Bitcoin’s $95K Crossroads: Bulls and Bears Clash Over the Next Mega Rally

Bitcoin teeters at $95,000—a make-or-break moment that's splitting crypto veterans down the middle. Is this the launchpad for six figures, or a bull trap waiting to snap shut?

Technical analysts point to the 2024 halving cycle's historical precedent, while skeptics highlight whale wallets quietly taking profits. Meanwhile, Wall Street's latest 'crypto advisory teams' are charging $500/hr to tell clients what Twitter threads explain for free.

The real battle? Whether institutional inflows can outweigh retail FOMO at this psychological price level. One thing's certain: volatility is back on the menu.

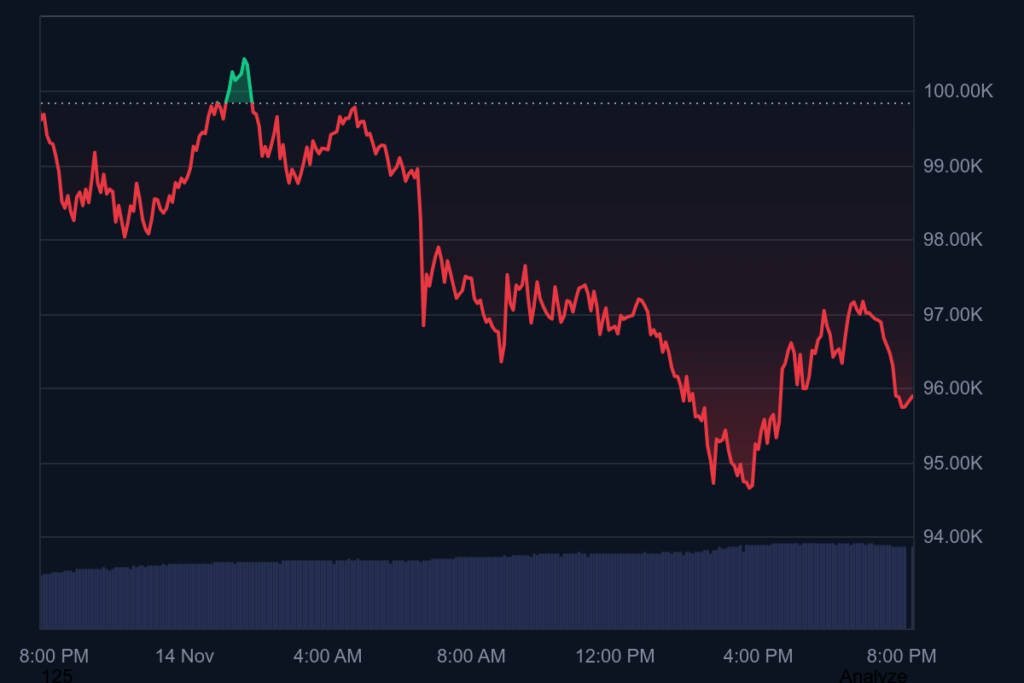

Bitcoin Price Today: Momentum Slips, Fear Rises

Bitcoin is changing hands around $95,900, extending its decline from earlier in the week. The MOVE places BTC firmly in the red across all short-term timeframes:

- 24h: -3.5%

- 7d: -5.5%

- Market cap: $1.93 trillion

- 24h volume: $127 billion

Sentiment has deteriorated significantly. The Fear & Greed Index has dropped to 22 (“Fear”), reflecting a market that is increasingly nervous about macro uncertainty, ETF outflows, and thinning liquidity on major exchanges. The broader crypto market is also feeling the weight, with total capitalization slipping to around $3.28 trillion.

Technically, traders are watching whether Bitcoin can reclaim $100,000, a level that provided support for months before giving way this week. A failure to rebound convincingly may keep selling pressure elevated into next week.

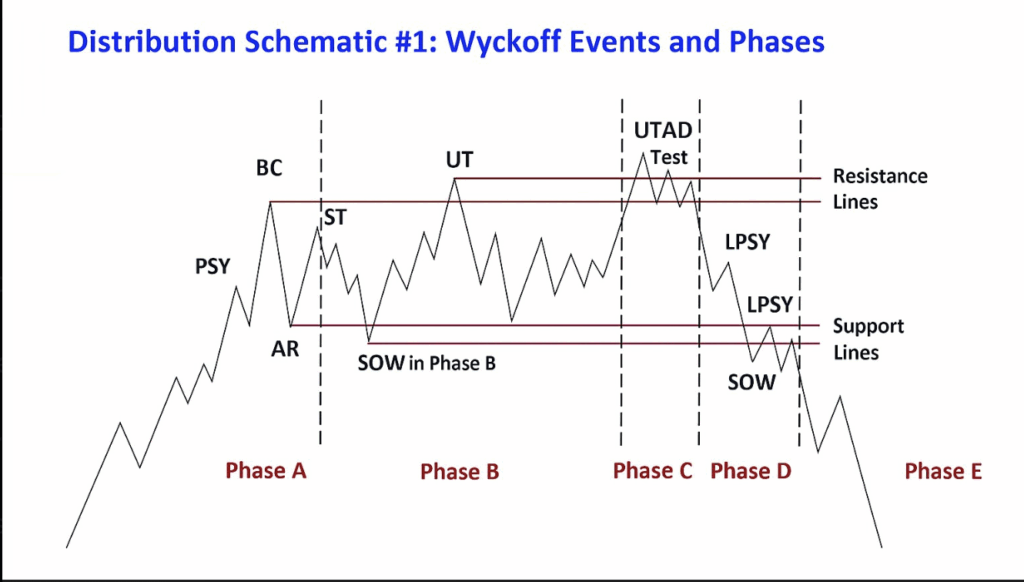

Wyckoff Distribution Signals Strengthen: Analysts Eye $86K

Alongside the weakening price structure, a number of analysts warn that Bitcoin’s recent behavior closely resembles a Wyckoff Distribution pattern, a formation often seen NEAR major cycle tops.

The comparison suggests that Bitcoin’s surge toward $122,000 marked a buying climax, followed by repeated failed attempts to FORM higher highs – a sign buyers were losing strength. The push above $126,000 in early October now appears, in hindsight, to be a classic “upthrust” — a final bullish deviation before the market turns down.

READ MORE:

After losing support near $110,000, bitcoin has now entered what Wyckoff describes as the markdown phase, where price accelerates lower as supply overwhelms demand. Under this interpretation, the measured downside target from the distribution range points toward $86,000.

Still, not all analysts believe the bull phase is finished.

CryptoQuant CEO Ki Young Juthat the trend remains structurally bullish as long as BTC holds above $94,000, the average cost basis of mid-term holders. A decisive break below that level, he says, WOULD be the real trigger for concern.

Bitwise’s Hunter Horsley adds that Bitcoin may have already endured a six-month internal bear phase and could be approaching the end of it – with strong long-term fundamentals waiting on the other side.

![]()