Ethereum and XRP Rocket—Is This the Start of Altcoin Season? Top Cryptos to Watch Now

Ethereum just punched through resistance levels like a bull in a china shop. XRP’s chart looks like a SpaceX launch trajectory. Traders are whispering: Altcoin season is here.

The Contenders Stealing the Spotlight

While BTC plays kingmaker, these alts are printing generational wealth—or vaporizing it faster than a DeFi rug pull. DYOR, but the charts don’t lie.

The Elephant in the Room

Institutional money’s finally playing ball—just in time for Wall Street to front-run retail (again). Stay sharp, stack smart, and maybe—just maybe—ride the wave without becoming exit liquidity.

Ethereum and XRP Leading the Charge – Signs of Altcoin Season?

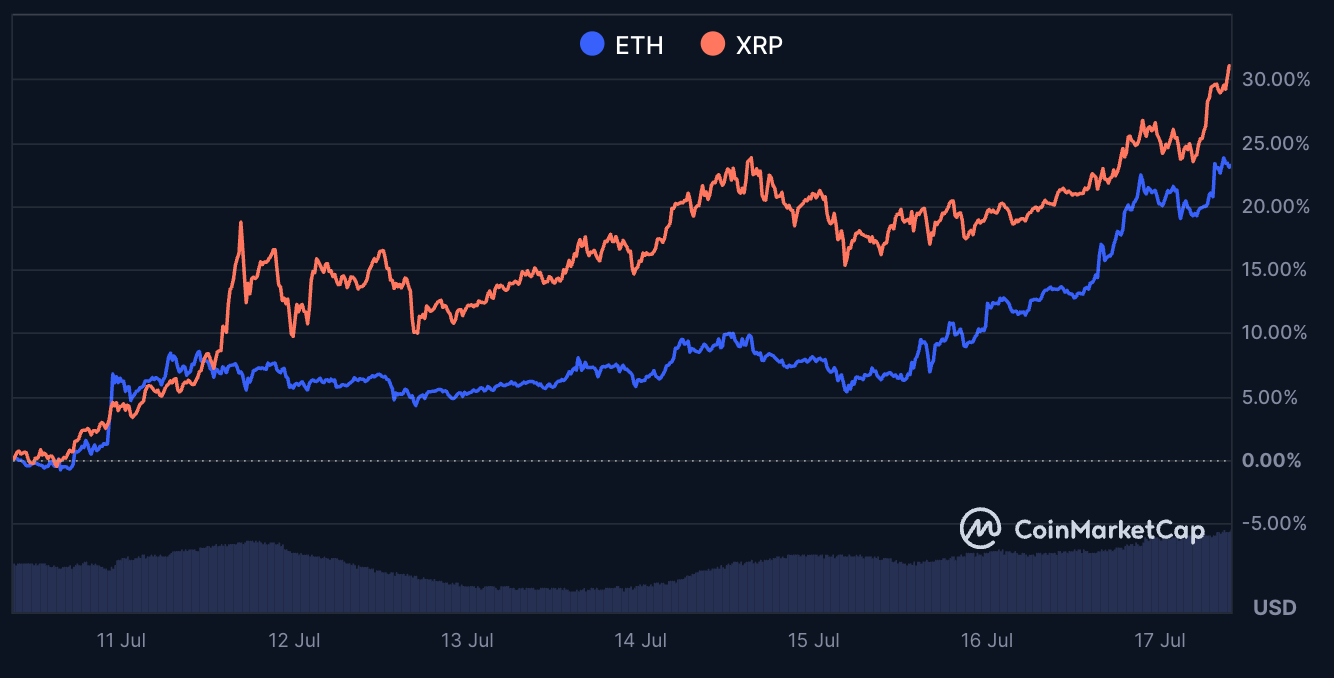

Ethereum has been on a tear lately, and there’s a clear reason for it. On Wednesday, the spot ETH ETFs pulled in $726 million in a single day – BlackRock and Fidelity accounting for most of that figure. That’s the biggest single-day intake since those funds launched, and it’s boosting sentiment across the board.

XRP isn’t lagging, either. It just surged past $3.19, locking in a 31% gain for the week. Two big factors are fueling the move: the ProShares Ultra XRP ETF launching tomorrow, and a real estate tokenization partnership with Dubai’s Land Department.

Both ETH and XRP have pushed through key resistance levels, backed by huge spot trading volumes. Meanwhile, Bitcoin’s dominance has slipped from 66% to 62.5%.

Both ETH and XRP have pushed through key resistance levels, backed by huge spot trading volumes. Meanwhile, Bitcoin’s dominance has slipped from 66% to 62.5%.

Analysts say we’re not in full-blown altseason yet – but we’re getting close. If bitcoin continues to consolidate while alts rally, next month could be when the switch flips for real.

What Are the Best Cryptos to Buy If Altcoin Season Kicks Off?

If we’re entering altcoin season, positioning in the right projects could be crucial if you want to maximize your gains. Here are four tokens that could benefit most from sustained altcoin momentum:

1. Snorter (SNORT)

Snorter (SNORT) is approaching meme coins from a different angle by combining HYPE with actual utility. Built on Solana, it features a Telegram-integrated trading bot with automated sniping, honeypot detection, and copy-trading – all benefits tied directly to holding the SNORT token.

The fee system is a key selling point. Rival Trading Bots usually charge 1.5% (or more) per trade. Snorter starts at that level, but if you hold the SNORT token, it drops to 0.85%. For anyone actively trading meme coins, that’s a genuine edge.

Snorter Bot’s features aren’t just for show, either. Honeypot detection achieved an 85% success rate in beta testing. And there’s also staking – estimated at 200% APY – with over 12.4 million SNORT already locked up.

Jacob Bury from 99Bitcoins has flagged SNORT as a potential 10x play after its presale wraps up. Ultimately, Snorter is positioned as an exciting new altcoin to consider, especially if you value trading tools alongside the usual degen energy. Visit Snorter Presale.

2. Haedal Protocol (HAEDAL)

Haedal Protocol (HAEDAL) is in a strong position as the leading liquid staking platform on Sui, and its momentum is only growing. Users can stake sui in exchange for haSUI – a token that earns staking rewards while remaining DeFi-ready.

The recent wave of big CEX listings has boosted HAEDAL’s visibility: Binance, Bybit, KuCoin, and Gate have all added the token this year. Each listing brought price jumps, especially the Binance airdrop of 30 million HAEDAL to BNB holders – which triggered a 35% spike within hours.

With Sui’s DeFi ecosystem expanding rapidly, Haedal’s TVL just keeps climbing. Strong volume and bullish indicators suggest HAEDAL could be one of the best cryptos to buy as liquid staking becomes more popular.

3. Bitcoin Hyper (HYPER)

Bitcoin Hyper (HYPER) is trying to solve Bitcoin’s oldest problem – speed. As a Layer-2 network using Solana VIRTUAL Machine tech, it bridges BTC over and lets you transact with near-zero fees and instant settlement, while keeping that Bitcoin-level security intact.

What’s clever is the decentralization angle. No go-between holds your BTC when you bridge it over. And for developers, it opens up the complete solana toolkit – smart contracts, Rust, and Anchor – all now usable on the Bitcoin blockchain.

The native HYPER token powers the ecosystem: fees, staking, and governance voting. Early investors can earn 286% staking yields during the ongoing presale, which has helped Bitcoin Hyper raise over $3.1 million so far.

Timing-wise, the project’s emergence feels sharp. Bitcoin has just posted a new all-time high, but its limitations are more apparent than ever. If Bitcoin Hyper pulls off what it promises, it could grab real market share as Bitcoin’s next upgrade layer. Visit Bitcoin Hyper Presale.

4. Chainlink (LINK)

Chainlink (LINK) isn’t flashy, but it continues to solidify itself as crypto’s go-to infrastructure play. Its decentralized oracle network powers smart contracts across multiple blockchains, now with heavyweight partnerships in the mix.

The Mastercard collaboration stands out: bringing blockchain infrastructure to potentially 3 billion people globally. chainlink is also rolling out new products, such as its Automated Compliance Engine and expanded Cross-Chain Interoperability Protocol (CCIP), providing more tools to attract TradFi players.

LINK has been on fire lately, rising 17% in the past week. If it breaks through resistance at $18, the technicals look good for another move higher, and that makes Chainlink one of the best cryptos to buy for infrastructure exposure this cycle.