From $100 to $271,000: How One Bitcoin Miner Struck Digital Gold

A Bitcoin miner just turned pocket change into a fortune—and the story's juicier than a Wall Street bonus season.

The Alchemy of Modern Mining

Forget gold rushes and pickaxes. Today's treasure hunt runs on algorithms and silicon. This miner's journey—transforming a sub-$100 stake into over a quarter-million dollars—isn't just luck. It's a masterclass in navigating crypto's volatile frontier.

Decoding the Digital Windfall

The math is simple, the execution brutal. Turning $100 into $271,000 demands a near-mythical 271,000% return. In traditional finance, that's a pipe dream sold by late-night infomercials. In crypto? It's a headline that makes hedge fund managers check their Bloomberg terminals twice.

Beyond the Hash Rate

This win wasn't about brute computational force alone. It involved timing the market's manic-depressive cycles, managing energy costs that can vaporize profits, and a stomach of steel during Bitcoin's infamous drawdowns. Most portfolios hemorrhage value during crypto winters—this one multiplied.

The New Prospectors

The playbook is public, but few can execute. It requires treating electricity as a tradable commodity, hardware as a depreciating asset on steroids, and blockchain confirmations as a heartbeat. One misstep on any front turns a mining rig into a very expensive space heater.

A Reality Check with Your Rocket Ship

Let's be clear—for every story like this, there are warehouses full of obsolete ASICs and broken dreams. The crypto mining game is a brutal efficiency war where the house edge is written in kilowatt-hours and semiconductor shortages. It makes the traditional 2-and-20 hedge fund fee look almost charitable by comparison.

The $271,000 question isn't just "how did they do it?" It's "what happens now?" Does the miner cash out for a sports car and bragging rights, or reinvest, betting the next cycle goes even higher? In a world where money is being rewritten line by line in a digital ledger, the only real mistake is thinking the game is over.

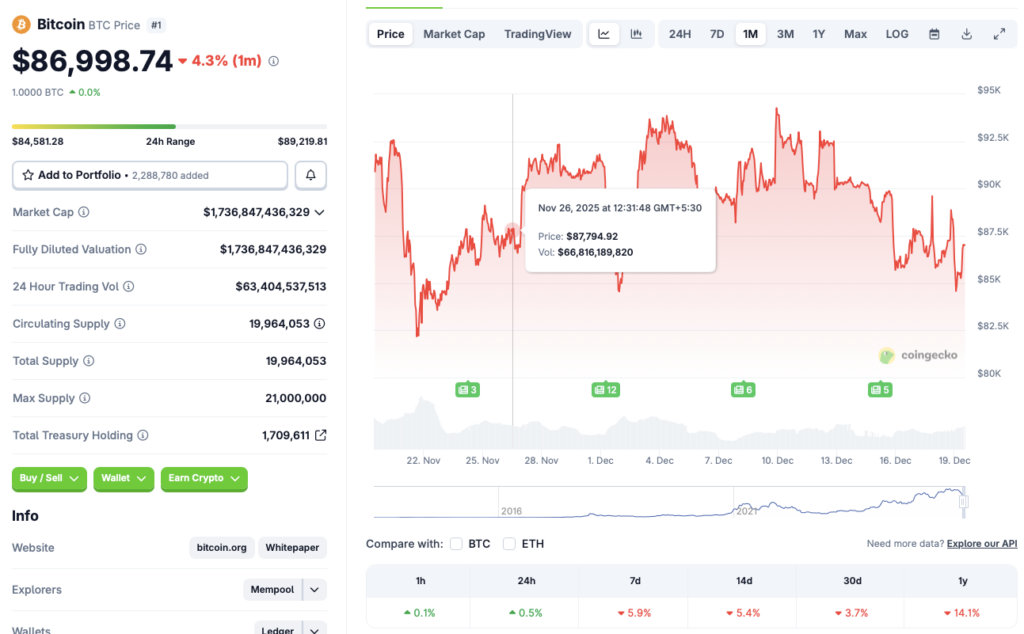

Bitcoin Shows Consolidation Signs

Bitcoin (BTC) seems to be consolidating around the $86,000 price level. According to CoinGecko’s BTC data, the asset has rallied by 0.5% in the last 24 hours, but is down 5.9% in the last week, 5.4% in the 14-day charts, 3.7% over the previous month, and 14.1% since December 2024.

The Bitcoin and the larger crypto market’s suffering arises from macroeconomic developments. Slow economic growth and high jobs figures have led to substantial inflation worries. Japan recently increased its interest rates by 75 basis points, the highest in nearly 30 years. On the other hand, inflation in the UK has dipped for November, prompting many to expect an interest rate cut in the nation. However, rate cuts in the US have not had the desired impact on the crypto market. Bitcoin (BTC) and other assets faced substantial price dips after the Fed’s October and December rate cuts.

Given the current market scenario, we may be entering another long crypto winter. However, Bitcoin (BTC) may maintain the $80,000-$85,000 price level, instead of falling to $15,000 as it did in the last crypto winter.

While Bitcoin (BTC) seems to see no recovery in sight in the short term, many anticipate the asset to hit a new peak in 2026. Bernstein and Grayscale expect Bitcoin (BTC) to climb to a new all-time high next year, while Barclays presents a more bearish outlook for the crypto market.