Solana Eyes $160 as Bullish Reversal Signals Flash Green

Solana's chart is whispering a comeback story—and the market's starting to listen. Key technical indicators are aligning, suggesting the recent slump might be giving way to a significant upward push. The target? A return to the $160 zone.

Signs of a Turn

Momentum oscillators have clawed their way out of oversold territory, while trading volume patterns hint at accumulation beneath the surface. It’s the classic setup: fear fades, conviction builds. The network's underlying activity—think transactions and developer engagement—provides a fundamental tailwind that technicals are now beginning to reflect.

The Path to $160

Reclaiming $160 isn't just a vanity metric; it represents a crucial psychological and technical hurdle. Breaking past it would signal a full recovery of recent losses and potentially open the door to higher highs. Of course, the path won't be a straight line—expect the usual volatility and a few skeptical headlines from traditional finance pundits who still think a blockchain is something you buy at a hardware store.

While the stars seem to be aligning, remember this is crypto. For every 'bullish reversal,' there's a whale waiting to take profits—because in this market, 'long-term holding' often just means 'haven't sold yet.'

TLDR

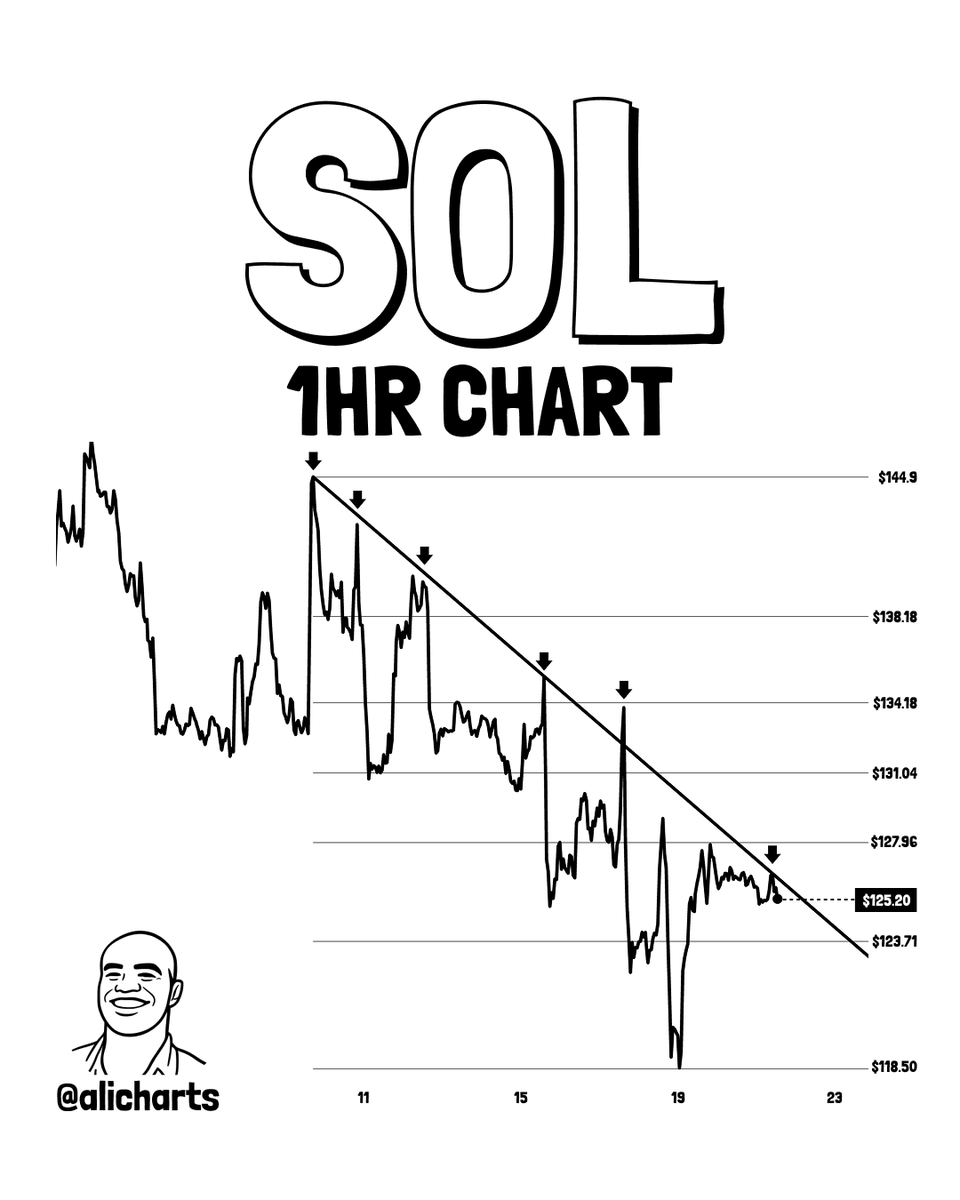

- Short-term charts show SOL under bearish pressure below a descending resistance line.

- Failure to reclaim $126 weekly could expose downside toward the $80–$90 zone.

- A long-term cup-and-handle pattern supports upside targets near $160–$180.

- Volume and structure suggest accumulation despite near-term volatility risks.

Solana is trading at a technical crossroads as analysts highlight conflicting short-term weakness and longer-term recovery structures. While near-term charts show persistent selling pressure, higher-timeframe patterns suggest the groundwork for a renewed advance. Market focus is now split between downside risk toward key supports and upside targets stretching into early 2026.

Solana Price Pressured by Short-Term Downtrend

According to analyst Ali, the one-hour chart shows solana locked in a steady decline since early December. Lower highs continue to form beneath a descending resistance line that has capped rebounds from $149 to the current $123 zone. Increased sell-side volume on red candles confirms that bears remain in control of the short-term trend.

SOURCE: X

Moreover, former support zones at $138 and $134 have flipped into resistance, reinforcing overhead pressure. Price compression NEAR $123 suggests a possible relief bounce, but historical price action shows similar setups often resolve with sharp volatility. Without a decisive break above the trendline, downside risk remains elevated.

Ali noted that a confirmed breakout could open the door to a recovery toward $130–$135. Conversely, failure to reclaim resistance may expose Solana to a deeper move toward $118.50. Volume behavior around the trendline is expected to determine the next directional move.

Inverse Pattern Raises Breakdown Concerns

Meanwhile, analyst Hardy highlighted a long-term inverse head and shoulders formation on the weekly chart. The structure spans from 2022, with a neckline positioned near $126. While such patterns typically signal bullish reversal, the recent rejection at the neckline raises caution.

Additionally, volume has not confirmed a sustained breakout, weakening the pattern’s reliability. The right shoulder shows fading momentum, increasing the risk that the structure may fail. In past crypto cycles, similar setups have transitioned into distribution tops during broader market weakness.

Most importantly, an invalidation could trigger a deeper correction toward the $80–$90 range. A decisive weekly close above $126 is required to restore confidence in this bullish reversal. Until then, Solana price remains vulnerable to market sentiment.

Cup-and-Handle Structure Supports $160 SOL Price Outlook

In contrast, analyst BitBull presents a more constructive long-term view based on a large cup and handle formation. The pattern stretches from 2023 through 2026, with a rounded base near $10 and a handle retracement holding above $89. This structure is often associated with accumulation phases before strong trend continuation.

SOURCE: X

Furthermore, volume behavior aligns with classic technical expectations. Participation increased during the cup formation and tapered during the handle, suggesting weak hands were flushed out. Such conditions have historically preceded sustained upside moves in altcoin markets.

Moreover, a brief sweep of the $90–$100 support zone WOULD still fit the bullish framework. If the pattern resolves as expected, upside projections extend toward $160–$180 in early 2026. This scenario positions longer-term buyers favorably, provided macro conditions remain supportive.

Overall, Solana faces near-term technical pressure while longer-term structures continue to attract attention from market participants. The next weeks may prove decisive in determining whether downside risks dominate or a recovery begins to take shape.