Trump’s Bold Move: Crypto Could Soon Flood 401(k) Retirement Plans

Wall Street's about to get a blockchain facelift—whether it's ready or not.

BREAKING: A seismic shift in retirement investing looms as Trump's executive order paves the way for Bitcoin and altcoins in 401(k)s. The move could funnel billions in institutional money into crypto—and send compliance officers into early retirement.

The Fine Print:

This isn't your grandpa's pension plan anymore. The proposed rule change would let workers allocate portions of their 401(k) to digital assets, effectively turning retirement accounts into crypto trading vehicles. Proponents argue it democratizes access to high-growth assets. Critics see a ticking time bomb wrapped in blockchain hype.

Why This Matters:

With over $7 trillion currently locked in 401(k) plans, even a 1% allocation would mean $70 billion flooding into crypto markets overnight. Suddenly those 'stablecoin yields' start looking awfully tempting compared to your money market's pathetic 0.5% APY.

The Bottom Line:

Get ready for financial advisors to suddenly become 'crypto experts'—just in time to charge you 2% annually for the privilege of losing your nest egg to the next Terra/Luna debacle. Because nothing says 'secure retirement' like 24/7 volatility and exchange hacks, right?

TLDR

- President Trump is preparing to sign an executive order allowing 401(k) retirement accounts to invest in cryptocurrencies and other alternative assets

- The order could be signed this week and would direct regulators to clear obstacles for crypto investments in retirement plans

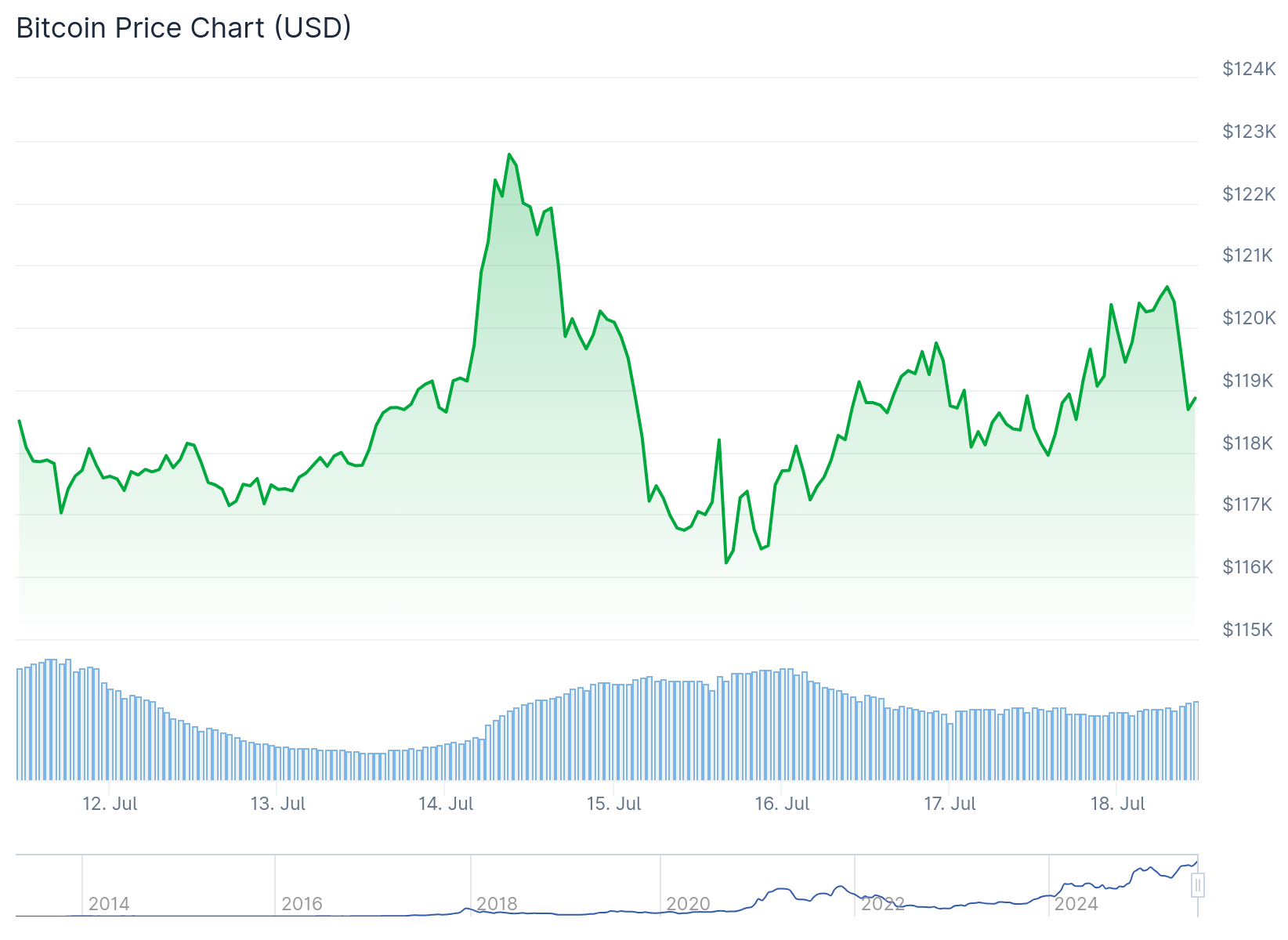

- Bitcoin jumped above $120,000 following news of the potential policy change

- The move would expand 401(k) investment options beyond traditional stocks and bonds to include digital assets, gold, and private equity

- White House spokesman cautioned that no decisions are official unless they come directly from President Trump

President Donald TRUMP is preparing to sign an executive order that would allow American 401(k) retirement accounts to invest in cryptocurrencies and other alternative assets. The Financial Times reported Thursday that the order could be signed as soon as this week.

The executive order WOULD expand investment options for 401(k) plans beyond traditional stocks and bonds. Under the proposed changes, retirement accounts could invest in digital assets, gold, private equity, and other alternative investments.

The order would direct federal regulators to investigate the best path forward for 401(k) plans to start investing in crypto. It would also instruct agencies to examine any remaining obstacles to making cryptocurrency investments in retirement accounts a reality.

Bitcoin ROSE above $120,000 following the report of the potential policy change. The cryptocurrency gained 1.7% in the 24 hours after the news broke. XRP also surged to a fresh all-time high, breaking its 2018 record.

However, WHITE House spokesman Kush Desai cautioned that nothing should be considered official unless it comes directly from President Trump. He told Cointelegraph that “no decisions should be deemed official” unless they come from Trump himself.

The potential executive order builds on previous regulatory changes under the Trump administration. In May, the US Labor Department rescinded guidance from the Biden administration that limited cryptocurrency inclusion in 401(k) retirement plans.

Current State of 401(k) Investments

A 401(k) is a retirement savings plan offered by many US employers. It allows employees to save and invest a portion of their paycheck before taxes are taken out. Typically, investments focus on mutual funds, exchange-traded funds, stocks and bonds.

The 401(k) market held $8.9 trillion in assets as of September 30, 2024, across more than 715,000 plans. The proposed changes would open this massive market to cryptocurrency investments for the first time on a broad scale.

Some companies have already begun offering crypto options in retirement plans. In April, financial services company Fidelity introduced a new retirement account allowing Americans to invest in crypto. Fidelity manages $5.9 trillion in assets.

State and International Developments

Several states have already begun exploring crypto investments for retirement funds. In March, North Carolina lawmakers introduced bills that could see the state’s treasurer allocate up to 5% of various state retirement funds into Bitcoin.

Other countries are also examining crypto in retirement plans. In November, a UK-based pension specialist reported that an unnamed scheme had made a 3% Bitcoin allocation into its pension fund.

Japan’s Government Pension Investment Fund was considering bitcoin as a potential diversification tool as of March last year. These international developments show growing acceptance of cryptocurrency in retirement planning globally.

The proposed executive order would represent a major shift in US retirement investment policy. It would give millions of American workers access to cryptocurrency investments through their employer-sponsored retirement plans.

The new investment options could span a broad spectrum of assets including digital currencies, precious metals, and funds focused on infrastructure deals and corporate takeovers. This would mark the largest expansion of 401(k) investment options in decades.

The executive order would need regulatory agencies to develop frameworks for crypto investments in retirement accounts. These agencies would need to establish guidelines for fiduciary responsibility and investor protection in the crypto space.