🚀 Solana (SOL) ETF Approval Now 99% Certain as Wall Street Goes All-In

Institutional money is flooding into Solana—and the crypto world just got its biggest validation yet.

The ETF stampede begins

BlackRock’s paperwork was the starting gun. Now every major asset manager’s scrambling to claim their slice of the fastest blockchain in finance. Forget ‘maybe’—the SEC’s rubber stamp is all but guaranteed.

Why Wall Street wants SOL

4000 TPS beats ETH’s lunch money. Institutions finally get it: you can’t build the Nasdaq of crypto on dial-up speeds. Cue the hedge funds ‘accidentally’ overexposing their clients to ‘just a small altcoin position.’

The cynical take

Watch the same suits who called crypto a scam in 2022 now pitch SOL ETFs as ‘portfolio diversification’—with a tidy 2% management fee, of course. The more things change…

TLDR

- Solana price is consolidating near $160-$170 with technical analysts targeting a rally to $300-$331, almost double the current value

- The REX-Osprey spot Solana ETF has attracted $73 million in inflows since launch, with approval odds reaching 99% on prediction markets

- Major asset managers including VanEck, Grayscale, and Bitwise are competing to launch spot Solana ETFs with SEC approval expected

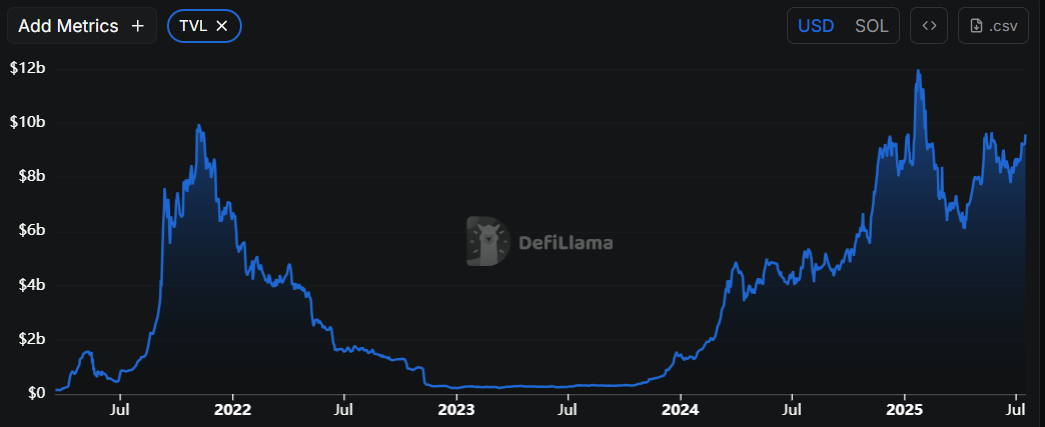

- Solana’s ecosystem has surpassed $4 billion in total deposits with daily DEX volumes hitting $3.15 billion in 24 hours

- Institutional interest grows as DeFi Development Corp purchased over 153,000 SOL tokens and corporate treasuries add SOL holdings

Solana price is consolidating near $160-$170 as the cryptocurrency gains momentum from multiple institutional developments. Technical analysts are targeting a possible rally to $300-$331 if certain resistance levels are broken.

The REX-Osprey spot solana ETF has attracted approximately $73 million in inflows since its launch. This strong performance signals rising institutional investor confidence in Solana-based products.

Major asset managers are competing to launch spot Solana ETFs. VanEck, Grayscale, Bitwise, 21Shares, Invesco, and Galaxy Digital have all submitted applications to the SEC.

The regulatory agency is urging issuers to resubmit paperwork quickly. Approval odds on some prediction platforms have reached 99% for a spot Solana ETF by the end of 2025.

Bloomberg analysts suggest Solana could join Bitcoin and ethereum as one of the few spot crypto ETFs in the United States. A Solana staking ETF designed to generate on-chain returns also appears set to launch imminently.

This would mark a U.S. first for staking-focused crypto ETFs. The development represents a new category of investment products in the crypto space.

Strong Technical Indicators Support Price Targets

Solana’s price is showing signs of a sustained upward movement after forming a cup-and-handle pattern over two years. This pattern started forming after the sharp correction that followed the collapse of FTX in late 2022.

The correction ended in 2023 and was followed by a strong rally to $294 in January 2025. As Solana price reached this high, it triggered profit-taking among traders.

This caused a temporary decline that formed the handle of the pattern. The handle now appears to be ending as SOL tests the resistance of a falling channel.

Technical analysts have identified the 161.8% Fibonacci extension as the breakout target. This places solana price at around $2,700 for long-term projections.

Solana $SOL is about to melt faces! pic.twitter.com/WRrav5aAfM

— Ali (@ali_charts) July 16, 2025

To reach projected targets, Solana price must first surpass its previous high of $294 and resistance at $787. Beyond that, it must overcome the 141.4% Fibonacci level at $1,314.

Strong ETF inflows, surging open interest, and increased trading volumes on both spot and derivatives markets support the bullish outlook. Daily DEX volumes have reached $3.15 billion, placing Solana second among all networks for decentralized trading volume.

Ecosystem Growth Drives Institutional Interest

Solana’s ecosystem recently surpassed $4 billion in total deposits. This growth is highlighted by robust activity in DeFi protocols and tokenized assets.

Onchain revenue and usage metrics remain strong, with Q2 revenue reaching $570 million. This represents about 46% of total chain revenue across all activities.

DeFi Development Corp recently purchased over 153,000 SOL tokens, making it one of the largest holders of the asset. Continued accumulation from corporate buyers may provide fuel for further upside momentum.

Nasdaq-listed Click Holdings and BIT Mining announced plans to load their treasuries with SOL and other crypto assets. This underlines growing corporate interest in Solana holdings.

Solana signed a Memorandum of Understanding with the Kazakhstan government to promote regional crypto development and adoption. The partnership represents expanding international recognition of the platform.

The Realms v2 upgrade was launched to enhance DAO governance tools. The update provides more transparent voting and advanced treasury management capabilities.

Solana’s market capitalization now surpasses that of Ferrari, standing at around $89 billion. Investor sentiment remains high with strong net capital inflows from both retail and institutional participants.