Hyperliquid (HYPE) Price Plummets 56%: Are Whales Buying the Dip?

Hyperliquid (HYPE) just got rocked—down 56% in a brutal sell-off. But while retail traders panic, the big money might be moving in.

The Whale Watch Is On

On-chain chatter points to large wallets accumulating HYPE tokens as prices crater. It's the classic crypto playbook: shake out the weak hands, then scoop up the pieces at a discount. These aren't your average 'buy the dip' tweets; we're talking about wallets with the capital to move markets making calculated entries.

Anatomy of a Correction

A 56% drop doesn't happen in a vacuum. The token got overheated, leveraged positions got liquidated, and the dominoes fell. It's a harsh reminder that in crypto, gravity always wins—eventually. The question now is whether this is a healthy reset or the start of something uglier.

What the Smart Money Sees

Whales aren't charities. Their buys suggest they see long-term value beneath the panic. Maybe it's Hyperliquid's underlying tech, its position in the DeFi stack, or simply a bet that the fear is overblown. Their moves often signal a coming stabilization, or at least a dead cat bounce that nimble traders can ride.

So, is this the bottom? Nobody rings a bell. But when the so-called 'smart money' starts acting, it pays to watch. Just remember—for every whale buying, there's a fund manager somewhere explaining a 56% loss as 'strategic portfolio rebalancing'.

TLDR

- Hyperliquid (HYPE) has dropped over 56.5% in less than 90 days, falling from $58 to under $25

- Whale wallets have deposited over $37 million USDC to accumulate HYPE tokens at various price levels

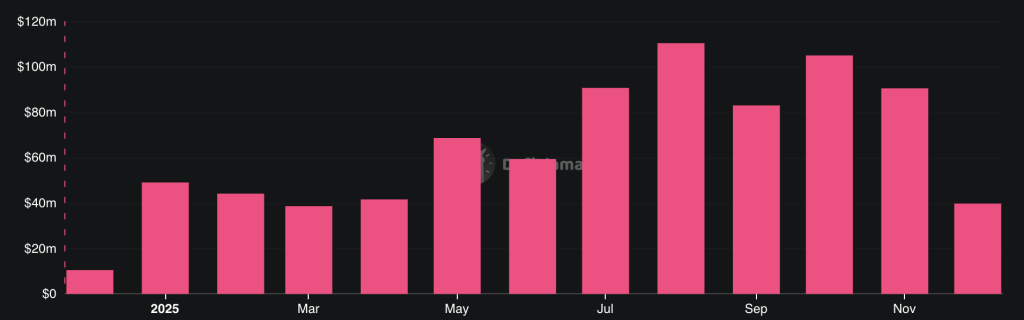

- The platform’s DEX revenue reached highs in October and November despite the price decline

- HYPE needs to break above $30 resistance to confirm a bullish shift, while a drop below $22.5 could push it toward $20

- The token is trading near $23.55 in an accumulation zone with RSI around 33, approaching oversold levels

Hyperliquid (HYPE) has experienced a sharp decline over the past three months. The token has fallen more than 56.5% from $58 to under $25 in less than 90 days.

The price drop comes despite strong fundamentals for the platform. Hyperliquid’s decentralized exchange revenue hit record levels during October and November. These months are typically considered difficult periods for the crypto market.

The decline has sparked debate about the effectiveness of token buybacks. Vlad Svitanko, CEO of Cryptorsy Ventures, compared buybacks to paying people to stand in line at a restaurant to create false demand. He called it one of the worst strategies in crypto.

Svitanko noted that Hyperliquid generates more profit than many banks. Yet the token remains down on the yearly chart. He suggested the money spent on buybacks could be better used to generate more revenue.

Large Investors Continue Buying

Despite the price drop, whale wallets are accumulating HYPE tokens. Data from Lookonchain shows over $37 million in USDC has flowed into Hyperliquid recently.

Whales are buying $HYPE.

0x5Ae4 deposited 20M $USDC into Hyperliquid, placing limit buy orders at $15.

0xE867 deposited 10M $USDC into Hyperliquid to buy more $HYPE and now holds 926,488 $HYPE($22.4M).

0x23Af deposited 7.1M $USDC into Hyperliquid to buy 277,420 $HYPE at $25.6.… pic.twitter.com/Uy6kvAMfik

— Lookonchain (@lookonchain) December 18, 2025

One wallet identified as 0x5Ae4 deposited $20 million USDC. The wallet set a limit buy order at $15. Another wallet, 0xE867, deposited $10 million USDC and now holds 926,488 tokens worth approximately $22.4 million.

A third whale wallet, 0x23Af, spent $7.1 million USDC to purchase 277,420 tokens. The average purchase price was $25.6 per token.

The accumulation across different price ranges suggests institutional investors see value at current levels. These buying patterns indicate confidence in the token’s long-term prospects.

Technical Analysis Points to Key Levels

HYPE price currently needs to break above $30 to confirm any bullish reversal. This level represents a psychological resistance point for traders.

It’s always nice to get something right …$HYPE is almost in my strike zone. I need it to dip below $20 though. Maybe if some more team members dump, my dreams can come true. pic.twitter.com/YW0J4XC7Iz

— Arthur Hayes (@CryptoHayes) December 19, 2025

The token is trading around $23.55, which sits in what analysts call an accumulation zone. The RSI indicator hovers around 33, close to oversold territory. This could signal a short-term bounce.

However, if the bounce fails to create a sustained rally, the downtrend WOULD remain intact. A break below $22.5 could push the price toward $20. Some analysts see $16 as a possible downside target if selling pressure continues.

Market Structure Remains Weak

The broader crypto market conditions are contributing to HYPE’s struggles. Futures trading volume reached record highs in 2025. Hyperliquid’s position as a leader in this sector makes some investors view the current dip as a buying opportunity.

Crypto analyst Hyper_Up noted that the token still faces strong selling pressure. The overall market structure continues to show downward movement.

A break below $23 could expose the token to further losses. The market needs to establish a weekly fractal before confirming a long-term bottom. Until then, buying remains speculative.

Once a confirmed low appears on weekly charts, a new range could form. Analysts suggest the $33 to $34 region could serve as a correction target. The previous swing high of $50.15 remains a distant goal.

The token remains one of the top 10 largest cryptocurrencies by market cap. As long as platform fundamentals continue improving, HYPE could return to previous highs when the broader market recovers. The current price action shows accumulation by large investors at $23 to $25 levels.