🚀 Ether ETFs Shatter Expectations: $727M Daily Inflow as Wall Street Goes Crypto-Crazy

Wall Street's latest love affair? Ether ETFs—and the numbers don't lie. Corporate whales are diving in headfirst, fueling a historic $727 million single-day capital tsunami.

The institutional floodgates open

Traditional finance's 'if you can't beat 'em, join 'em' moment hits hyperdrive as suits finally grasp what degens knew years ago. The $727 million daily haul isn't just growth—it's an admission of crypto's inevitable dominance.

Behind the buying frenzy

Forget 'dip buyers'—this is full-blown FOMO from CFOs who spent 2024 dismissing ETH as 'tech nonsense.' Now they're scrambling to explain these positions to skeptical boards (and secretly praying Vitalik doesn't tweet).

The ironic twist? This institutional stampede coincides with crypto natives shifting to DeFi 2.0—just as banks finally understand the 1.0 playbook. Classic finance: always late, but never humble.

TLDR

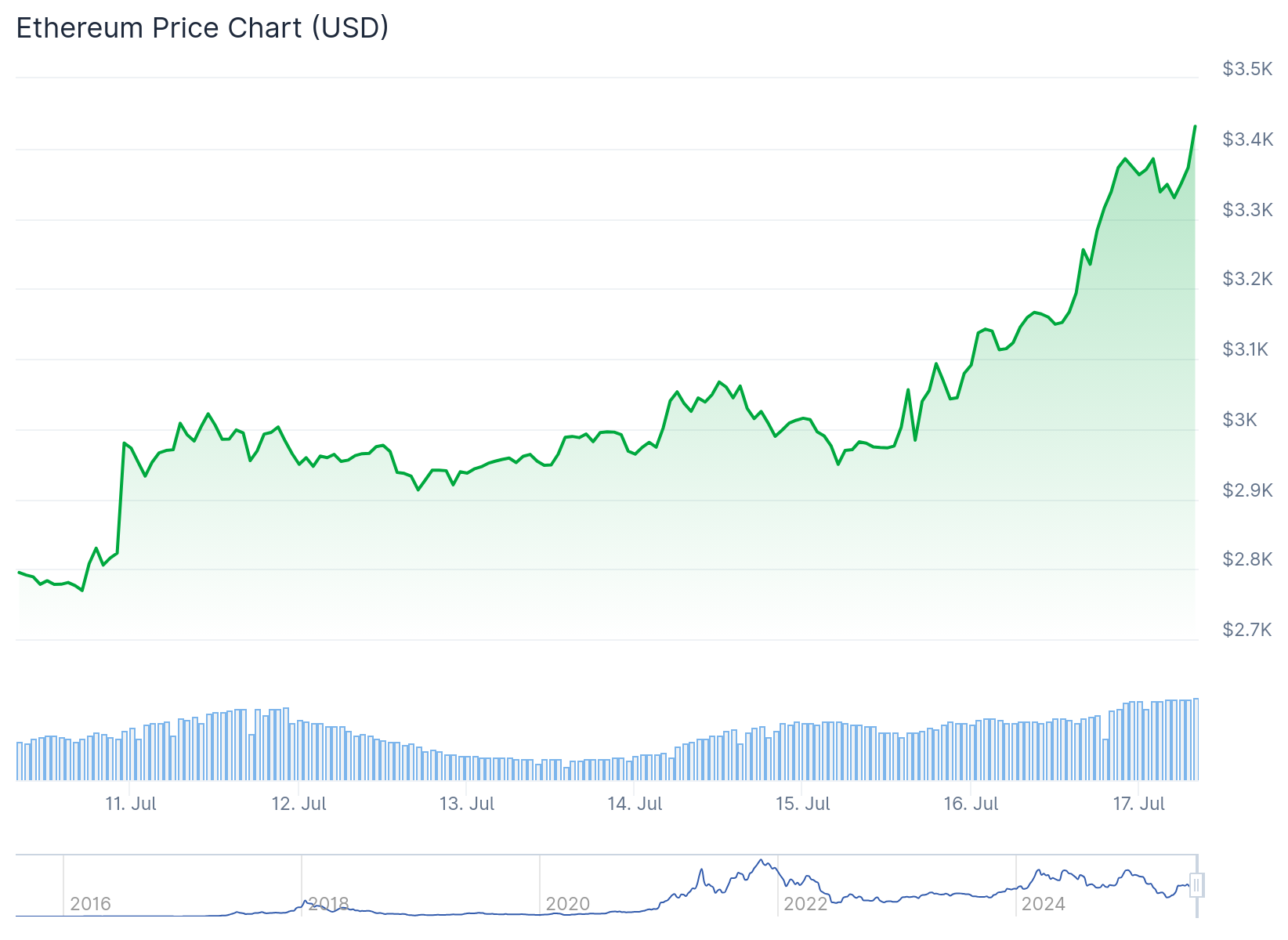

- US spot Ether ETFs recorded a record $726.74 million in daily net inflows on Wednesday as ETH rose 8.1% to over $3,560

- BlackRock’s ETHA led with nearly $500 million in new inflows, followed by Fidelity’s FETH with $113 million

- ETFs now collectively hold over 5 million ETH, representing more than 4% of the circulating supply

- Corporate treasuries holding ETH now exceed $5.33 billion, accounting for nearly 1.33% of ETH’s circulating supply

- Altcoins rallied across the board with XRP up 7.6%, Solana up 5.2%, and Dogecoin up 6.9% in 24 hours

US spot Ether exchange-traded funds shattered previous records on Wednesday, attracting $726.74 million in daily net inflows. This massive influx coincided with ETH prices surging 8.1% to cross $3,560, marking the token’s best single-day performance since March.

BlackRock’s ETHA dominated the inflow activity with nearly $500 million in new investments. The fund also recorded over $1.78 billion in trading volume during the session.

Fidelity’s FETH followed as the second-largest contributor with $113 million in inflows. Grayscale’s newly launched ETH fund also participated in the rally, helping push the combined total to record levels.

The Wednesday inflows beat the previous daily record of $428 million set on December 5, 2024, by almost 70%. These funds now hold cumulative inflows of $6.48 billion with total net assets exceeding $16.41 billion.

US spot Ether ETFs collectively hold more than 5 million ETH tokens. This represents over 4% of the entire circulating supply of the cryptocurrency.

In the past 24 hours, the ethereum network issued $6.74 million worth of new ETH. The ETFs purchased nearly 107 times this issuance amount on Wednesday alone.

Corporate Treasury Buying Accelerates

Corporate treasuries holding ETH now exceed $5.33 billion in total value. This represents nearly 1.33% of ETH’s circulating supply across various companies.

Last month, corporations added over $1.6 billion in Ether to their holdings. SharpLink Gaming emerged as one of the biggest recent buyers, purchasing another $68 million in ETH over the past 24 hours.

The gaming company has acquired $343 million worth of ETH in just eight days. World Liberty Financial, backed by US President Donald Trump, purchased an additional $5 million worth of ETH at $3,266.

BitMine Immersion Technologies, chaired by Fundstrat’s Tom Lee, announced it now holds more than half a billion dollars worth of ETH in its treasury.

Altcoin Market Responds

The broader cryptocurrency market responded positively to Ether’s performance. XRP climbed 7.6% in the past 24 hours, while Solana gained 5.2%.

Dogecoin rose 6.9% and Cardano increased 3.5% during the same period. BNB and Tron posted gains of 3.4% and 3.2% respectively.

Bitcoin managed only a 0.7% gain, suggesting investors may be rotating into alternative cryptocurrencies. Bitcoin’s market dominance currently stands at 61%, with some analysts suggesting it may have peaked.

Crypto analyst Matthew Hyland stated that altcoins could rally further if Bitcoin dominance falls to 45%. ETH is currently trading at approximately $3,346, up 7.2% in the past 24 hours.

The token has witnessed a 30% rally over the past 14 days. JLabs Digital’s Ben Lilly noted that Digital Asset Treasuries are creating new demand patterns for ETH that didn’t exist before.