MicroStrategy Shifts $5.7B in Bitcoin to Fresh Wallets—Saylor Insists ’No Sell-Off’

Michael Saylor's Bitcoin vault just got a $5.7 billion shuffle—but the crypto king swears it's not a liquidation play.

Cold Storage or Quiet Exit?

MicroStrategy's latest blockchain ballet moved 100k+ BTC to new addresses, sparking sell-off fears. Saylor—never one to miss a PR beat—called it 'routine treasury management.' Sure, and Wall Street bonuses are 'performance incentives.'

The HODLer's Dilemma

The transfers come as Bitcoin flirts with $60k again. If this were traditional finance, someone would've leaked a PowerPoint by now. But in crypto? Just another Tuesday.

Watch those wallet addresses. Because in Saylor we trust—but verify.

TLDR

-

Michael Saylor denies Bitcoin sale after $5.7B transfer by Strategy.

-

$5.7B Bitcoin transfer sparks rumors but is part of a custody restructure.

-

Strategy holds 641,692 Bitcoin worth over $62 billion, fueling confusion.

-

Recent Bitcoin transfers tied to U.S. market conditions, adding volatility.

A recent $5.7 billion Bitcoin transfer has sparked speculation across the crypto market. Early chatter suggested that Strategy, a business intelligence company, had unloaded a significant portion of its Bitcoin holdings. However, Michael Saylor, the CEO of MicroStrategy, quickly shut down rumors of a sale, clarifying that the transfer was part of a custody restructuring rather than a move to sell.

The confusion arose when large bitcoin transactions linked to Strategy’s addresses began circulating in the market. This led to widespread concern, as traders and analysts feared that one of the largest corporate holders of Bitcoin was reducing its exposure. Despite the noise surrounding the transfer, analysts believe this move was strategic and not an indication of a sale.

Strategy’s Bitcoin Transfer Sparks Market Panic

The recent Bitcoin transfer by Strategy, amounting to $5.7 billion, was initially misunderstood by the market. Arkham Intelligence data indicated a significant drop in Strategy’s Bitcoin holdings, leading many to believe that the company had sold part of its stash. The transfer, which moved funds from addresses previously associated with Strategy, prompted panic among traders, who feared a bearish signal for Bitcoin.

This uncertainty was exacerbated by a report from Walter Bloomberg, which noted the first recorded decrease in Strategy’s Bitcoin holdings since mid-2023. This drop fueled speculation, which spread quickly across social media and crypto news platforms. Influencers and market commentators jumped on the story, amplifying the rumors that Strategy had sold Bitcoin at a time when the market was already under pressure.

In response, Michael Saylor took to social media to clarify the situation, firmly denying that any Bitcoin was sold. “There is no truth to this rumor,” he stated on X (formerly Twitter), putting an end to the speculation. His comment helped calm the market and clarify that the transfer was simply a part of a larger custody restructuring process.

Strategy’s Custody Reshuffle and Bitcoin Holdings

Strategy’s decision to MOVE $5.7 billion worth of Bitcoin is linked to a larger strategic move within the company. With a focus on enhancing Bitcoin acquisition and improving institutional access, Strategy has been restructuring its holdings. This is part of the company’s efforts to make Bitcoin more accessible to risk-averse investors, especially through improved credit ratings and institutional channels.

The company’s Bitcoin holdings, now totaling 641,692 BTC worth over $62 billion, remain intact. The transfer to new wallets is seen as a move to better manage the custody of these assets, not a sign of selling.

Analysts have emphasized that this is a routine adjustment rather than a signal of reduced exposure to Bitcoin. The recent moves are expected to improve the overall structure of the company’s Bitcoin acquisition strategies, further supporting its long-term bullish outlook on the cryptocurrency.

Bitcoin’s Broader Market Impact and Ongoing Uncertainty

The confusion surrounding Strategy’s Bitcoin transfer comes amid a period of heightened market volatility. Bitcoin has been under pressure, partly due to broader economic conditions, including concerns about inflation and the potential for interest rate hikes by the Federal Reserve. As liquidity continues to tighten and U.S. market sentiment fluctuates, Bitcoin’s price has struggled to maintain upward momentum.

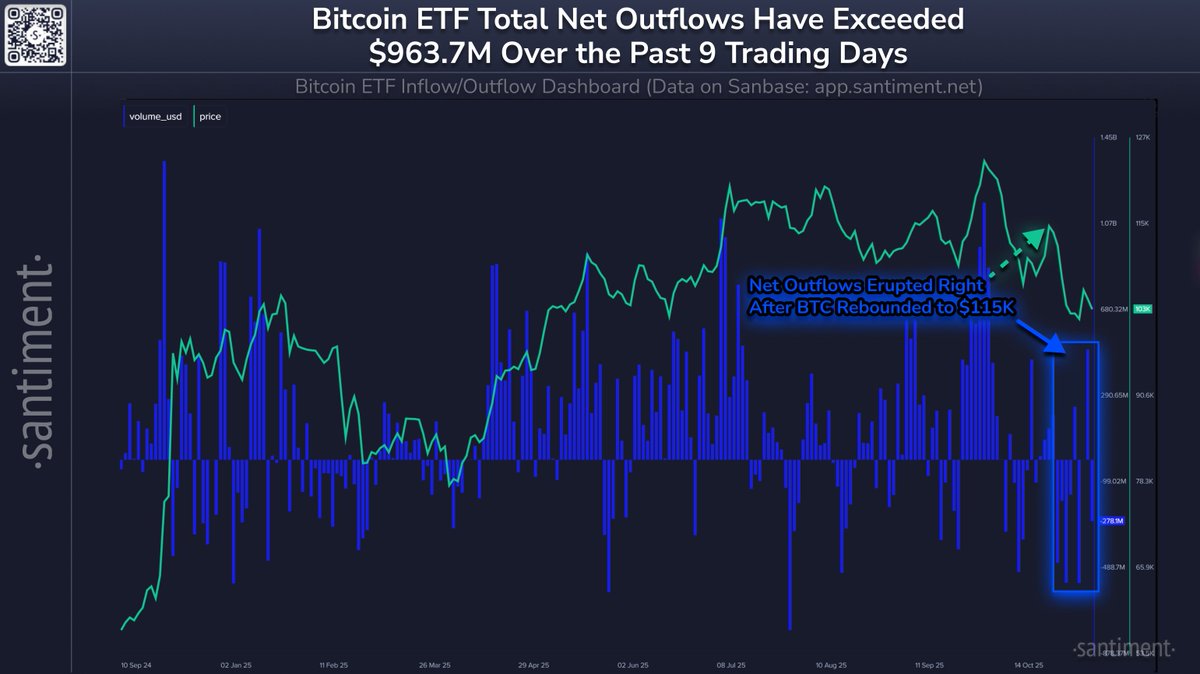

Recent market data shows a significant decrease in Bitcoin futures open interest, suggesting that many investors are taking a cautious stance on the cryptocurrency. Additionally, Bitcoin ETF net flow of -$963.7M have been observed, with investors wary of continued volatility in the sector. On-chain data indicates that large holders of Bitcoin are becoming more active in selling, further compounding concerns about market conditions.

Despite these challenges, the long-term outlook for Bitcoin remains strong, with institutional interest continuing to grow. The recent transfer of Bitcoin by Strategy is not an indication of panic or a change in market sentiment but rather a strategic move aimed at securing Bitcoin’s future as a Core asset for institutional investors. As liquidity conditions improve and market sentiment shifts, Bitcoin may see renewed interest from large players in the space.