Dogecoin Price Prediction: DOGE Pre-Surge Signals Flash, Pointing to $0.20 Breakout

Dogecoin's chart is whispering—and the message sounds like a rally cry. Technical indicators are aligning in a pattern crypto veterans recognize: the calm before the parabolic move.

The Setup on the Screen

Forget the memes for a minute. On-chain metrics and price action are painting a more serious picture. Key resistance levels have been tested and held, building a foundation that often precedes a significant leg up. Trading volume patterns suggest accumulation is happening under the radar, a classic sign of smart money positioning before a public surge.

Why $0.20 Isn't a Fantasy

The path to twenty cents hinges on a few critical breaks. Watch for a sustained move above a specific, stubborn price ceiling—that's the launchpad. Momentum indicators, currently coiling, need to snap into bullish territory. When they do, the move tends to be fast and leaves traditional finance analysts scrambling to explain the 'irrational' rally—as if logic ever governed a market driven by fear, greed, and viral tweets.

The Trigger Waiting in the Wings

Catalysts are everywhere in crypto. A major exchange listing, renewed celebrity endorsement, or even a broader market upswing could be the spark. Dogecoin's community remains its core engine, capable of turning a technical signal into a self-fulfilling prophecy overnight. They've done it before.

The signals are on the board. The pattern is familiar. All that's left is for the market to decide if it's time for DOGE to have its day again—and send another polite reminder to Wall Street about who really moves the needle now.

TLDR

- Long-term DOGE cycles suggest the current pre-surge phase may be nearing completion

- Inverse head and shoulders pattern signals short-term trend reversal potential

- TD Sequential buy setup points to downside exhaustion and rebound risk

- Break above key resistance could open upside toward $0.15–$0.20

Dogecoin (DOGE) price is drawing renewed attention as multiple technical indicators suggest a potential shift in trend. Long-term cycle analysis, combined with short-term reversal patterns, indicates DOGE may be transitioning from consolidation into an expansion phase. Based on current setups, analysts are watching for upside toward $0.14 in the NEAR term, with higher targets near $0.20 if momentum sustains.

Dogecoin Price Near End of Long-Term Pre-Surge Phase

According to analyst Trader Tardigrade, the two-week Dogecoin chart highlights a repeating multi-cycle structure that has defined DOGE since 2014. Historical price action shows extended downtrends capped by descending trendlines, followed by prolonged consolidation phases. These periods, marked as “pre-surge phases,” have historically preceded strong upside breakouts.

SOURCE: X

More so, the current cycle places Dogecoin price near the $0.09–$0.10 region, close to the descending multi-year resistance. Volume has steadily declined throughout the downtrend, a pattern commonly associated with seller exhaustion. This compression suggests that market participation has thinned, often a prerequisite for trend reversals in meme-driven assets.

Trader Tardigrade noted that a decisive break above the long-term trendline could trigger a fresh expansion phase. Based on previous cycles, initial upside targets are projected in the $0.20–$0.30 range. However, failure to hold above $0.08 could extend consolidation and delay the breakout scenario.

Inverse Pattern Signals Reversal Potential

Meanwhile, the two-hour dogecoin chart presents a clearer short-term bullish structure. Trader Tardigrade identified a completed inverse Head and Shoulders pattern, a classic reversal setup following a decline. The formation shows a left shoulder near $0.1360, a head around $0.1280, and a right shoulder near $0.1320.

The neckline, positioned between $0.1330 and $0.1340, has already been breached, signaling a shift in control toward buyers. Volume increased during the right shoulder and breakout phase, reinforcing the pattern’s validity. Such confirmation often strengthens confidence in follow-through moves.

Based on the measured move of the pattern, short-term targets lie between $0.1400 and $0.1450. A sustained move could extend toward $0.1500 if market conditions remain supportive. Pullbacks toward the neckline may act as support, while a breakdown below the right shoulder WOULD invalidate the setup.

TD Sequential Buy Signal Reinforces Upside Bias

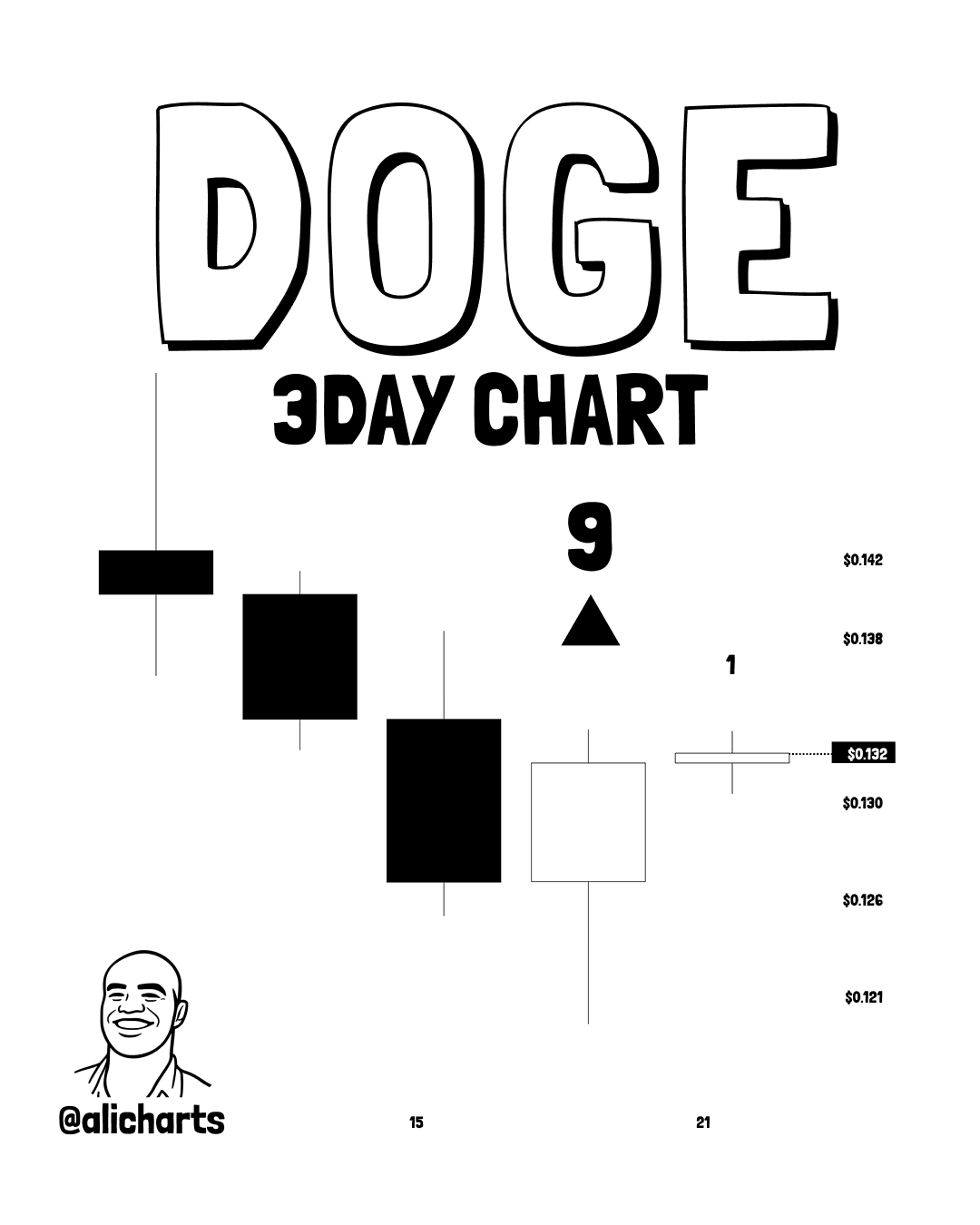

In addition, analyst Ali highlighted a momentum-based signal on the three-day Dogecoin chart using the TD Sequential indicator. The indicator recently printed a “9” sell signal, followed by a “1” buy setup near the $0.132 level. This sequence often marks trend exhaustion and the start of a new directional move.

SOURCE: X

Following the signal, the price retraced toward the $0.121 support zone, aligning with oversold conditions. The indicator’s historical reliability on Dogecoin suggests such setups often precede notable rebounds. The defined range between $0.121 and $0.142 now acts as a critical decision zone.

Ali pointed to an initial reclaim of $0.138–$0.142 as confirmation of bullish continuation. A successful move above this range could open the path toward $0.150, aligning with targets from the inverse pattern. At the time of writing, dogecoin price trades near $0.13, keeping reversal scenarios firmly in focus.