Crypto Market Pulse: Is Extreme Fear Still Capping BTC and ETH’s Potential?

Fear grips the crypto market—again. The 'Extreme Fear' sentiment that's dominated headlines isn't just a passing mood; it's shaping price action for the majors. Bitcoin and Ethereum, the twin engines of the digital asset economy, are trading in a zone where psychology matters as much as fundamentals.

The Fear & Greed Index Flashes Red

Market sentiment tools are screaming caution. When the crowd panics, even solid projects get dragged down. It creates a self-fulfilling prophecy of selling pressure and sideways chop, leaving traders wondering if the bottom is in or still ahead.

Breaking the Sentiment Shackles

History shows these fear phases don't last forever. They're often the fertile ground major rallies grow from. The key question isn't if sentiment will shift, but what catalyst will flip the script—a major institutional move, a regulatory clarity breakthrough, or just plain old market exhaustion.

For now, the market's mood is doing what Wall Street analysts get paid six figures to do: overthink everything. The next move hinges on who blinks first: the fearful sellers or the patient accumulation engines waiting in the wings.

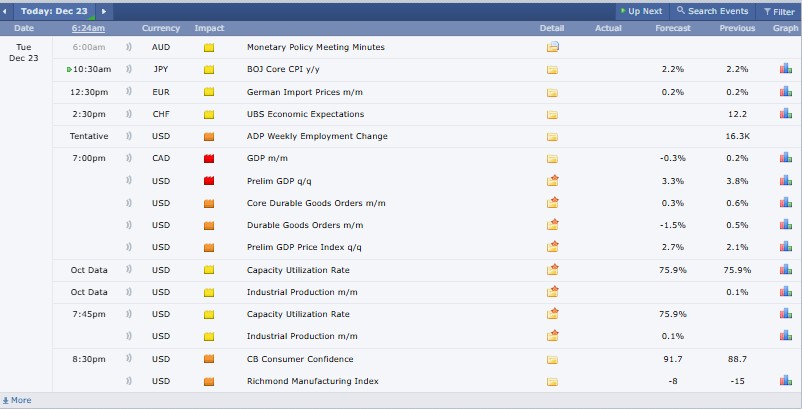

Major Crypto Events Today

Source: Forex Factory

24-Hour Crypto Market Update: Prices, Volume & Trends

The global cryptocurrency market today recorded a capitalization of $3.09 trillion, reflecting no change in the last 24 hours. Total trading volume noted $109 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 57.3%, while Ethereum (ETH) carries 11.8%. As of now, 19089 cryptocurrencies are being tracked. The largest gainers of the industry are Polkadot and the XRP Ledger ecosystem in the last 24 hours.

(Note: BTC and ETH are often viewed as less volatile historically, but still risky)

Bitcoin (BTC) price today reached $88739.12, down by 0.11% in the last 24 hours, with a trading volume of $36.49 billion and a market cap of $1.77 trillion.

Ethereum (ETH) price today $3023, slightly dipping by 0.16% in 24 hours with a trading volume of $19.47 billion and a market cap of $364.94 billion.

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

AI Cyclone (CYC) at $0.0001650, down 5.79% with a trading volume (TV) of $8.9K.

Yooldo Esports at $0.4462, posting a 3.23% gain, supported by TV $916.76M

Bitcoin (BTC) is at $88,624.14, slightly down 0.27% with a TV of $36.28B.

RateX (RTX) price today at $3.53, rising 6.09% with a TV of $324.78M.

Hachiko (HACHI) at $0.084023, falling 14.62%, with a TV of $937.05K.

(Ranked by 24-hour percentage gain)

Humanity Protocol (H) is priced at $0.2078, up 43.58%, with trading activity of $201.67 million

Curve DAO Token (CRV) is priced at $0.3796, gaining 7.82%, and has recorded a TV of $105.26 million

Midnight (NIGHT) price $0.09962, rising 6.13%, backed by $5.53 billion in trading volume.

(Ranked by 24-hour percentage loss)

MemeCore (M) sits at $1.36, down 9.32%, with trading volume of about $19.05 million.

Canton (CC) is at $0.08716, falling 8.32% with trading activity of around $46.18 million.

Aave (AAVE) trades at $149.50, down 7.70% with a volume of $707 million

Stablecoins noted a 0.1% negative change over the past 24 hours, with a market capitalization of $313 billion and trading volume of $83 billion.

The Decentralized Finance (DeFi) market declined 0.2% over the last 24 hours, recording a market cap of $104.7 billion and total value locked (TVL) at $5.17 billion.

(TVL refers to the total crypto assets locked in DeFi protocols.)

Fear and Greed Index Today

Source: Alternative Me

Today’s Crypto Fear & Greed Index is 24 (Extreme Fear), down from 25 yesterday, but higher than 11 last week and 13 last month. Numerically, fear remains dominant. Theoretically, weak prices, uncertainty, and risk-off sentiment persist, though h slight improvement suggests panic selling is easing, not reversing.

Latest Crypto Market News Today, 23 December

(Note: Each of these updates impacts traders by affecting liquidity, market sentiment, and potential returns, highlighting the need for careful monitoring.)

Peter Thiel-backed Erebor Bank is raising $350 million at a $4.35 billion valuation, led by Lux Capital, serving crypto, tech, defense, and aerospace clients after SVB’s collapse.

WLFI wallets linked to TRON founder Justin Sun remain blacklisted, as locked WLFI value has dropped nearly $60 million in three months, according to Bubblemaps.

Michael S. Selig was sworn in as the 16th CFTC Chair on December 22, replacing Acting Chair Caroline Pham, pledging coordinated crypto regulation and rejecting regulation by enforcement practices nationwide.

Aave founder Stani Kulechov bought 32,660 AAVE for 1,699 ETH. He now holds 84,033 AAVE worth $12.6 million, facing $2.29 million unrealized loss on paper currently.

Hyperliquid has launched the Lighter LIT pre-market contract, according to its official page, allowing traders to access early pricing with leverage up to three times maximum.

Ethereum treasury firm ETHZilla sold 24,291 ETH for $74.5 million to redeem senior notes, shifting focus to RWA tokenization, ending its public mNAV dashboard while continuing periodic disclosures via filings.

Comparative Insight

The index today has a slight emotional recovery compared to the deeper levels of fear that were seen last week, even with flat prices. The volumes of trading are still healthy, indicating the active participation, yet the strong bullish momentum is still not provided by the uncertainty, regulatory news, and profit-taking.

What This Means for Crypto Users

The current condition is a warning to crypto users rather than panic. Good volumes and a stable market cap are an indication that liquidity is not lost. Nevertheless, excessive fear implies that the risk is increased, and risk management, selective exposure, and close attention to macro and regulatory changes are necessary in the short term.

This commentary is only informational and not for long-term conditions. It does not indicate the direction of the price or indicate an action to be taken on the investment.

CoinGabbar’s Opinion

Based on the 24-hour crypto market update, crypto investment remains high-risk but selectively beneficial. There is low volatility and weak sentiment. Short-term traders can have an opportunity, and long-term investors should not rush into the markets, but prefer to preserve their capital, act disciplined, and research before investing their money.

Disclaimer: This is not financial advice. Do Your Own Research before investing. CoinGabbar is not liable for any financial loss. The crypto assets are risky and you may lose all your investments. Not all regions can offer some of the services or assets discussed.