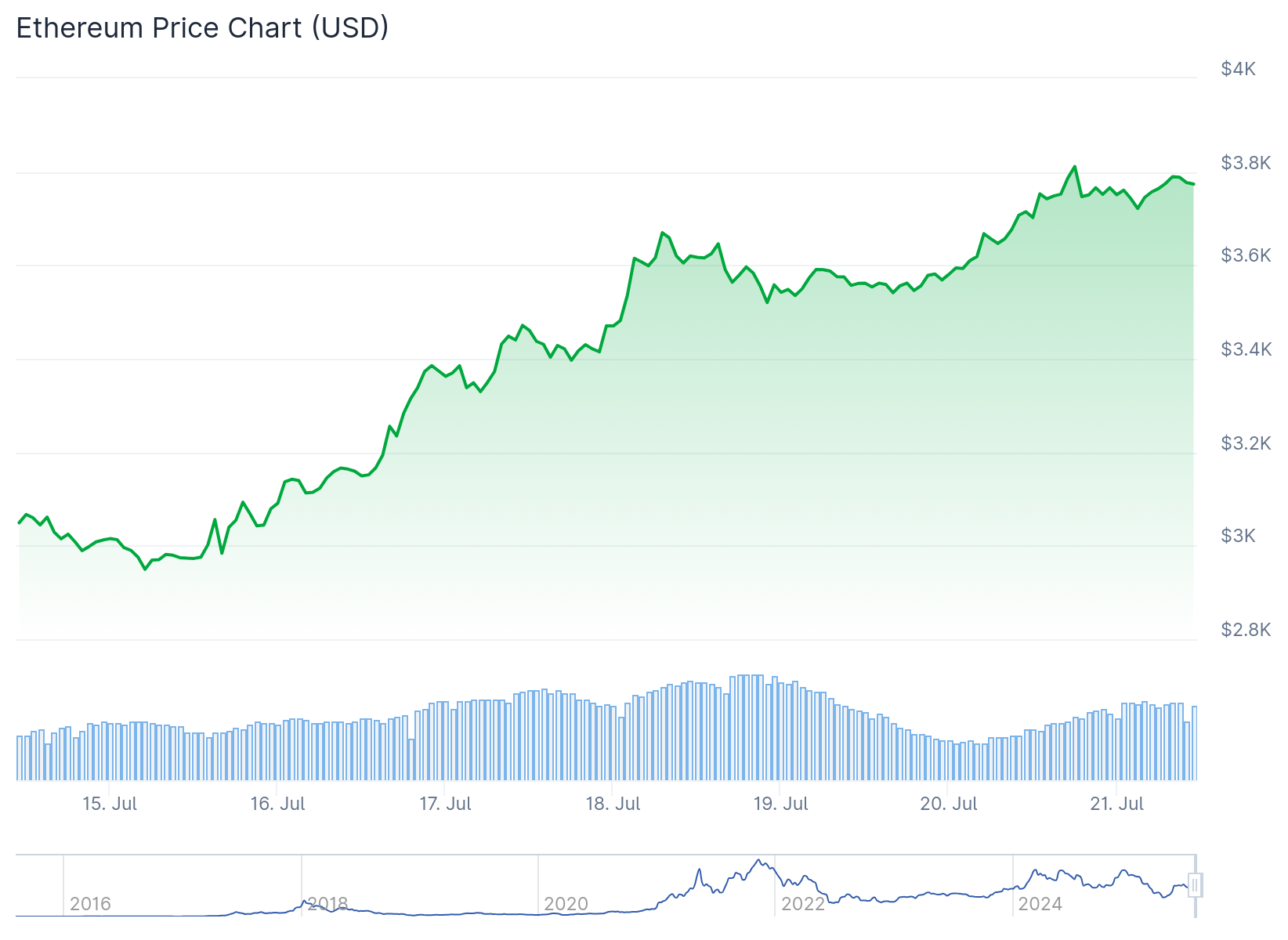

- ETH price surged 65% since June, currently trading at $3,745 and approaching key $4,000 resistance level

- Major investors including Peter Thiel acquired stakes in companies holding large ETH positions like BitMine’s 300,000 ETH

- Technical indicators show RSI at 84 and MACD strength not seen since late 2024, suggesting continued momentum

- Regulatory developments and potential SEC approval of staking ETFs could push price toward $5,000 target

Ethereum is experiencing strong upward momentum as institutional investors pile into the cryptocurrency. The second-largest digital asset by market cap has gained 65% since late June, trading at $3,745 and approaching the critical $4,000 resistance level.

Spot ETH funds recorded $3.28 billion in net inflows during July alone. This represents a massive increase compared to combined flows in the first half of 2025. The surge indicates growing institutional adoption as companies treat ETH as a treasury asset.

On July 18, ETH spot ETFs saw $402 million in net inflows. This outpaced Bitcoin’s daily ETF earnings for that period. BlackRock’s iShares ethereum Trust leads the pack with $9.17 billion in net assets under management.

Corporate accumulation is driving much of the demand. BitMine and SharpLink are among companies expanding their ETH holdings. BitMine currently holds approximately 300,000 ETH tokens.

Billionaire Peter Thiel recently acquired a 9.1% stake in BitMine Immersion Technologies. This MOVE gives him indirect exposure to the company’s substantial ETH reserves. SharpLink purchased nearly 33,000 ETH and plans to raise $5 billion to grow its ETH treasury further.

Whale Activity Supports Price Movement

On-chain data reveals intense whale activity. One large investor purchased 122,000 ETH within a single week. These large-scale purchases reduce circulating supply and create upward pressure on prices.

The current price of $3,745 puts ETH just 6.8% away from the $4,000 psychological resistance level. Previous rallies have struggled at this mark. However, current momentum appears stronger than past attempts.

Technical analysis supports the bullish outlook. The Relative Strength Index (RSI) sits at 84, indicating strong momentum but potential overbought conditions. The MACD shows trend strength not observed since late 2024.

Regulatory Environment Improves

Recent regulatory developments favor Ethereum’s outlook. The signing of the GENIUS Act and positive US legislative changes improve the legal framework for cryptocurrencies. These developments reduce regulatory uncertainty that has previously weighed on prices.

Traders are closely watching for SEC decisions on staking ETFs. Approval could provide additional momentum for ETH prices. Market participants believe this could be the catalyst needed to break through $4,000 resistance.

Bitcoin’s market dominance has declined from 66% to 61% since June. This shift suggests funds are rotating from Bitcoin into alternative cryptocurrencies like Ethereum. The rotation provides additional support for ETH prices.

Ethereum Price Prediction: $5,000 Not Far? Key Factors To Watch Out

July’s $3.28 billion net inflow into spot ETH funds shows DEEP institutional conviction.

Tech firms and whales are treating ETH as a treasury asset, tightening its supply.

With Bitcoin’s declining dominance… pic.twitter.com/XSXxd13JCU

— crypto MINING FIRM (@MININGCRYPTOLTD) July 20, 2025

Some analysts predict ETH could reach $5,000 if current trends continue. Others suggest even higher targets based on historical patterns. During the 2020-2021 cycle, Ethereum rallied 59 times from its lows to reach $4,800.

If Ethereum achieved even half of that performance, prices could reach $41,000. Such levels would push ETH’s market cap to $5 trillion. However, this scenario would require bitcoin reaching $500,000.

Current resistance levels sit between $3,800 and $4,000. If these levels break, there appears to be little technical resistance before $5,000. Profit-taking could cause temporary pullbacks to $3,530 or $3,131.

The combination of institutional flows, corporate adoption, and regulatory clarity creates a favorable environment. ETH spot ETF flows in July exceeded $3 billion, well above earlier periods in 2025.